As capital continues to flow strongly, the amount of ETH that was excluded to keep its prices down in 2025 is also unexpectedly surged, as capital continues to flow strongly.

What does this mean for Ethereum price trends? Here are some expert insights.

I’m waiting for more than 350,000 ETH to be unorganized. What does it mean?

Udi Wertheimer, a well-known investor in the Crypto community, raised concerns after discovering that over 350,000 ETH (approximately $1.3 billion) are currently waiting in queues that are not on stage.

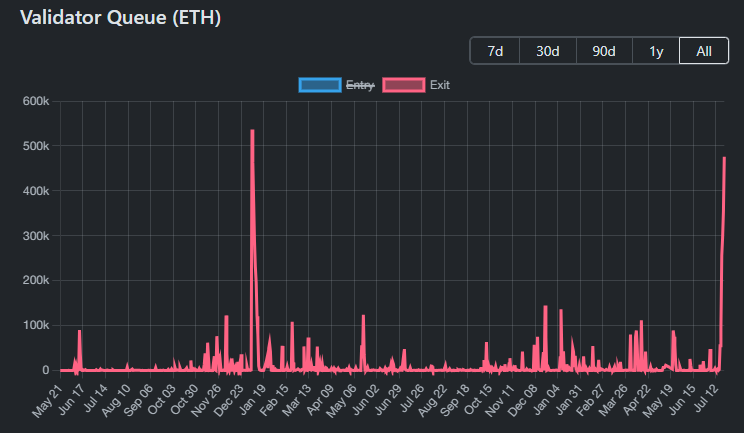

Ethereum Validator queue. Source: validatorqueue

“There are 350,000 ETHs being carried out in a volatile fashion, about $1.3 billion. Finally, many of those ETHs were integrated in January 2024 after a 25% rallies at ETH/BTC in a week.

Unstaking allows users to withdraw ETH from staking smart contracts and return them to freely available assets.

A big wave without staking can indicate potential sales pressure. This is especially true if investors are trying to make money after 160% of ETH’s rally since the April low.

In early 2024, more than 500,000 ETH was unraveled and later returned to $2,100 before ETH surged from $2,100 to more than $4,000.

Where will this indifferent ETH go?

Coinbase’s OG protocol specialist Viktor Bunin suggested that the ETH could move to the Internal Treasury Ministry. These funds could be useful for financial strategies such as long-term investments and portfolio diversification.

If so, this is not a sign of panic sales. What’s more likely is the form of asset management. This actually helps to stabilize the market in the long term.

Meanwhile, a LookonChain report shows that data on the chain shows that around 23 whales or institutions have accumulated 681,103 ETH (valued by $2.57 billion) since July 1st.

And the accumulation has not stopped. In the fourth week of July, more institutions continued to add billions of dollars worth of ETH.

“The new ETH Treasury Department (ether machine) announced a $1.5 billion ETH this morning, which was still the biggest. But last week, Tom Lee of Fundstrat Capital said he was planning to buy a $20 billion ETH, Sean Adams said.

How about ETH being staked?

Udi Wertheimer’s concerns may sound surprising, especially when compared to historical patterns. But it lacks an important perspective: the amount of ETH currently waiting to stake.

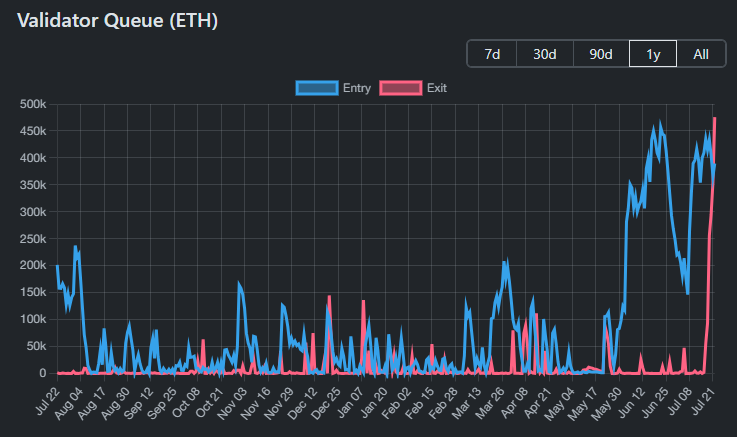

Ethereum Validator queue. Source: validatorqueue

BalidatorQueue data shows that ETH queued for staking is actually far more than the amount queued for staking. The queue has been surged since June, waiting for more than 450,000 ETH to be wagered on a given day.

This reflects the ongoing interest of investors in participating in the Ethereum network through staking.

“And at this point, we have a healthy amount of es to eat,” Wertheimer added.

Data from BeaConcha.in shows that over 35.7 million ETH are currently covered across a variety of protocols. This accounts for 29.5% of the circulation supply.

Ultimately, the balance of ETH, which breaks in and leaves the staking protocols, is a key factor. It helps you determine whether the market is facing real sales pressures or simply witnessing strategic reallocation by institutions and individual investors.