Ethereum has risen 60% over the past month to $2,543, marking a markedly surge in prices. The rally is driven primarily by a significant accumulation by investors, with an ETH of 1.34 million totaling over $3.42 billion.

Despite growth, some key investors are beginning to step down and are aiming to secure profits before potential risks arise.

Ethereum investors increase supply

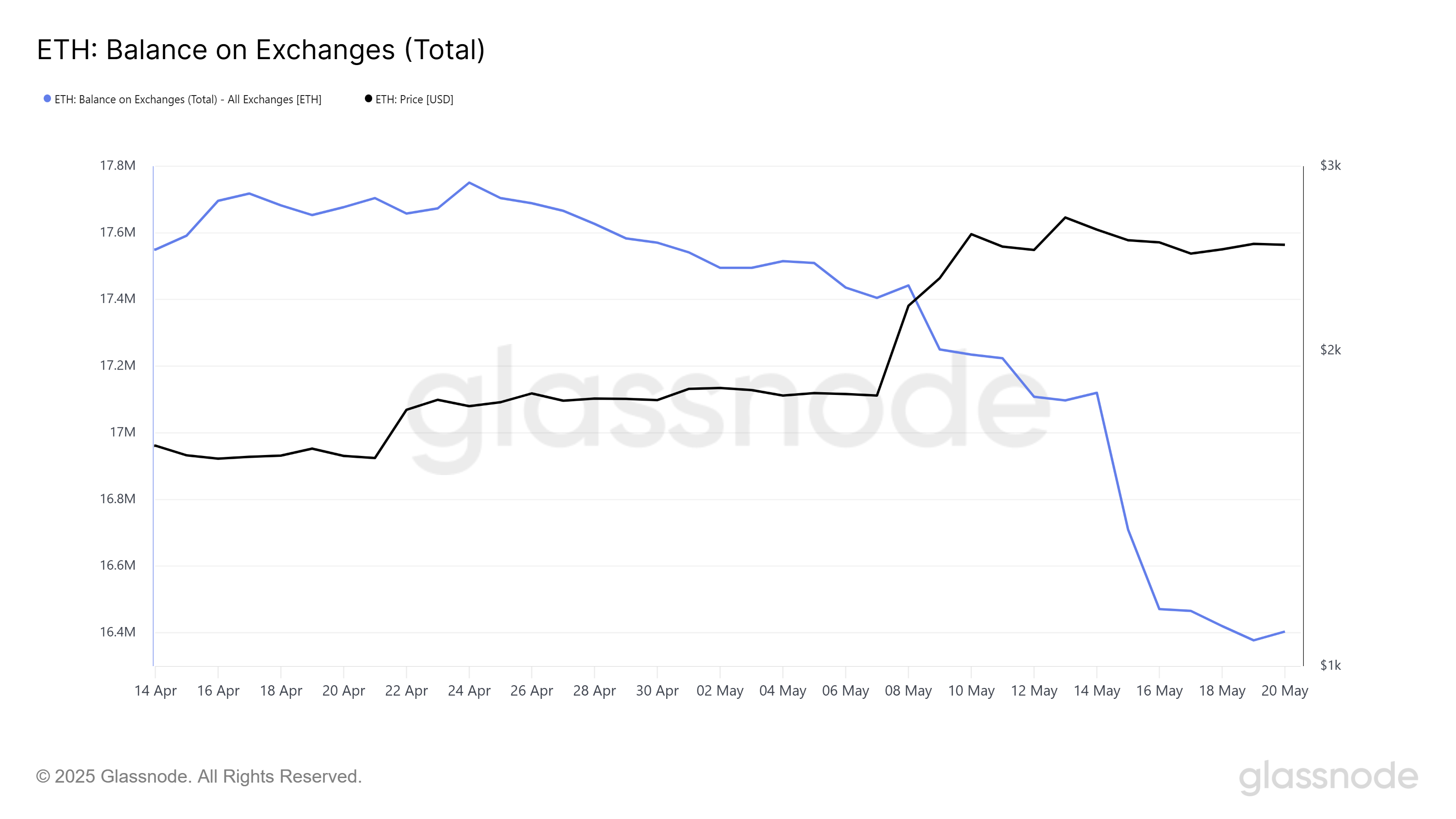

Ethereum exchange balances have marked a major change in the market situation, with 1.34 million ETH dropping over the past month (April 21 to May 21). The supply cut is valued at over $3.42 billion, and has boosted investors’ confidence in Ethereum’s long-term growth, primarily due to Pectra upgrades.

The decline in Exchange Supply reflects the growing belief that Ethereum can continue its upward trajectory. This rush, which earns Ethereum, creates a FOMO (missed fear) effect, and contributes to price increases.

Exchange Ethereum Balance. Source: GlassNode

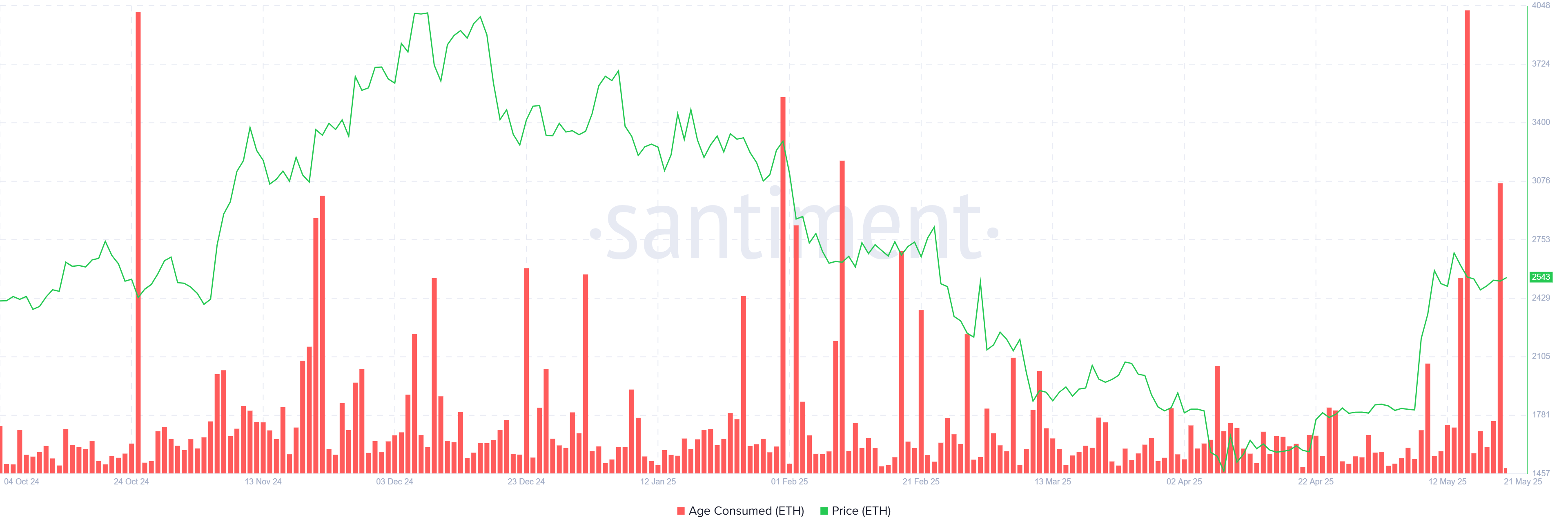

However, the macro momentum surrounding Ethereum is mixed, with long-term holders (LTHS) showing behaviors that suggest attention. This week’s consumed metrics have been spiked twice, indicating that a significant portion of ETH is being sold by LTHS to lock in profits.

This is the biggest wave of sales in the last seven months, and these holders believe Ethereum may have reached the top of the market. The sale by LTHS draws attention to potential risks that could affect Ethereum’s future performance. This continued profit trend could hinder cryptocurrency growth prospects.

It was consumed during the Ethereum era. Source: Santiment

ETH price rise

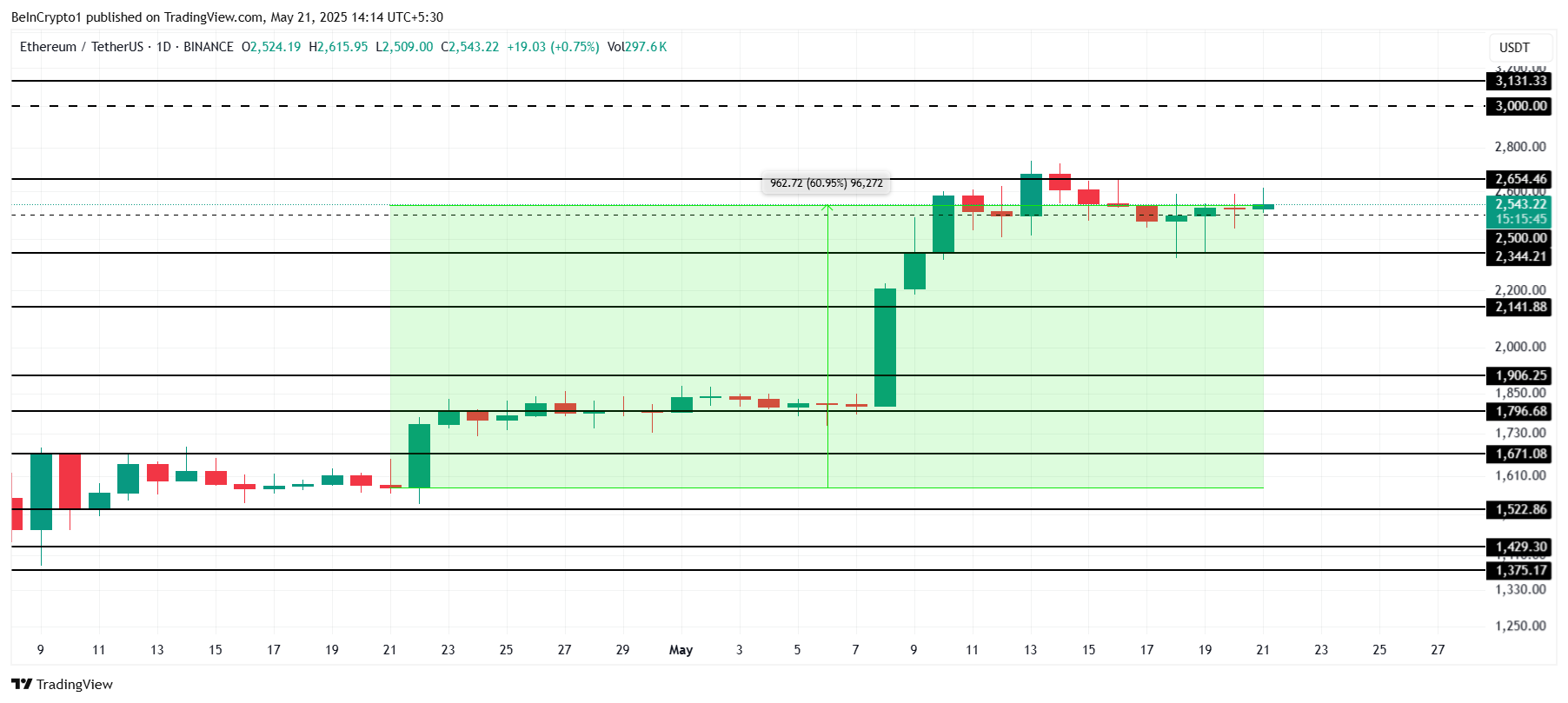

Ethereum prices currently trade at $2,543, marking 60% of the rally in the past month. However, the price is facing $2,654 resistance. Violating this resistance is important for Ethereum to continue rising.

Because Ethereum has a strong correlation with Bitcoin, prices could skyrocket above this level if Bitcoin forms a new all-time high (ATH). The move could bring Ethereum closer to $3,000 and further strengthen its bullish outlook. If the broader market remains positive, Ethereum prices can see continued upward momentum.

Ethereum price analysis. Source: TradingView

However, there are risks in the market. If sales pressure from LTHS intensifies and the accumulation phase ceases, Ethereum prices can struggle to maintain their upward trajectory. Losing support at $2,344 is likely to drop to $2,141, which will disable current bullish papers and create a bearish outlook for cryptocurrency.