On-chain data shows that Ethereum investors’ profitability has seen a sharp shift following the latest rally in asset prices.

The profitability of Ethereum Holders has recently been observed a dramatic reversal

In a new post from X, the institutional debt solution offers Sentora (formerly Intotheblock) and talks about how the decline in profits has changed on the Ethereum Network.

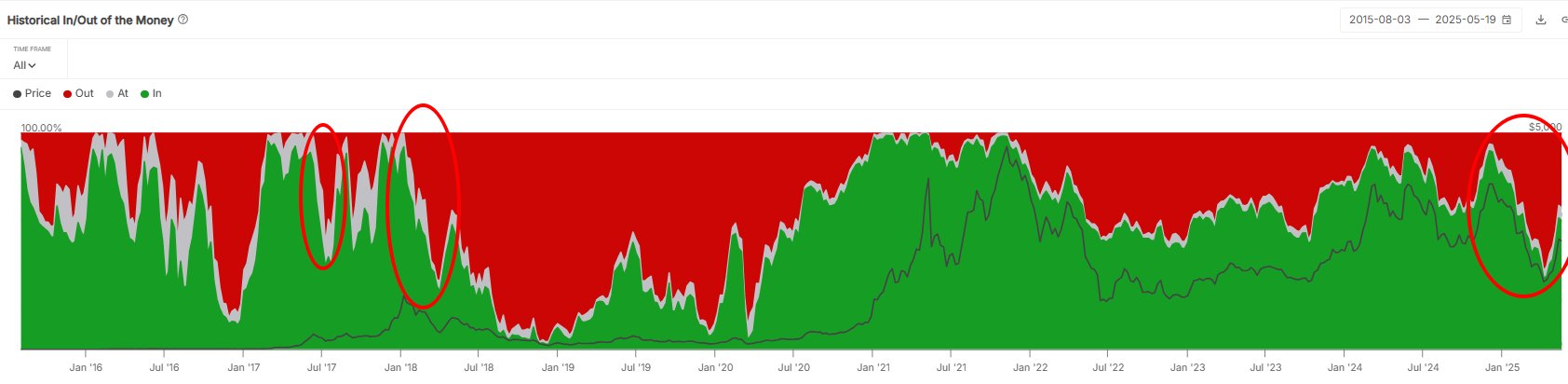

The on-chain indicator of relevance here is “the historical inside and outside of money.” This tells us that the ETH user base portion is profit (“in money”), loss (“from money”), and is evenly uniform.

The metric works by going through the on-chain history of each address on the network to see the average price you got the coin. If this average cost base is lower than the spot price of a wallet, that particular user is considered to be in the money. Similarly, the address is assumed to be out of money in the opposite case with money when the two prices are equal.

Well, here’s a chart showing the trends in/money in Ethereum history over the past decade.

Looks like the amount of green investors has gone up in recent days | Source: Sentora on X

As shown in the graph above, investors in In The Money Ethereum had observed a sharp decline following the sale that began in December 2024. Before this drawdown, the metric is over 90%, meaning that the majority of users are holding unrealized benefits. However, by April 2025, the value had dropped to just 32%, which completely reversed for investors.

It appears that there is yet another shift in cryptocurrency addresses now. This is because we saw a sharp meeting this time. Almost 60% of holders are now back in money, but not close to the same level as the end of last year, but are significantly higher than the lower level.

On the charts, the analytics company highlights when Ethereum last saw such sharp profitability. “The asset has not witnessed volatility on this scale since the 2017 cycle,” Sentora said.

In some other news, ETH has recouped two important on-chain levels after the recovery run, as discussed in its latest weekly report by analytics company GlassNode.

The price of the coin seems to have surpassed the True Market Mean | Source: Glassnode's The Week Onchain - Week 20, 2025

It is clear from the chart that Ethereum regained realised prices early in its execution. Realized prices represent the average cost base of all investors on the ETH network. This level is currently at $1,900. In other words, at current exchange rates, holders are prominently profitable.

Cryptocurrency has now managed to surpass the true market average at $2,400. This is similar to the price the model realizes.

There is another level remaining in Ethereum. This is an active realised price of $2,900. This is a model that repeats realised prices.

ETH Price

Ethereum rose to the $2,660 mark, following a roughly 4% rally last week.

The trend in the ETH price over the past five days | Source: ETHUSDT on TradingView

Featured images from charts on Dall-E, Glassnode.com, IntotheBlock.com and cradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.