Ethereum faces a major drop in prices, dropping from its high to $4,750 to $4,200.

Nevertheless, the decline may not be over. Ethereum could experience further downtrends in the coming days, with some metrics indicating potential sales pressures.

Ethereum holders can cause crashes

Ethereum long-term holders (LTHS) are currently seeing a surge in profits, as indicated by the long/short difference in MVRV. Typically, when this indicator falls deep within the negative zone, it indicates that short-term holders (STHs) are making profits and selling trends.

However, Ethereum metrics are in the positive zone, suggesting that LTHS is enjoying significant benefits. This positive movement generally shows strength, but it shows that LTHS is looking to make a profit and could lead to potential sales pressure.

LTHS’ continued profits put Ethereum in a precarious position. These owners have made substantial profits, so their decision to sell can exacerbate downward price movements.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum MVRV Long/Short difference. Source: GlassNode

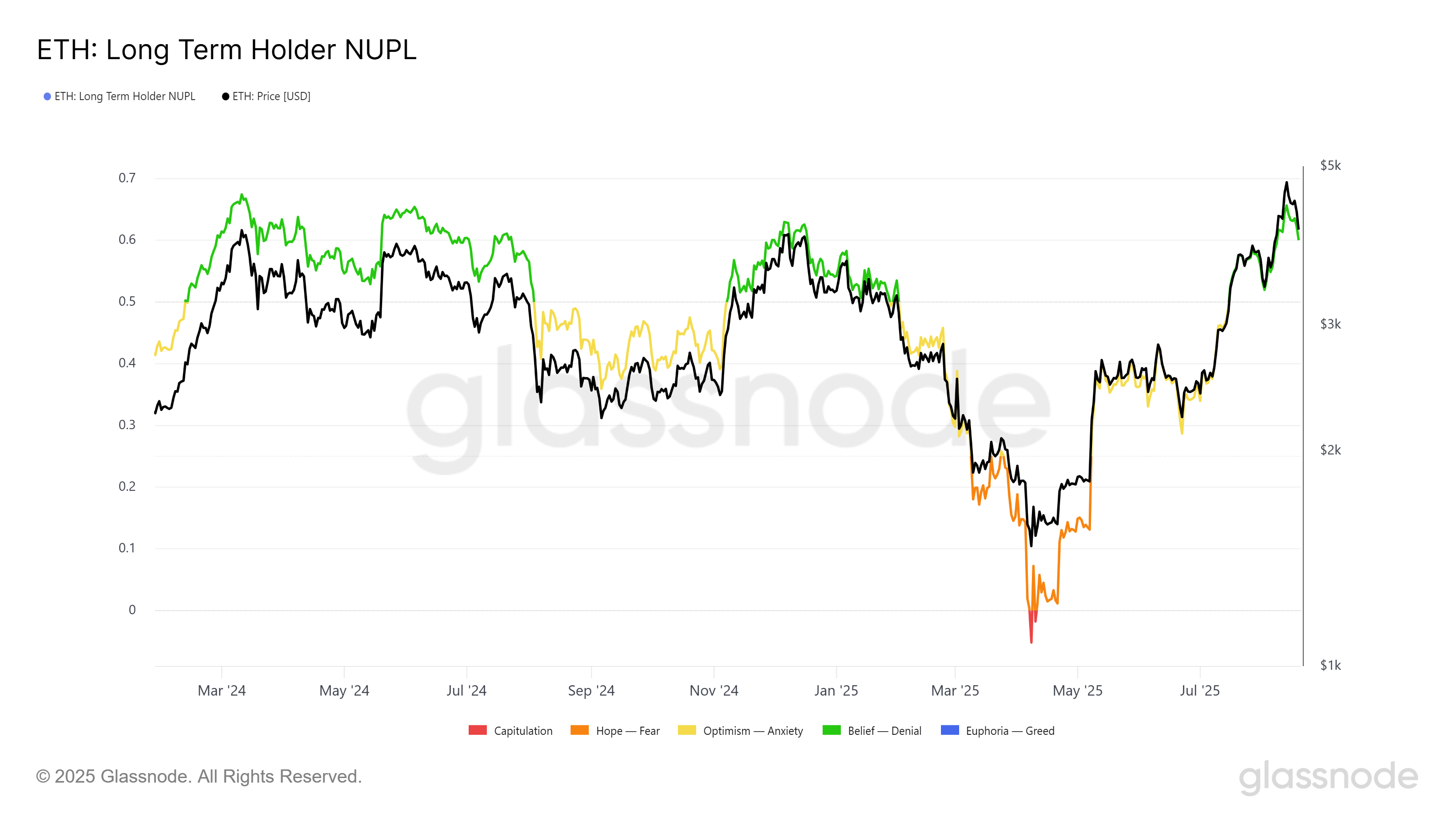

Ethereum’s Lth Nupl (net unrealized profits/losses) is currently at an eight-month high, reflecting historic patterns. The NUPL indicator shows the difference between realized profits and losses for long-term holders, with recent increases suggesting significant gains for these holders.

However, historical trends show that Ethereum prices are facing a reversal when NUPL exceeds the 0.60 mark. This indicates that Ethereum could experience a price drop if the current trend continues, as the profits pointed out by LTHS may encourage them to sell.

High levels of Ethereum’s Lth Nupl make it more likely that long-term holders will sell their positions and amplify market modifications. The past shows that this is a strong signal for potential price drops, and Ethereum may be ready for a similar scenario.

Ethereum Nupl. Source: GlassNode

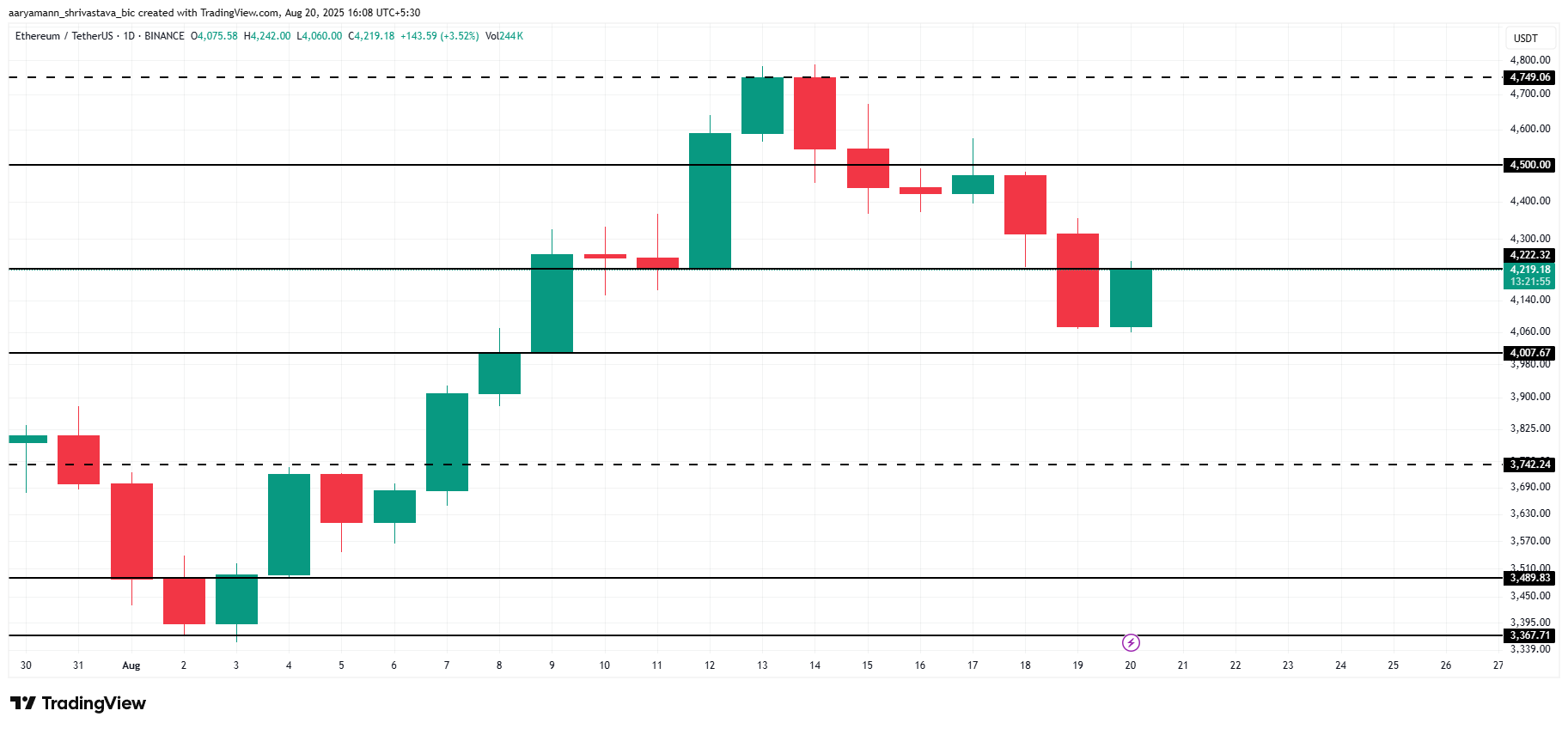

ETH prices may drop to $3,000

The price of Ethereum has already declined, with the current price being $4,219. If the downtrend continues, it could fall below the $4,000 key level. However, the greater concern is the potential drawdowns caused by long-term holders deciding to sell. If LTHS starts to make profits, it could put a lot of pressure on Ethereum’s prices.

Looking at Ethereum’s past price movements, the NUPL indicator shows that when LTHS created the Market Top, Ethereum prices fell below $3,000, reaching a low of around $2,800. If this pattern is repeated, Ethereum prices will experience a similar drop, reaching a critical level to look at $3,000.

ETH price analysis. Source: TradingView

Meanwhile, the market can bounce back if Ethereum’s LTHS holds its position and resists sales. If Ethereum can regain support for $4,222, it could push back to $4,500, potentially disabling the current bearish outlook. This depends on whether the LTHS is confident or not and does not cause any further sales pressure.

Post Ethereum prices fall below $3,000 as these holders first appeared on Veincrypto.