ETH prices rose 76%, collaborating with increased speculative activity and open positions.

If the hull bang momentum continues, technical analysis suggests a breakout to $2,739.

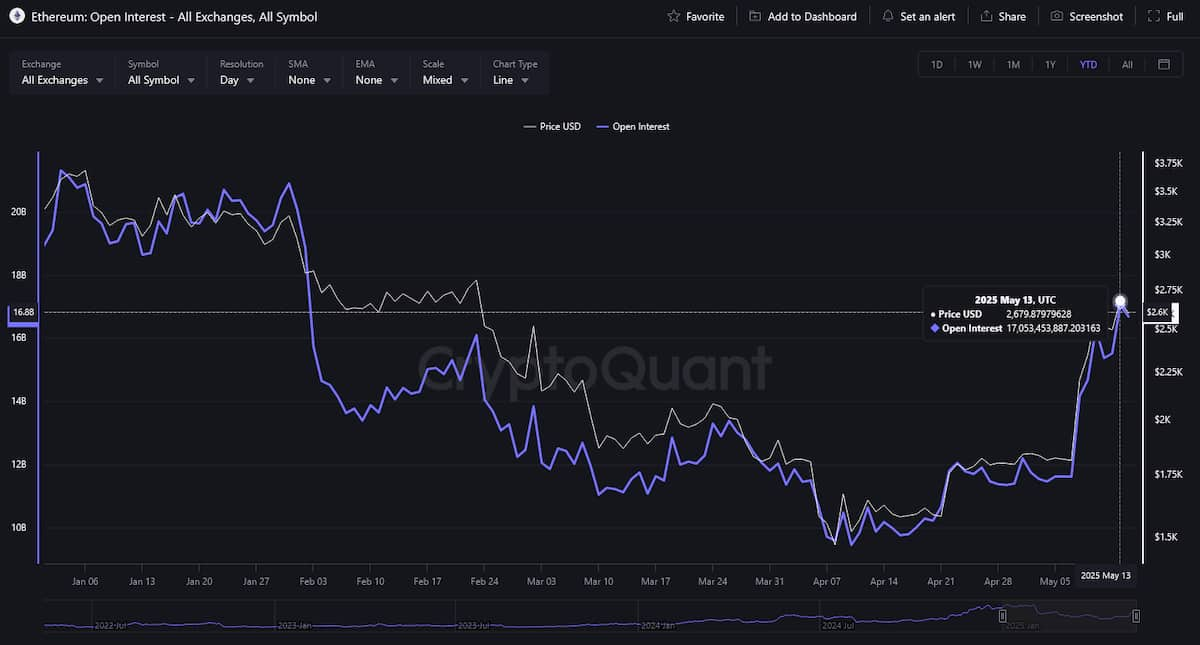

Ethereum (ETH)’s open interest is always a measure of the position of open derivatives, reaching a height of three months on May 13th, showing strong confidence that the current gathering will continue.

The total amount of derivative positions open during the day is 170.5 billion, the highest since February 2nd, and is worth around $326.8 billion for each data Finbold obtained from the cryptocurrency analytics platform. Encryption. The rise in ETH’s level of open interest is a clear indication of an increase in speculative trading, and traders appear to be betting that the rally will continue as Ethereum prices have skyrocketed recently.

Speculative trading still needs to rise significantly to surpass the height of 21.3 billion (YTD) in early January, but the recent high represents an 80.47% surge from the YTD low of just 94.9 billion seen on April 10th.

Ethereum’s surge in open interest is the latest in a long line of bullish ETH signals

During the same period, ETH prices rose 76.13% to $2,679 from $1,521 on April 10, indicating a strong consistency between open profits and bullish price action.

Despite the latest moves towards the top, ETH, which was trading at $2,602 as of May 14th’s coverage time, is down 22% year-on-year.

However, recent developments suggest that ETH’s long-standing slump may have ended. Despite the significant influx, the assembly has not yet caused significant pressure.

Finally, on the technical analytics side of things, veteran trader Peter Brandt recently highlighted a busy pattern he believes he can tell ETH’s “moon shot.” The next zone of Ethereum’s resistance is around $2,739. And if the overall market dynamics are preferred, that level of testing can occur in very near periods.

Featured Images via ShutterStock