Ethereum price today is trading near $3,613 and is trying to extend the rebound from the demand zone between $3,300 and $3,450. The rally comes as the latest derivatives data shows increased open interest and improved positioning among traders.

Buyers protect key demand zones

ETH price trends (Source: TradingView)

Ethereum price today stabilized after tagging into a demand zone that lasted from August to September. This region near $3,300 to $3,450 is just above the 200-day EMA of $3,596, which has absorbed significant selling pressure in recent sessions.

The daily chart shows the price attempting to retake the 20-day and 50-day EMAs. Immediate resistance lies at $3,694 and then $3,887, where the 50-day and 100-day EMAs are concentrated. Above that, the downtrend line from the year-to-date high reaches a price near $4,001. The structure will remain fixed until buyers close above that trendline.

Parabolic SAR has broken below price for the first time in recent weeks, showing early strength. The current battle is about control. A close above $3,694 will confirm the first step in the trend recovery. A loss of $3,450 will reinstate downside pressure.

Stablecoin growth suggests capital will return to Ethereum

🔥 Latest: Ethereum leads stablecoin growth with $84.9 billion added in the past 12 months, according to Artemis. pic.twitter.com/WuAh1xVsVD

— Cointelegraph (@Cointelegraph) November 10, 2025

Ethereum dominated stablecoin supply growth this year, adding $84.9 billion, according to Artemis data. No other chain can match this. Tron and Solana are a distant second and third on the charts.

An increase in stablecoin supply often signals an influx of new liquidity into the ecosystem. Stablecoins serve as dry powder for trading, market making, lending, and staking. As the base of a stablecoin increases, the likelihood of future inflows into ETH or ETH-based assets increases.

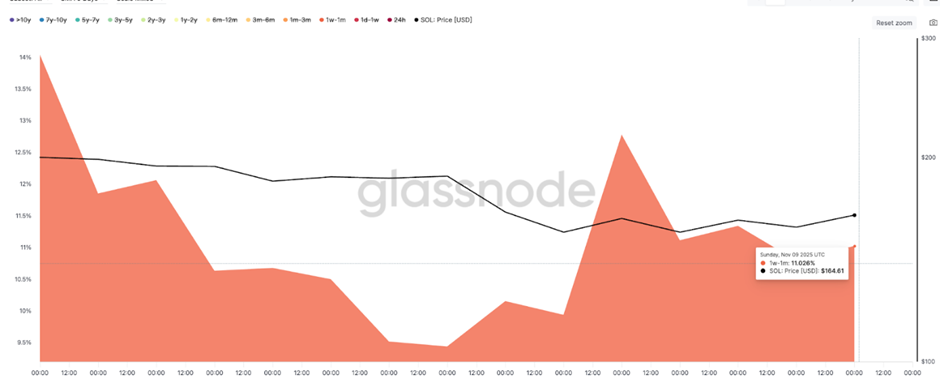

Derivatives data shows re-leveraging to rebound

ETH derivatives analysis (Source: Coinglass)

Derivatives positioning confirms changes in market behavior. Coinglass data reflects:

- Trading volume increased by 36.32% to $81.6 billion

- Open interest increased by 8.80% to $42.37 billion

- Options trading volume increased by 127.08% to $1.21 billion

A spike in open interest indicates that traders are adding exposure rather than unwinding. The long-to-short ratio indicates bullish behavior.

- Binance long-to-short ratio: 1.99

- Binance Top Trader Long Bias for Positions: 2.89

- OKX Long to Short Ratio: 1.61

Spot flows show capital is returning after weeks of outflows

ETH Netflows (Source: Coinglass)

From most of October to early November, Ethereum faced spot outflows, which were a sign of circulation. That has changed today.

The latest Coinglass data shows:

- Spot net inflows on November 10 were $127.82 million

The reversal in spot flows supports the idea that investors are returning to Ethereum after key demand zones hold. This makes sense because spot buyers are typically taking long-term positions rather than short-term speculative trades.

outlook. Will Ethereum go up?

The setup has changed from being reactive to being constructive. The expansion of stablecoins suggests that liquidity is being built on top of Ethereum. Derivatives positioning shows that traders are gaining confidence rather than retreating. Spot inflows confirm that capital is circulating back into the ecosystem rather than leaving it.

- Bullish case: A daily close above $3,694 and then $3,887 would confirm a trend recovery and set targets at $4,300 and $4,500.

- Bearish case: If the daily close price falls below $3,450, the rebound is void and $3,250 and $3,000 may be exposed.

If Ethereum holds the 200-day EMA and clears $3,887, the trend will return to higher highs. Losing the demand zone turns the movement into a deeper correction.

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to conduct due diligence before taking any action related to our company.