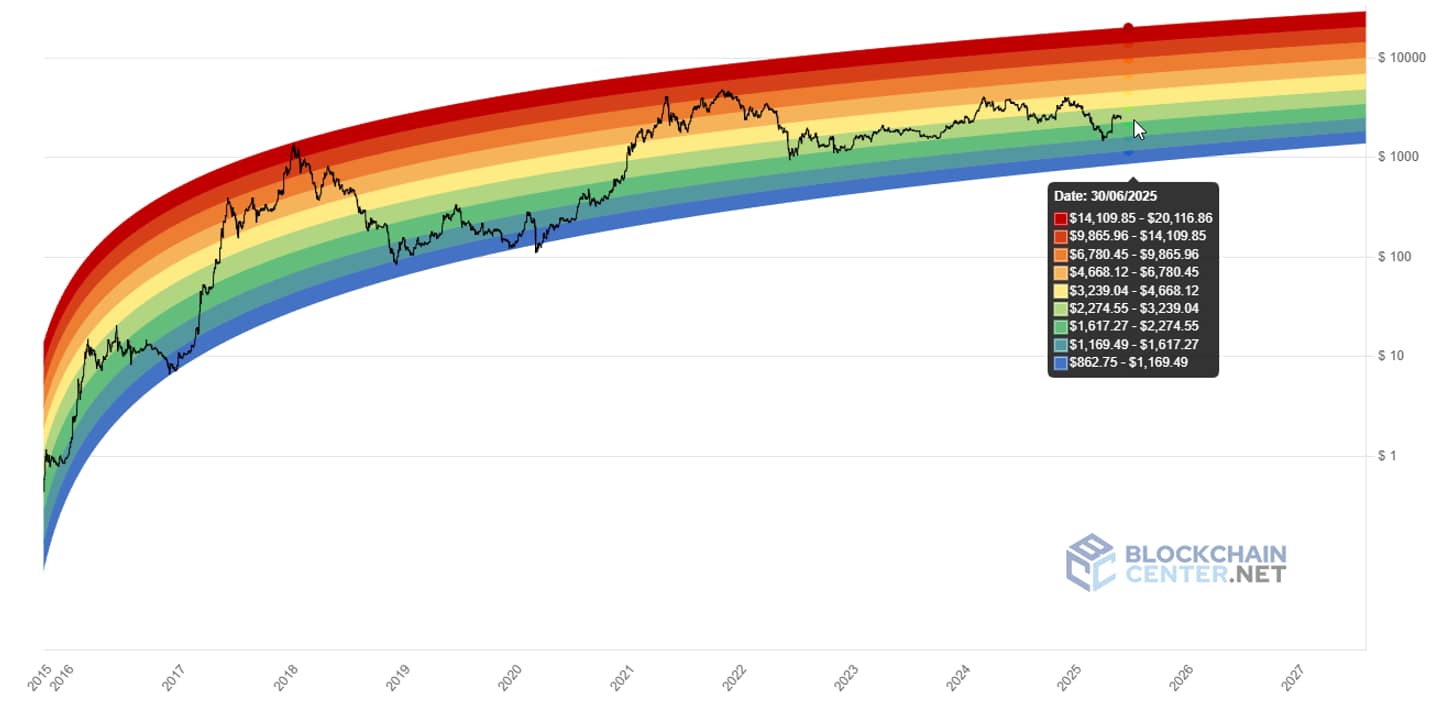

Ethereum (ETH) currently promises the $2,480 mark, with Rainbow Chart predicting that prices could fall to triple digits or rise to the five-digit range by the end of the month.

This chart uses logarithmic regression curves to track Ethereum’s historical price performance and projects future prices on a color-coded scale divided into nine zones. Each zone represents a different level of market sentiment, ranging from significant underestimation to intense overexcess.

On June 30th, Rainbow Chart forecasts its price range from $862 to $20,117.

The lowest color band labeled “Fire Sale” is projected to be between $862.75 and $1,169. This range indicates deep underestimation and rare purchasing opportunities. Above that, the band is “Buy!”, ranging from $1,169.49 to $1,617.27, and is considered an equally attractive entry point.

Second, the “accumulation” level has grown from $1,617 to $2,274, suggesting a moderate bullish outlook. On top of that, the “still cheap” zone covers the $2,274 to $3,239 range. Here, Ethereum is considered below fair value, but it rises attractively. At current prices, ETH is currently in this zone.

“Hoddle!” A band that ranges from $3,239 to $4,668. This band reflects neutral to positive emotions. On top of that, the so-called “Is this a bubble?” zone ranges from $4,668.12 to $6,780.45 with price momentum beginning to draw attention to the market.

At a higher up, the “FOMO Enhancement” ranges from $6,780.45 to $9,865.96, bringing increased speculative enthusiasm. As prices go up further, the “Sell. Seriously, Sell!” zone offers peak market heat ranging from $9,865 to $14,109.

The “maximum bubble territory” band, the top zone, ranges from $14,109 to $20,116.86, suggesting extreme overvaluation.

Ethereum price analysis

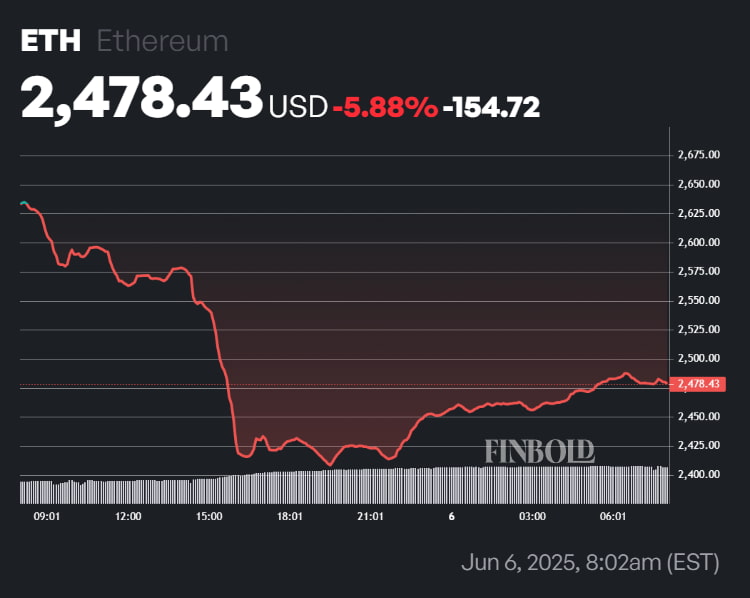

At the time of pressing, Ethereum is trading at $2,478, a DIP of -5.88% over the last 24 hours.

This means it will be placed somewhere in the middle of the “still cheap” zone, and it is trading below fair value, and it is likely that the appeal will soon increase.

Certainly, upcoming upgrades like Fusaka and Glamsterdam could boost Ethereum’s throughput and bullish long-term outlook. However, increased leverage could also increase the risk of volatility.

Additionally, the bearish signal includes a moving average convergence/divergence (MACD) histogram of -40 and a relative strength index (RSI) of 46.72, suggesting integration.

Featured Images via ShutterStock