Ethereum price has broken out of a bullish reversal pattern as the supply of tokens held on exchanges continues to decline to record lows.

summary

- Ethereum price has increased by 7% over the past week.

- ETH foreign exchange reserves have fallen to multi-year lows.

- A falling wedge breakout was confirmed on the daily chart.

The price of Ethereum (ETH) fell over nearly two weeks, from $3,633 recorded on November 10 to a monthly low of $2,680 on November 21, according to data from crypto.news. It then rebounded and rose above $3,000. Analysts say this level needs to be maintained for the trend to change from bearish to bullish. The second-largest cryptocurrency, trading at $3,013, is up 7.3% over the past seven days, but is still down nearly 40% from its all-time high in August of this year.

There are three main factors driving Ethereum prices higher this week.

First, the price of Ethereum rose, hitting multi-year lows as the supply of tokens held across exchanges continued to dwindle.

According to CryptoQuant data, foreign exchange reserves have plummeted from 20.9 million recorded in early July to 16.8 million at the time of writing. Reduced exchange supply means fewer tokens are available for immediate sale, which reduces immediate selling pressure and generally favors upward price momentum.

Source: CryptoQuant

You may also like: Ethereum network raises gas limit to 60 million, highest level in 4 years

Second, the community hype surrounding Ethereum’s possible upcoming upgrade on December 3rd is also driving up the altcoin’s price. The upgrade will be the network’s biggest update since “The Merge” and is expected to address one of the network’s most pressing bottlenecks: rollup data availability.

Third, capital inflows into Spot Ether ETFs also contributed to the bullish shift. The nine U.S. Spot ETH ETFs have recorded net inflows of $236 million so far this week, after three consecutive weeks of $1.7 billion in outflows from the funds, according to SoSoValue data.

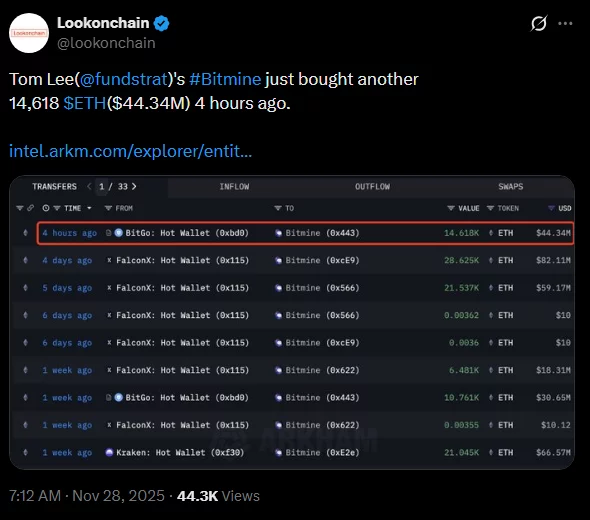

Meanwhile, continued accumulation by institutional investors such as Bitmine also served to boost traders’ confidence in Ethereum’s long-term prospects.

Bitmine’s Latest ETH Acquisition | Source:X

On the daily chart, Ethereum price has broken out of a descending wedge pattern. This pattern is a structure that forms when an asset price forms consecutive lows and highs while trading within what appears to be two converging downward trend lines.

Ethereum price breaks out of falling wedge on daily chart — November 28 | Source: crypto.news

A breakout from such a pattern is usually a sign that the trend is changing from bearish to bullish.

For now, the next major resistance lies at the 200-day moving average of $3,096, which has been holding prices down since early November. A breakout from this level could trigger a rally towards $3,600, a zone roughly in line with the 61.8% Fibonacci retracement level from the recent high to low.

The importance of this level is that it frequently serves as a pivot point where large price reactions tend to occur, often attracting renewed buying interest from traders watching for confirmation of a broader trend reversal.

However, failure to hold the $3,000 support could result in a fall towards the next key support level at $2,750, which coincides with the 38.2% Fibonacci retracement level.

read more: Top 4 reasons why a bull market is near in the crypto market

Disclosure: This article does not represent investment advice. The content and materials published on this page are for educational purposes only.