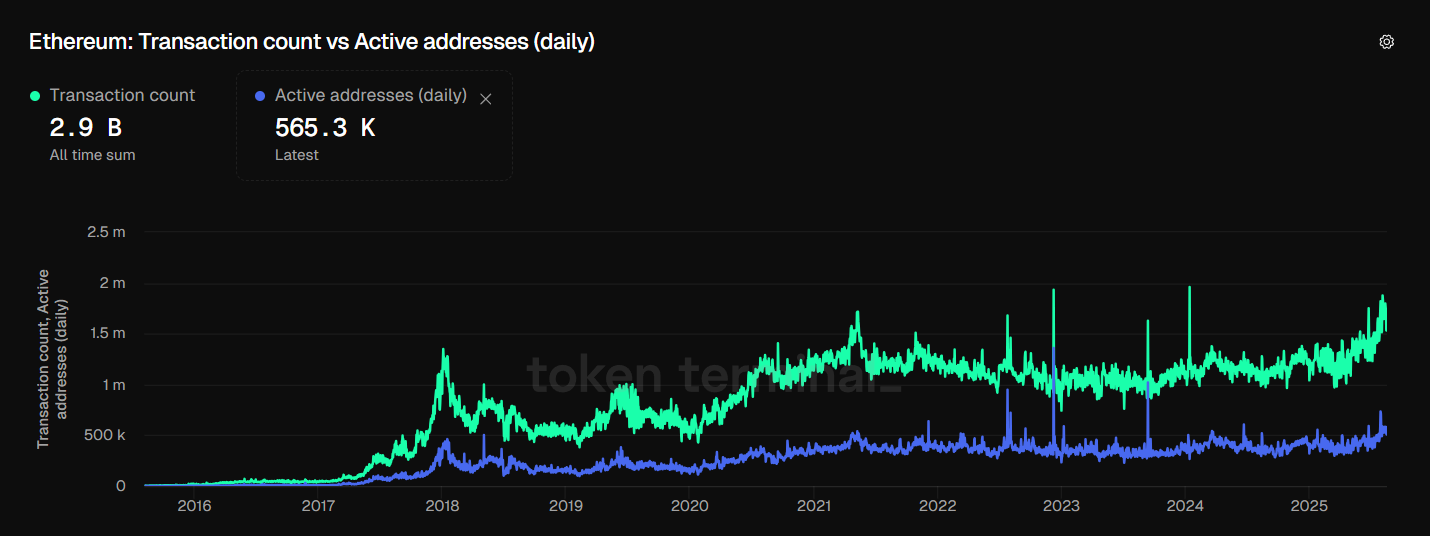

Trades at Ethereum and daily active addresses are nearing an all-time high, indicating new involvement on the network as public companies rush to scoop ETH for the Cryptocurrency Department.

Ethereum Transactions and Active Addresses

On Thursday, August 15th, the network recorded nearly 1.8 million transactions, close to an all-time high of 1.9 million transactions, according to token terminal data. Since then, daily trading has been stable at an average of around 1.5 million people, starting from about 950,000 in January 2024.

Daily Active Address has also climbed, approaching 600,000 people, setting new records in 2023 when they excluded occasional spike days.

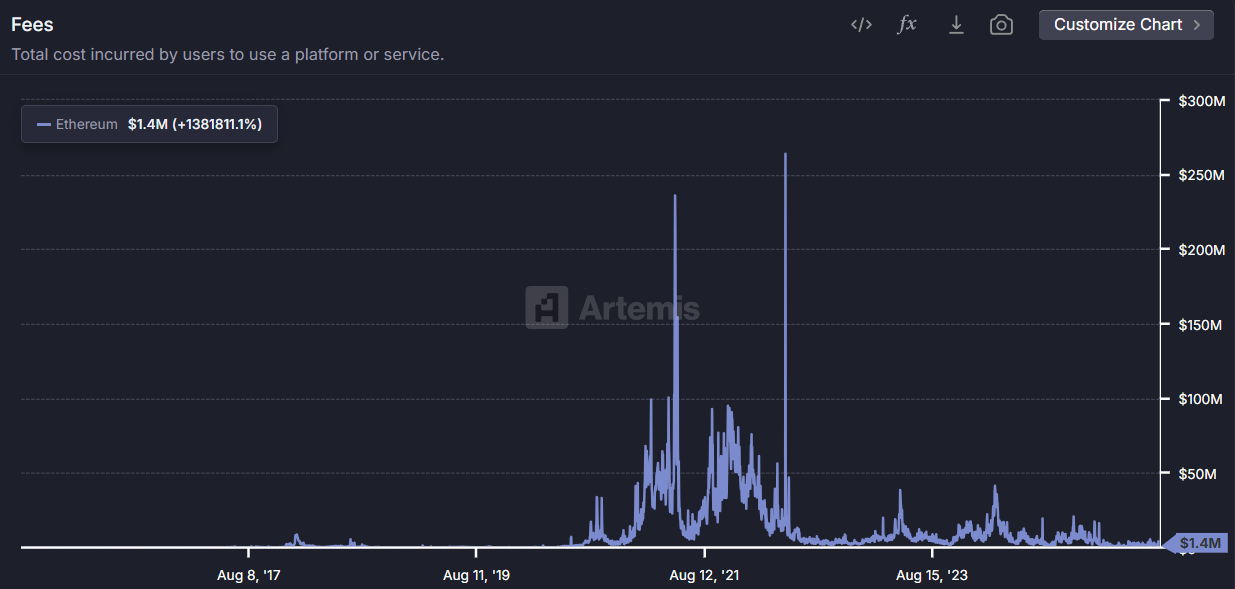

Ethereum Fees

At the same time, Artemis’ figures show that gas usage remains moderate at around $1 million per day, well below the $40 million peak in 2021-2022.

Amidst an increase in on-chain activity, the total value of Ethereum’s defi ecosystem (defi) was the highest level since November 2021, reaching $97 billion when Ethereum’s TVL reached its all-time high of $105 billion.

Healthy money

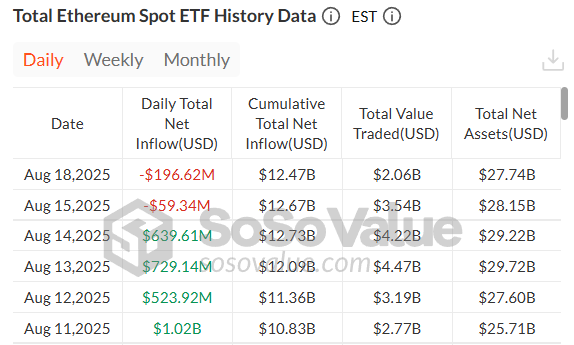

Surge coincided with an unprecedented institutional influx as SOPE Ethereum ETF attracted more than $2.8 billion in a week. This includes a daily inflow of $1.02 billion on August 11th, with ETF’s total assets exceeding $25 billion. This trend was reversed on August 18th, when funds saw a $196.6 million spill.

Ethereum SpotETF

Supported by systemic profits, ETH prices rose to $4,776 on August 14th, at its highest level this year, sliding to $4,076 and recovering to about $4,300 at press.

While the tokens are below their all-time high peak, Sean Farrell, head of digital asset research at FundStrat, said on August 13 that he expects ETH to reach $10,000 by the end of the year, and is bullish between $12,000 and $15,000.