Ethereum prices fell 2.6% against the US dollar on Friday, and were hot on Bitcoin’s overnight fall heels. Bitcoin’s weekly loss is 0.7% and the watch is in its watch, but the price of ether shows some courage and boasts a more vibrant 2% increase over the past seven days.

Ethereum has been stable at $3,650 after the recent DIP

At the time of reporting, Bitcoin commands a massive 60.8% of the $3.82 trillion crypto market, while the ether covers the itself at 11.6%. Ether’s market share just slipped slightly, but shines brighter than the 11.1% stake a week before January 18th.

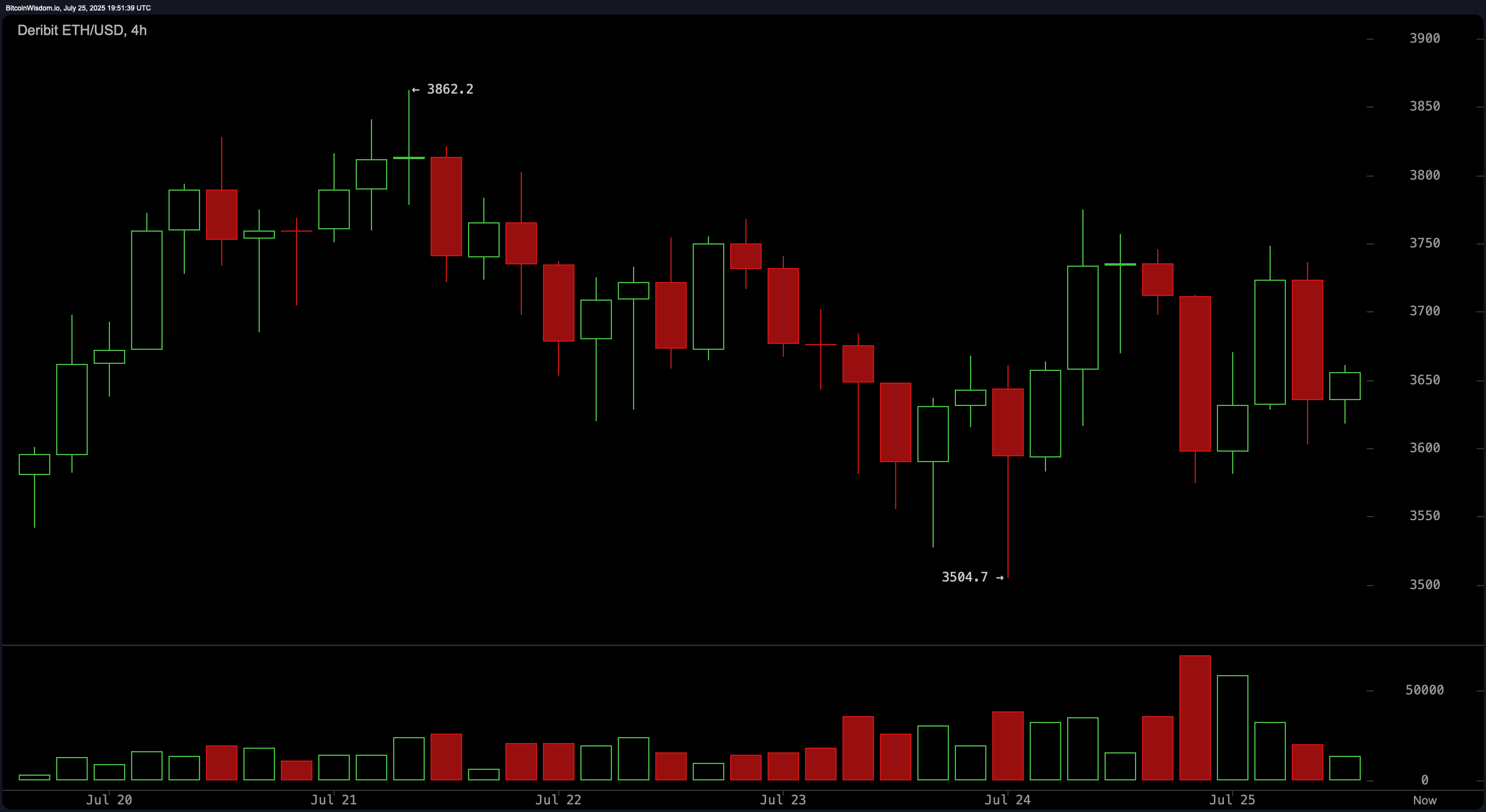

4-hour chart for ETH/USD DERIBIT on July 25th, 2025.

With a market capitalization of $441 billion, the second-largest cryptocurrency has danced between $3,585 and $3,750 in the last 24 hours. Ether’s 24-hour trading volume is held strong at $905.5 billion, taking over Bitcoin’s $1037.8 billion global trading.

After hitting a high of $3,750 last night, ETH plunged to a low of $3,585 before rebounding to $3,602 after a 10-minute recovery. By 3:45pm on Friday, January 24th, Ether had exchanged hands for a cool, cool $3,653 per coin. Binance dominated Supreme as ETH’s top exchange against today’s trading activities.

In the wild world of Crypto Derivatives, $114.14 million of ETH positions have been settled over the past day, of which $8,218 million is in short positions. ETH won a silver medal for daily liquidation and chased Bitcoin, but overtook Sol’s leveraged loss of $40 million. Just a moment ago, Binance’s long ETH/USD position received a $30,000 hit with a dramatic liquidation at 3:36pm ET.

Despite recent market turbulence, Ethereum’s resilience shines and maintains modest weekly profits. As crypto traders navigate the volatile crypto landscape, the recent presence of etheric markets and aggressive trading volumes suggest a potentially challenging future that could challenge Bitcoin’s advantage in the evolving digital economy.