Ethereum prices are in the consolidation stage, but show signs of accumulation, which could lead to bullish breakouts.

Ethereum (ETH) was trading for around $2,500 in its last check on Saturday, July 5th, within a narrow range that has been maintained since May.

Third-party data shows that whales and Wall Street investors have expanded their Ethereum status in the past few months. Sosovalue shows that Spot ETH ETF added more than $229 million in assets this week, continuing the trend that began in May. This was the eighth consecutive week of inflow and a sign that these investors were hoping prices would rebound.

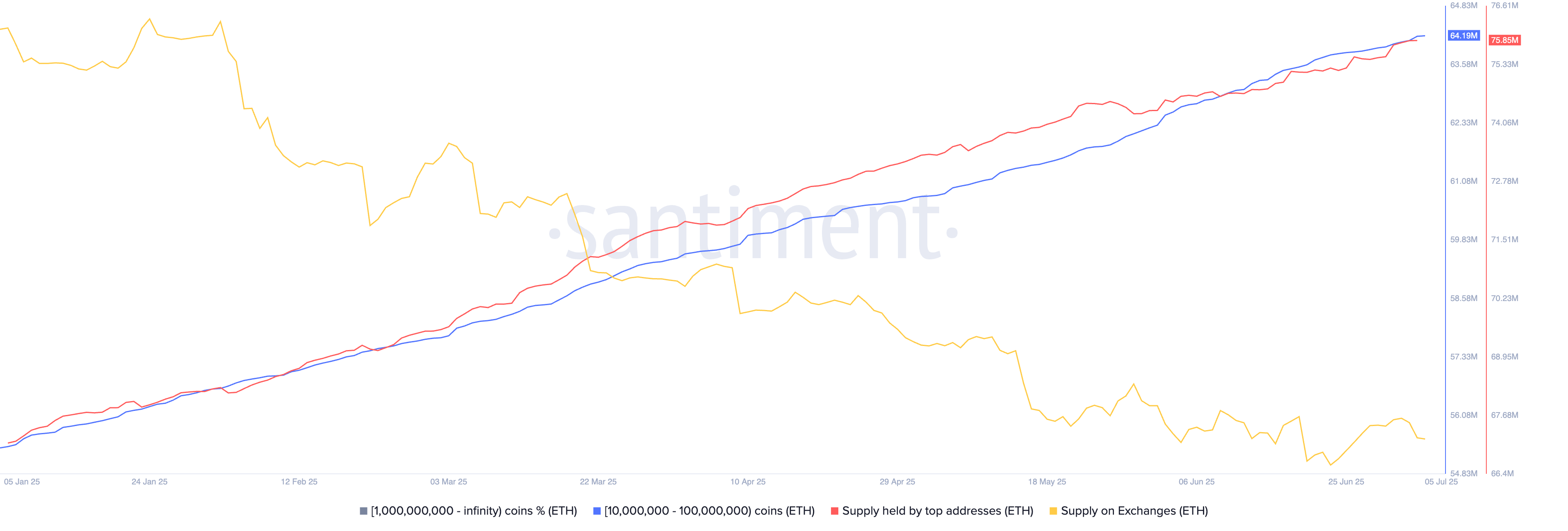

More data shows that whales continue to buy Ethereum this week, with addresses holding 10 to 10 million tokens increasing their position to 64 million tokens.

Similarly, as shown by the chart below, the supply held by the top address continued to be strong upward trend, reaching a high of 75.6 million.

You might like it too: Humanity’s tokens go against market slump with a surge in prices of 40%

Ethereum The balance of exchanges decreases and staking levels increase

Currently, there are 7.3 million ETKENs on the exchange. This is down from 1.73 million in February. The balance of exchange is a sign that investors continue to move coins to self-reliance.

ETH Whale Purchase and Supply Exchange | Source: Santiment

More investors are staking their ETH coins. StakingRewards data shows a net increase of 2 million coins, over $4 billion, in pool staking. This increase marked staking ratios of 29.45%, bringing steaking market capitalization to nearly $90 billion.

ETH spills from the exchange, coupled with rising staking, indicate the transition from short-term trading to long-term holdings and yield generation. It reflects the increased ethereum ecosystem, increased decentralization, and increased trust in the mature investor base.

Ethereum price technology analysis

ETH Price Chart | Source: crypto.news

Daily charts show that Ethereum prices have remained in a tight range since May this year. Accumulation and distribution indicators continue to increase, and this year we are approaching the highest level.

Ethereum formed a bullish flag pattern that includes vertical lines and horizontal integration. This pattern often leads to a strong bullish breakout, which corresponds to flagpole height.

In this case, the flagpole height is about 52%, and the target price is $4,287, measured from the breakout point. If it rises above last year’s high of $4,100, the target level profits are confirmed.

The bullish Ethereum price forecast will be invalidated if you lower your psychological points to $2,000 down.

read more: Maple syrup prices are rebounded so that smart money accumulates