Ethereum has shown resilience amid the recent wave of market volatility and uncertainty. The broader crypto market has been pulled back over the past few weeks, but ETH continues to hold businesses beyond its key psychological and technical support zone of $2,500. This strength has attracted the attention of traders and analysts who view Ethereum’s current price action as a potential launchpad for moving into higher territory.

Despite major altcoin-wide retracements, Ethereum remains structurally intact, with the Bulls defending the low boundary of current range. The lack of panic sales at these levels suggests increased confidence in the long-term trajectory of ETH, even as macroeconomic pressures, including harsher liquidity and geopolitical uncertainty, continue to squeeze emotions.

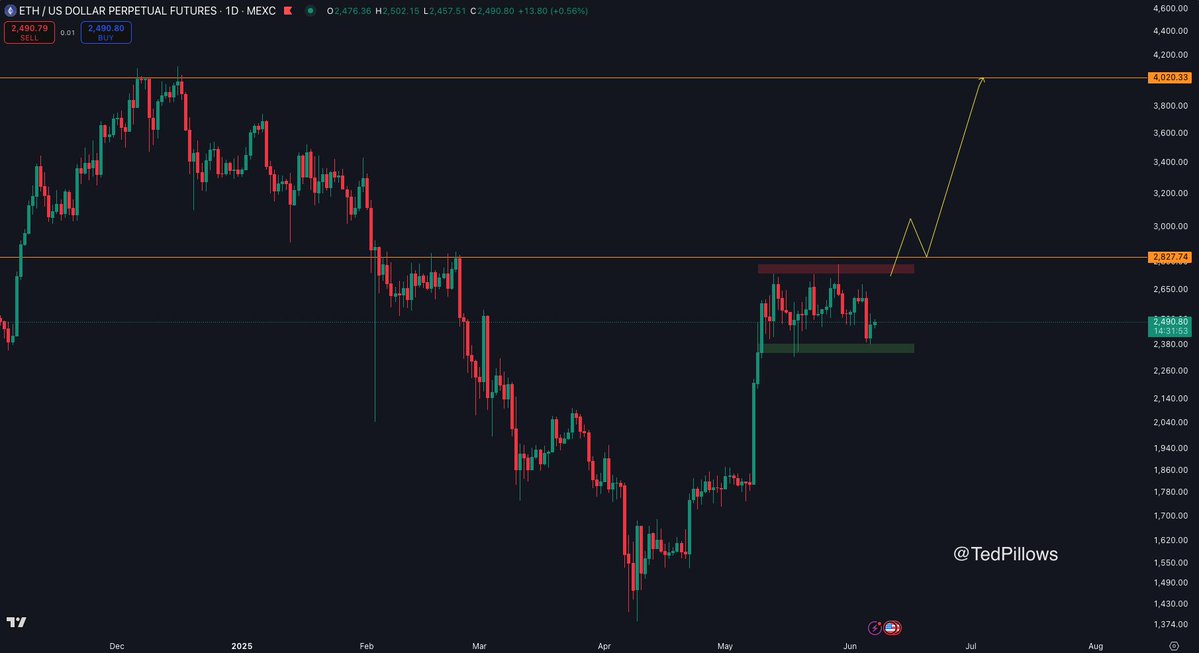

Top analyst Ted Pillows recently shared a technical update highlighting that ETH is still trading within a well-defined range. According to his view, Ethereum’s ability to integrate without losing critical support is a sign of fundamental strength. Breakouts above the range highs could cause updated momentum towards regions ranging from $2,800 to $3,000, while breakdowns below $2,500 will disable current setups.

Ethereum approaches a critical zone amid uncertainty

The crypto market navigates a volatile environment, and Ethereum is no exception. However, despite the turbulence, ETH was able to maintain scaffolding of over $2,500. This is an important level of support that continues to act as a buffer for deeper downsides. As Bitcoin holds strong and Altcoins prepares for a potential breakout move, the coming weeks could be decisive for Ethereum’s next major trend.

ETH is currently 48% below its all-time high, but price action suggests the Bulls are gaining momentum. Ethereum has absorbed the recent volatility well, despite being shaken up by rising geopolitical tensions, particularly by the growing conflict between Elon Musk and US President Donald Trump. These headlines added uncertainty, but Ethereum’s ability to remain bound by scope reflects the growing confidence among investors.

Pillow points out that Ethereum is still traded within a well-defined range and the structure remains intact. His analysis shows that regaining the $2,800 level is a key breakout trigger, potentially opening up a gorgeous rally up to $4,000. Until then, ETH will remain in integrated mode, but with Bitcoin showing leadership and the market entering a pivotal stage, Ethereum could save them from catching up.

If the Bulls can maintain control and push resistance through, ETH could eventually break out of its range and re-enter the bullish price-discovery phase. However, if resistance is the case, traders can see the foot of another integration. In any case, Ethereum enters a key window where market direction is likely to be defined, and how ETH behaves around the $2,800 mark can determine the outlook for Altcoin for the rest of the summer.

Eth Weekly Chart shows a momentum build that is close to resistance

Ethereum has stabilized nearly $2,500, as seen on its weekly charts, showing signs of promising strength despite recent market overall volatility. After a sharp bounce from the $1,800 level in May, ETH is currently consolidating a $2,707 resistance (a 50-week simple moving average (SMA). This level coincides with the boundary above the current range and still the keylines the Bulls need to retrieve to unlock it upside down.

ETH is currently trading beyond the 34-week EMA ($2,501) and the 200-week SMA ($2,450) and both serve as dynamic support. Holding these levels reinforces the idea that buyers are stepping into the dip and provides a strong foundation for potential continuity. However, prices are still limited by a 100-week SMA at $2,610, making the region between $2,700 and $2,800 a key zone of resistance.

Closer to once a week on this moving average cluster can trigger a breakout and pave the way for over $3,000. Volume remains increasing during this integration, suggesting sustained interest from both traders and investors.

Dall-E special images, TradingView chart