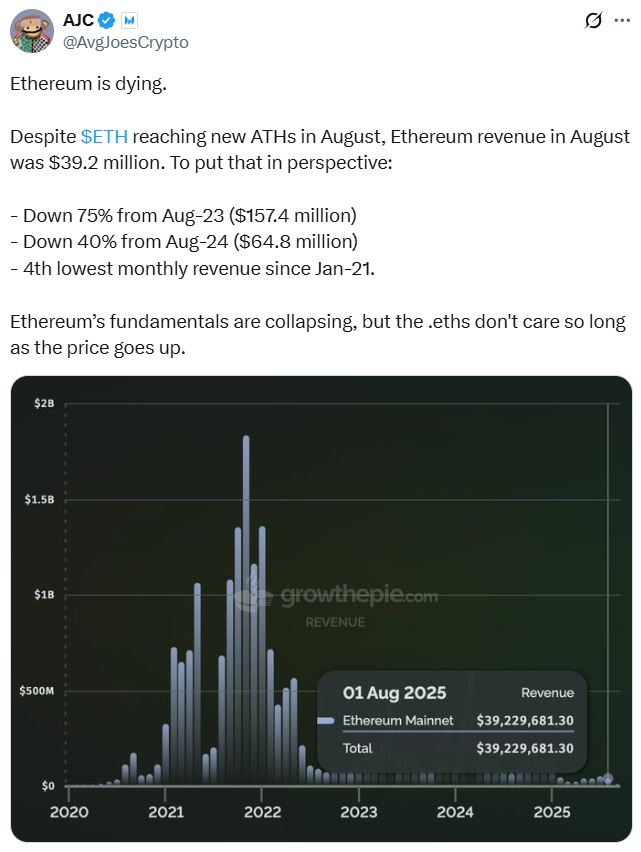

Messari analysts sparked heated debate over the weekend after Ethereum declared it “dying” as network revenues fell in August.

In a Saturday X post, Messari Research Manager AJC said that “Ethereum basics are falling apart” as it earned $39.2 million from Ethereum’s fees in August, more than 40% year-on-year and about 20% on the moon.

sauce: AJC

However, many who read this post disagreed, noting that Ethereum’s rising metrics, app revenue, stablecoin supply, ongoing L2 scaling, and that Ethereum is a product rather than a technology stock, and that it should not be valued based on revenue.

Ethereum remains a vibrant ecosystem

The majority of Ethereum’s revenue declines came as a result of the Dencun upgrade in March 2024, with transaction fees in the Layer-2 Scaling Network used as the base layer for posting transactions.

Speaking to Cointelegraph, Ethereum L2S Analytics Tool GrowthEpie data shows that “livery ecosystems with stable supply, throughput, and active addresses remain high and always close by, Henrik Andersson, chief investment officer at investment firm Apollo Crypto, said it’s unlikely that Ethereum is dying.

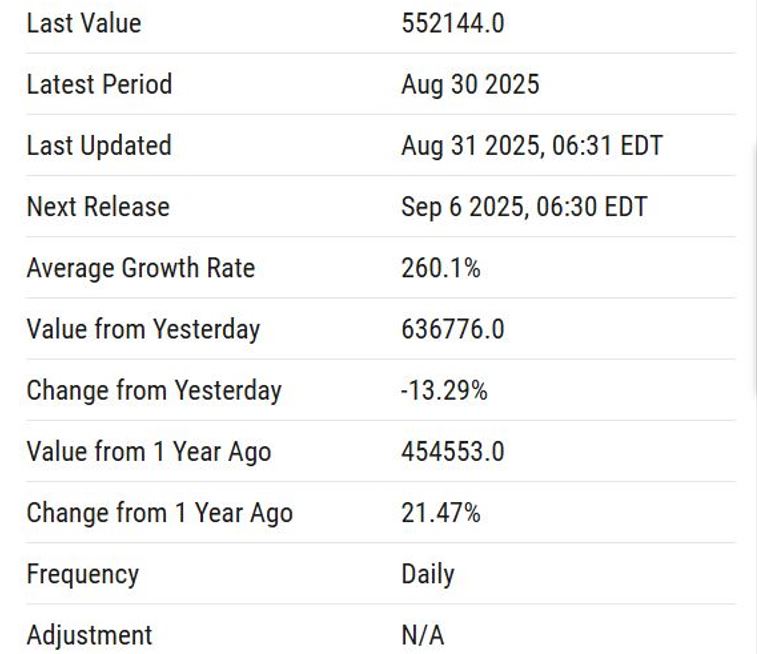

As of August 30th, there were also more than 552,000 active addresses daily for Ethereum, representing a 21% increase in 2024, according to investment research platform YCHARTS.

As of August 30th, Ethereum had over 552,000 active addresses every day. source: YCHARTS

“We believe both Ethereum and Bitcoin are located in the crypto portfolio,” Anderson said.

“Ethereum is becoming a neutral, decentralized base layer for finance, and while Bitcoin is not valued for revenue, as a valuable reservoir, we don’t think Ethereum is valued for its revenue alone.”

However, in response to critics, AJC defends the use of revenue to assess the Layer-1 blockchain, explaining that one of the biggest historic demand drivers of consumption is “trend towards zero.”

At the same time, the AJC argued that active addresses and transactions are “meaningless statistics because they have meaning related to demand.”

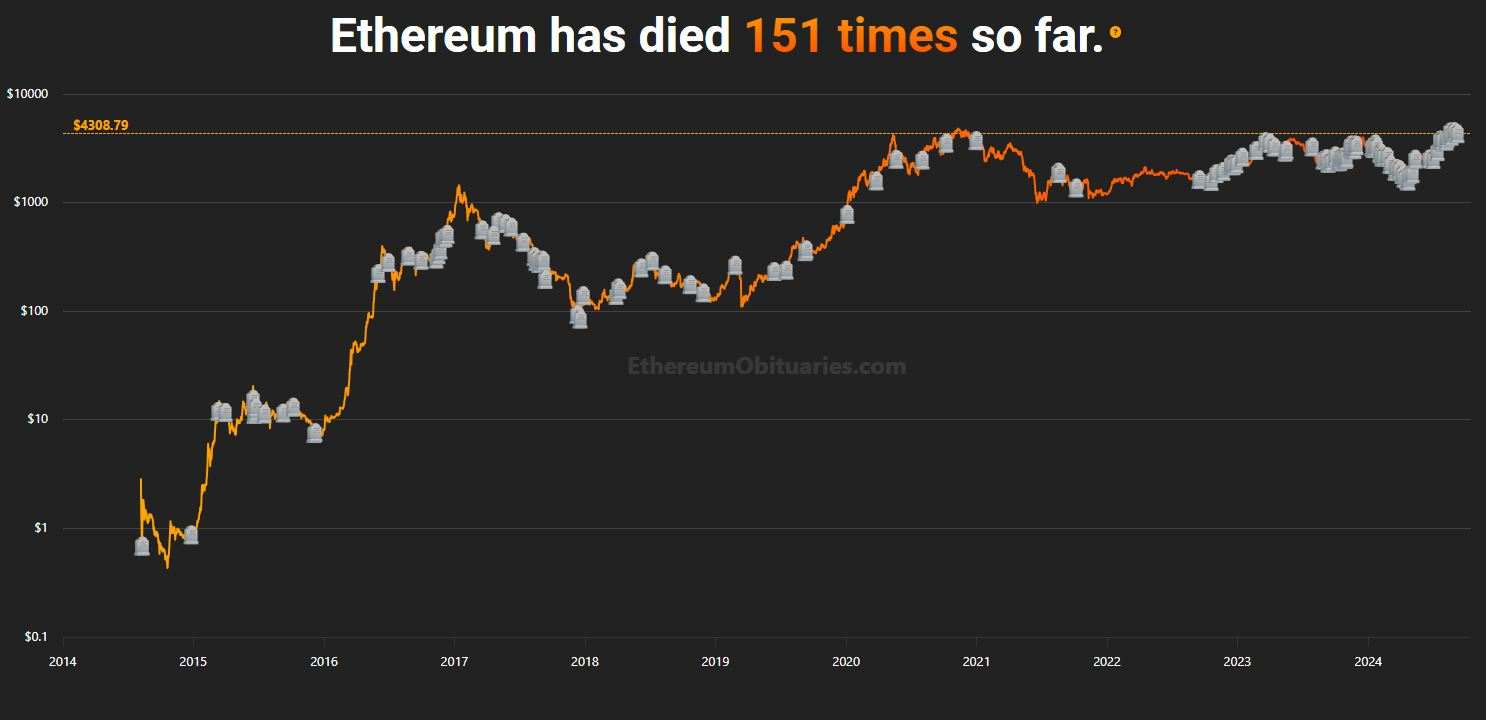

Ethereum has been declared “dead” 40 times this year

Ethereum has been declared at least 150 times by various sources since 2014. Most of these deaths have been recorded this year, with around 40 people recorded, according to the Ethereum obituary.

Ethereum has been declared dead 150 times in the ACJ post. sauce: Ethereum obituary

Ryan McMillin, chief investment officer at Merkle Tree Capital, told CointeLegraph that Ethereum continues to adapt and is declared dead at weaker narratives, lower fees, moments when transactions drop, or when competitors outweigh that.

He said, in theory, that because smart contracts are a competitive sector, developers and capital could move slowly but permanently elsewhere.

“But in reality, its developer community gives it more persistence power than the defi protocols they define, and the acceptance of regulators, than the deaths suggest.

“The bigger story is that crypto is maturing into a differentiated asset ecosystem, and Ethereum will remain one of the central parts for years to come, and competition from the other L1s is very healthy.”

McMillin said he doesn’t think Ethereum would “death,” but he has been trapped in a “difficult place” for nearly two years, as it is trapped as a faster, cheaper alternative between the Bitcoin story and Solana’s pitch.

Related: Ether Whale added 14% more coins from April’s price

“Ethereum’s Ultra-Sound Money Framing never won the more difficult financial premiums of Bitcoin. Solana simply offers the magnitude of improvement when it comes to throughput and costs,” he said.

According to McMillin, one area that supported Etherum in 2025 was spot exchange trade funding, which unleashed traditional funding flows and positioned Ether as a play based on Stablecoin adoption and network growth.

“However, the benefits may not last long. Spot Solana ETFs are expected in the coming weeks.

magazine: Korean bill to legalize ICOs, Chinese companies’ Ethereum RWAS mystery: Asia Express