Ethereum will recover from key support levels as open interest jumps by 4.75% and short liquidation exceeds $34 million. The main resistance is $2,699 and $2,800.

At the time of pressing, Ethereum recorded an intraday profit of 3%, reflecting Bitcoin’s bullish recovery. Among the wider market rebounds, along with increasing optimism in the derivatives market, the decline in Ethereum exchanges shows potential benefits.

Ethereum Price Analysis Eyes Breakout is over $2,699

On the daily charts, Ethereum showed a big bullish failure last week, failing to hold a 50% Fibonacci level above $2,699. This reduced prices to a weekly low of $2,439, followed by a bullish reversal.

The candles have long shadows these days, with Ethereum bounced back at the $2,626 market price, showing a bullish turnaround. A bullish surge in momentum increases the likelihood of a breakout as they aim to retest 50% Fibonacci levels.

The MACD and signal lines are approaching a bullish crossover, but the RSI is reversed upward from the midpoint, indicating an increased purchase pressure. Therefore, technical indicators remain optimistic about Ethereum.

According to Fibonacci levels, breakouts above the 50% level could target 61.8% Fibonacci levels for $3,003. However, a recent peak of nearly $2,800 could serve as an intermediate resistance.

On the downside, critical support remains at $2,395 at a Fibonacci level of 38.2%.

Supply pressure is alleviated amid declining Ethereum reserves

Last week’s bullish failure hit a weekly high of ETH of 1,889 million, following a short surge in Ethereum’s exchange reserves, according to encrypted data. However, as the market recovers, investors are once again withdrawing ETH from the central exchange, reducing sales pressure.

Currently, the replacement spare is 18.67 million ETH, close to the record low of 18.63 million ETH recorded on June 4th

Ethereum Exchange Reserve

Bulls win position in the Ethereum derivatives market

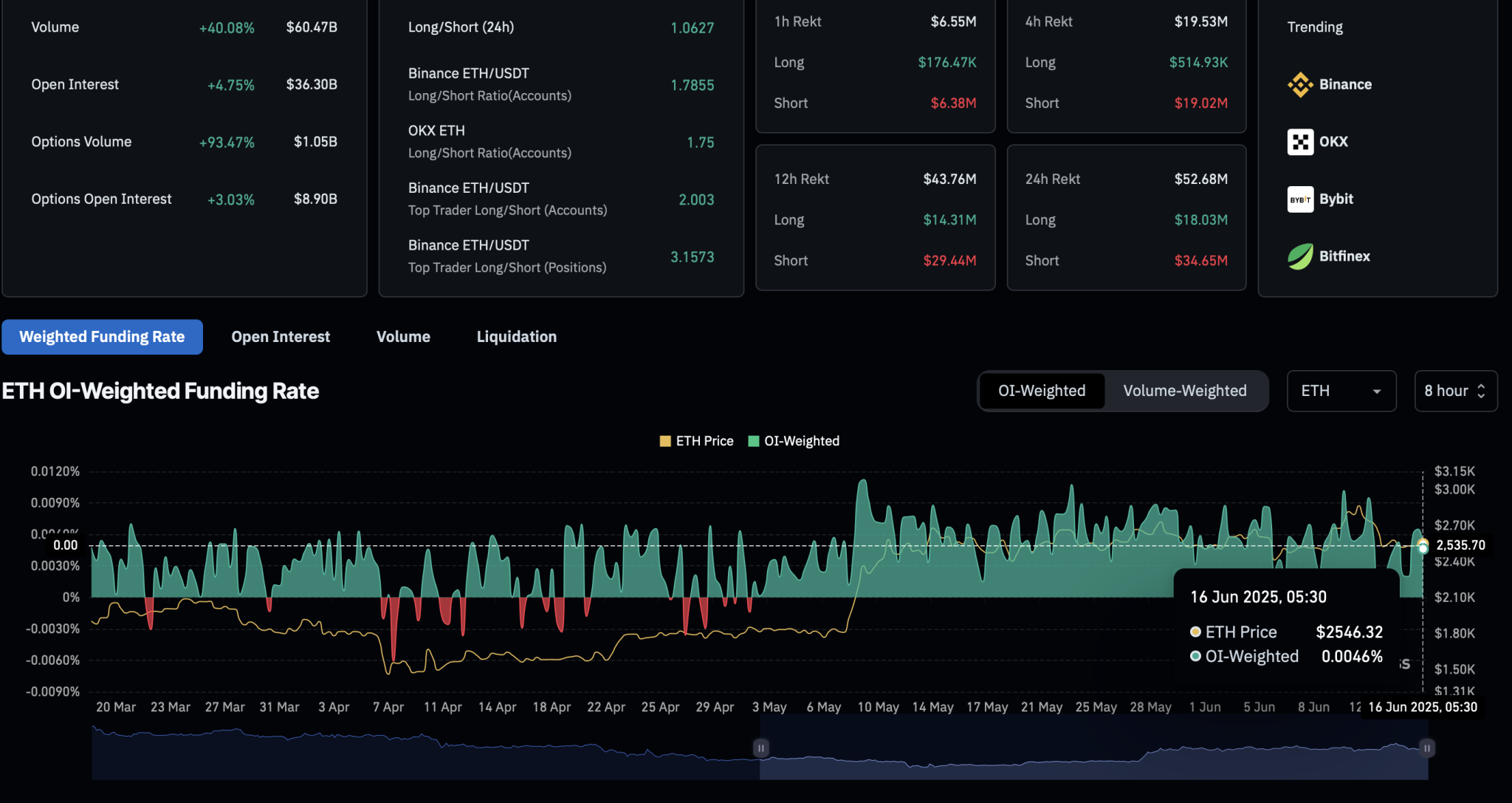

Coinglass data shows the growing optimism for Ethereum as the broader market recovers. Ethereum’s public interest increased by 4.75% to $363 billion, with an OI weighted funding rate of 0.0046%. This reflects the expectations of increased bullish emotions and sustained recovery.

Ethereum Derivatives

Over the past 24 hours, liquidation has revealed bullish bias, with a short position of $34.65 million being settled and a long position of $18.03 million.

Following a rather short aperture, the short-to-short ratio rose to 1.0627, indicating a bullish imbalance in the open position.