Bitwise’s research director recently shared an annual update on the company’s 2025 price forecasts for Bitcoin, Ethereum and Solana.

Earlier this year, we shared Bitwise of these best cryptocurrencies and were hoping for a strong market rally. Six months later, experts returned to discuss what has changed, what is stable, and how the current market situation has affected these forecasts.

On the Milk Road podcast, Ryan Rasmussen said that price predictions are by no means accurate, but he is confident that Bitcoin will reach $200,000. “We hold Bitcoin strongly,” he confirmed.

However, Bitwise fixed previous targets for Ethereum and Solana. The company had previously forecast $7,000 for Ethereum, but now expects it to reach its record high of just over $4,500 by the end of the year.

Related: Ethereum is becoming a “master ledger” for finance, says co-founder Joseph Rubin.

Source: TradingView

Solana was also expected to be expensive, but is currently forecast to reach a historical record of around $250. Rasmussen explained that global issues such as slow retail interest, uncertain markets and trade tensions are delaying rallies where global issues are expected.

Related: Solana and BNB are putting pressure on a market that only has something to do with Bitcoin

Despite lowering the short-term target, Rasmussen believes the bigger bull run is not over. He said the market cycle could grow in early 2026, with Bitcoin, Ethereum and Solana likely to hit new highs at the time. He added that while recent events slow the momentum of the crypto, there will remain strong long-term trust in these top assets.

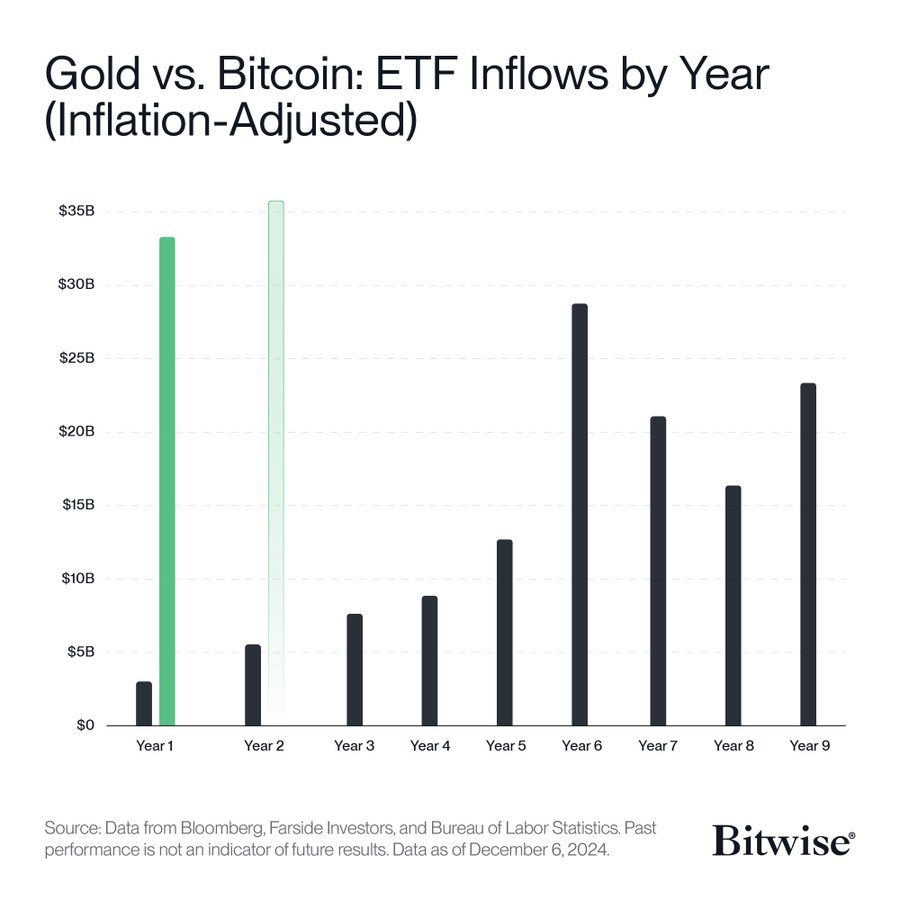

Bitcoin ETF inflows remain an important factor

Bitcoin has been compared to gold by traditional investors and institutions, but it was previously uncommon. Many of these big players are unable to buy spot bitcoin directly, so they turn to ETFs for exposure.

Source: Ryanrasmussen

Last year, US Bitcoin ETF saw a record $35 billion inflow, seven times higher than previous records. So far, in 2025, around $9 billion has flowed into Bitcoin ETFs. Although the pace is slower than last year, Bitwise still believes there is a lot of undeveloped demand, and expects the total annual inflow to reach between $3.5-40 billion.

Additionally, it was known that nine countries would hold Bitcoin as part of a national reserve or sovereign wealth fund earlier this year. The number has now increased to 11. Bitwise believes that more governments will join the list by the end of the year, but may not double what was originally forecast. He expects that around 15 countries will be able to hold Bitcoin by the end of 2025.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.