Ethereum is resilient in the current market, holding above the $4,500 level after a few weeks of steady momentum. The second-largest cryptocurrency maintains a bullish structure, but buyers are currently struggling to break past the $4,750 resistance zone. This has become an important short-term test. The fundamentals remained solid, but reluctance to this threshold has prompted some analysts to warn of increased risk as Ethereum approaches historically significant levels.

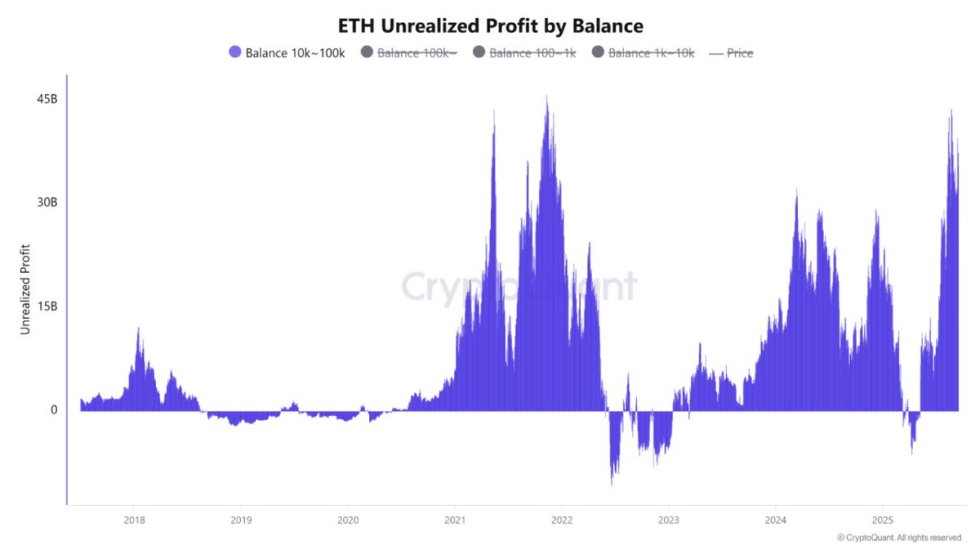

Data from encryption adds weight to this careful outlook. The company reports that unrealized profits from Ethereum wallets, which hold 10,000 to 100,000 ETH, are surged to levels not seen since November 2021, when ETH reached an all-time high. This means that medium sized whales are currently sitting in substantial paper benefits, similar to the conditions observed at the peak of the last cycle.

With bullish enthusiasm still strong, but the risk of profits increases, Ethereum’s next move could prove to be critical. A breakout above $4,750 could open the door to new highs, but a denial could cause a sudden correction.

Ethereum whales signal important stages

As medium-sized whales now sit in significant unrealized benefits, Ethereum is in a pivotal stage. The profits of these papers have reached levels comparable to those seen at the peak of November 2021, when Ethereum touched an all-time high. Similarity of profit terms has sparked concern among analysts. Earlier cycle moments of such moments often preceded periods of increased profit acquisition or sales pressure.

Historically, when unrealized profits from medium-sized whales reached such an uptick in levels, the market has tended to experience an increase in volatility. Some owners chose to lock the profits, causing a cascade of price weight sales. This behavior does not guarantee immediate corrections, but it does highlight the psychological pressures that investors face while sitting on a substantial profit. Market participants, especially large holders, often affect broader emotions and fluidity, creating ripple effects across exchanges and trading desks.

At the same time, Ethereum remains fundamentally strong. Inflation in facilities, network activities, and broader optimism in the crypto market could limit aggressive sales and extend rallies. Still, analysts warn that the balance between bullish momentum and profitable actions will determine Ethereum’s trajectory.

The next few weeks are decisive. Successful pushes over resistance could rekindle momentum and test new highs, but increased sales pressure could lead to a consolidation stage or a more sharp revision. The fate of Ethereum depends on whether the whales have chosen to hold for a higher rating or whether to realize their profits at the current level.

Technical Insight: Important Levels to See

Ethereum (ETH) currently trades around $4,599, showing resilience above the $4,500 support level. The chart highlights the consolidation period after ETH failed to maintain momentum beyond the $4,750 resistance zone, where sales pressures repeatedly close the cap. Nevertheless, the overall trend remains constructive, with ETH still remaining higher and lower since early September.

The 50-day SMA (blue) is facing upwards and sits near $4,307, offering dynamic support that eases recent pullbacks. Meanwhile, the 100-day SMA (green) was $3,614 and the 200-day SMA (red) was $2,846, reflecting a broader bullish structure, suggesting that the market remains on a long-term upward trend. Moving averages align in bullish order, further strengthening positive momentum.

However, ETH has encountered a strong resistance of nearly $4,750. This remains an important barrier before the most recent potential barrier of retest. A critical breakout beyond this level with rising volumes could pave the way for more than $5,000. On the downside, failing to hold $4,500 can lead to a revision to psychological support of $4,300 or $4,000.

Dall-E special images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.