According to Crypto Rover, investment company BlackRock has purchased $54 million worth of Ethereum (ETH). The transaction serves as a major institutional approval from the world’s largest asset managers, creating short-term market changes and strengthening ETH’s appeal to institutional investors.

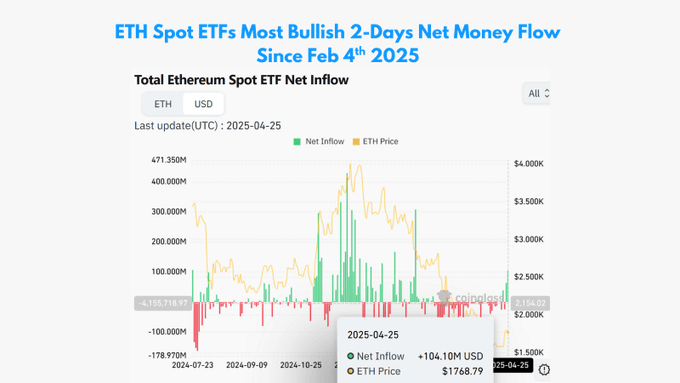

The surge in spots in Ethereum ETF influx coincides with changing US regulatory reforms. Analysts see this shift as a sign of optimism. Spot Ethereum ETF inflows continue to increase, with trading volumes rising sharply in line with the positive week of ETF inflows that have not been seen since February. Market participants are monitoring Ethereum’s ability to maintain a critical support area of $1,800 and establish a massive market recovery.

Ethereum trading activity and market indicators will be strengthened

Ethereum (ETH) traded at $1,807.19 at press, indicating daily market growth of 1.38%. The asset’s market capitalization reaches $21.816 billion, with 24-hour trading volume reaching $17.08 billion, with a high growth rate of 29.95%. This surge in activity often indicates a surge in forward volatility, warnings for bulls and bears.

Related: Ethereum Whale borrows 4,000 ETH at Aave to start a new short position

Ethereum’s short-term outlook relies on its ability to hold more than $1,800. If this support is achieved, further testing will be possible for $1,830, and perhaps $1,850. On the other hand, if there is a critical break below $1,790, ETH could be exposed to further downside risk to $1,760 or $1,720.

The strategic timing of Blackrock amid political change

The BlackRock acquisition shows growing interest from institutional investors in purchasing Ethereum-based investment products. SOSOValue data shows the first positive trend since February, Spot Ethereum ETFS, which recorded a net inflow of $157.1 million the previous week, hitting $104.1 million on Friday.

BlackRock’s ETHA products recorded an influx of $54.43 million, surpassing Feth’s performance from Fidelity and Grayscale’s Ethe’s performance. And more about President Trump’s soft rhetoric on Chinese tariffs and the appointment of crypto-friendly figure Paul Atkins, as the SEC chairman has significantly improved sentiment among institutional investors.

Related: The Ethereum Whale stacks 449k eth in one day, but holds a $1,895 resistance firmly

The new SEC chair Atkins has adopted a supportive approach to digital assets and plans to develop “rational and targeted” regulatory guidelines. The political shift towards encryption-friendly regulations creates high expectations for the SEC’s SPOTETF approval and its staking capabilities.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.