According to a recent X post by Crypto Trader Coinvo, Ethereum (ETH) is “very undervalued” at its current price. Some on-chain metrics appear to support Coinvo’s valuation as ETH’s accumulation addresses continue to stack digital assets despite poor price performance over the past few years.

Ethereum may soon be a great gathering

ETH has risen 8% over the past two weeks, but has fallen 43% over the past year, trading around $1,700 at the time of writing. Ethereum has fallen 63.6% from its all-time high (ATH), a stark contrast to Bitcoin (BTC), 13.7% below ATH.

Compared to Ethereum’s other major cryptocurrencies, its relatively low performance raises questions about its long-term outlook. Bitcoin benefits from FirstMovers’ advantages and wider institutional adoption, but Ethereum faces competition from rival smart contract platforms such as Solana (SOL), SUI and Polkadot (DOT).

Despite the general negative sentiment, some analysts believe that ETH may be on the turnaround crisis. Coimbo, for example, claims that Ethereum is significantly undervalued and ready for a large gathering.

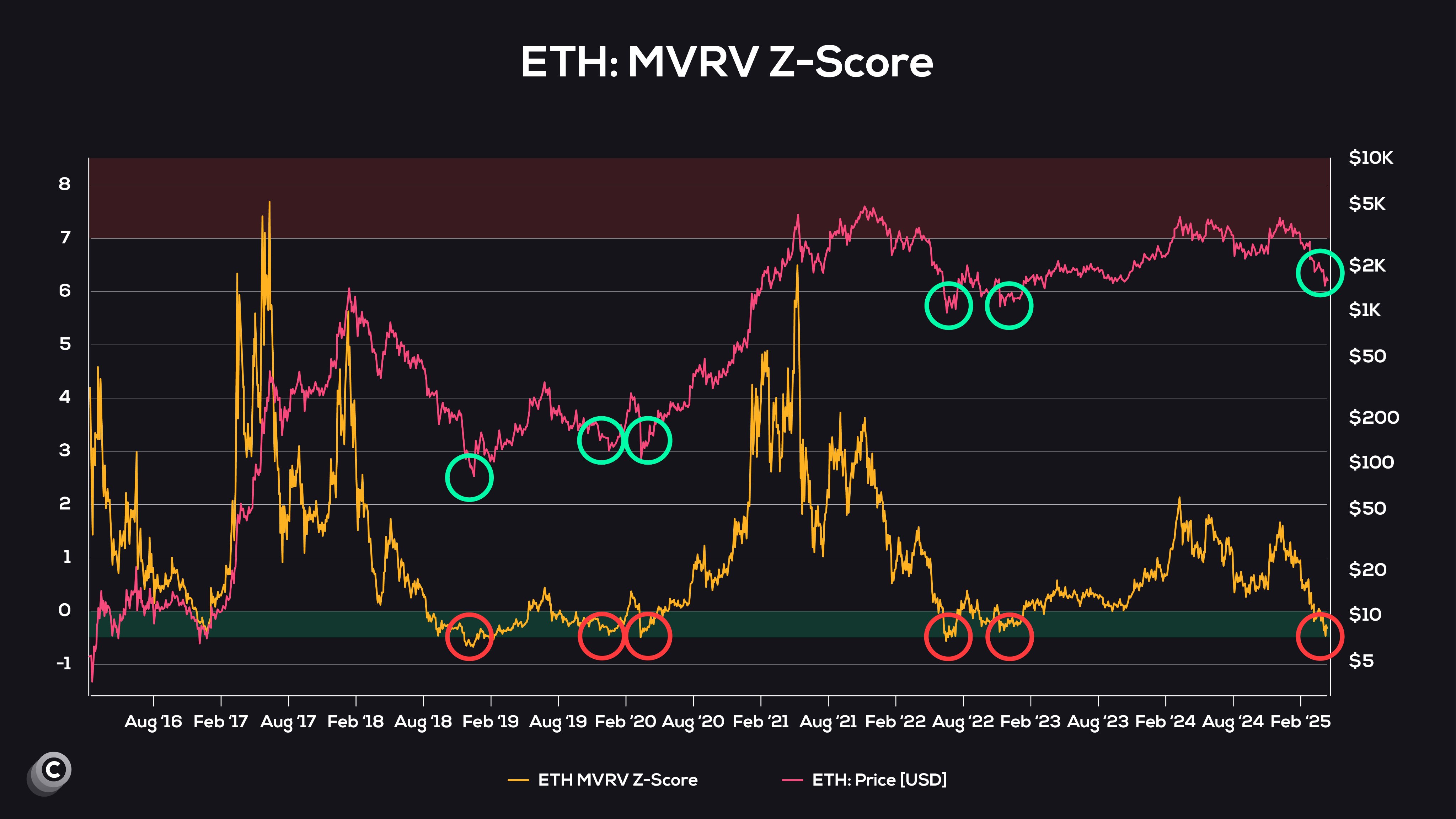

Traders shared the following charts that utilize market value for realised value (MVRV) Z scores: This is the metric used to identify the top and bottom of a potential market. According to the charts, Ethereum’s MVRV Z-Score has entered the green zone. Market bottom And it’s possible Trend reversal.

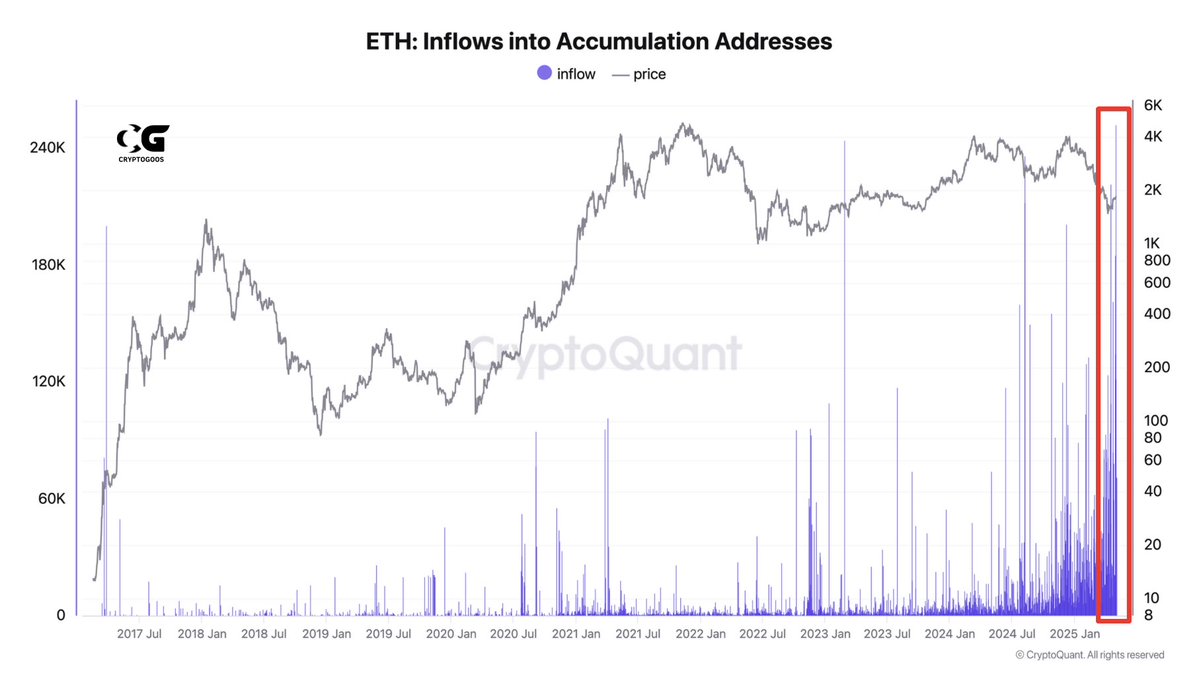

Meanwhile, the inflow of Ethereum into accumulation addresses has skyrocketed to historic highs. In X Post, analyst Cryptogoos shared a chart showing record-breaking ETH inflows at these addresses in 2025.

The high inflows into accumulated addresses indicate that long-term investors are actively purchasing and holding ETH even in the market slump. This behavior often reflects an increased confidence in Ethereum’s future values, suggesting a building of potential bullish sentiment beneath the surface.

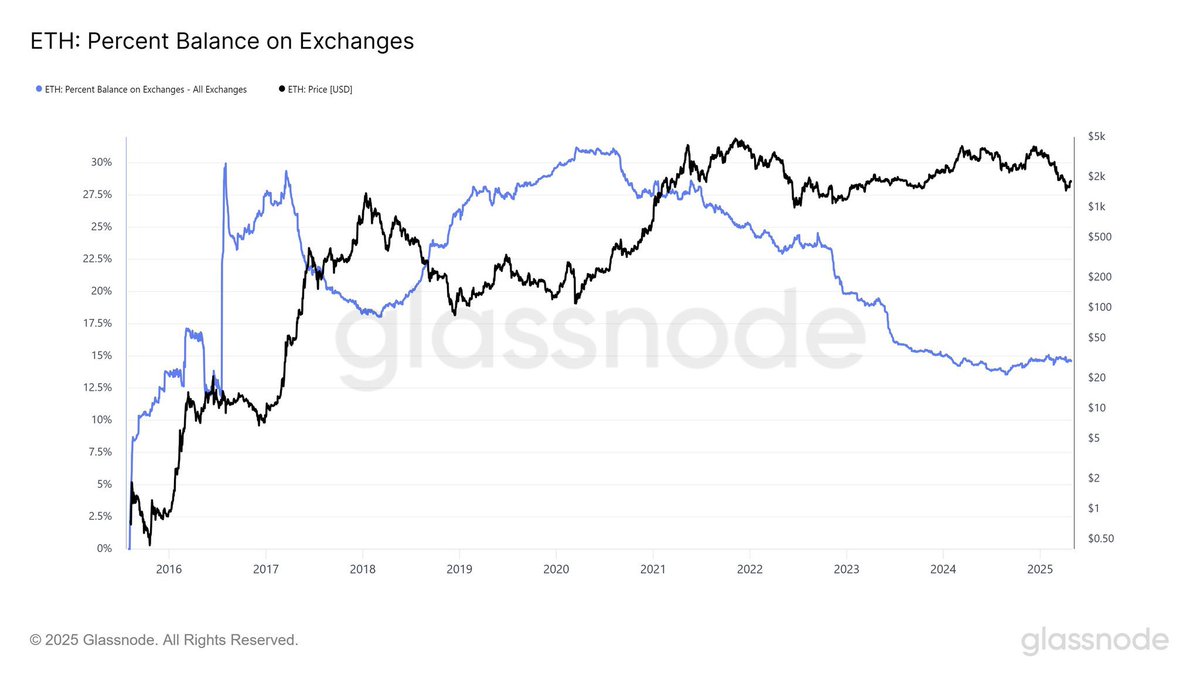

In another post, Cryptogoos also highlighted that Ethereum replacement spares are at multi-year lows. A decrease in exchange reserves refers to a lower sales pressure and tightening supply, strengthening the story of ETH’s rarity and increasing prices in the short term.

ETH owners are not “busy enough”

Famous analyst Crypto Rover drew similarities between ETH’s current price action and BTC’s 2021 trajectory. According to analysts, if Ethereum reflects Bitcoin’s past performance, it could be well on track to reach new ATHs in the coming months.

However, concerns remain Further reduction At ETH prices if the global macroeconomic situation worsens amid the looming mutual trade tariffs of President Donald Trump. At press time, ETH will trade at $1,754, a 2.1% decrease over the past 24 hours.

X and tradingView.com charts, featured images created with Unsplash