Ethereum (ETH) price has risen about 3.5% over the past week, suggesting a small rebound. However, the token is still down more than 2% on the daily chart, indicating that the selling pressure has not completely eased.

This combination of short-term recovery and day-to-day weakness explains why Ethereum’s breakout attempt failed on October 27th, but one group of investors is still quietly preparing for the next rebound.

Cooling demand explains breakout failure

Ethereum’s recent rejection is rooted in slow accumulation among active holders.

The holder accumulation ratio, which measures how much wallets are increasing compared to decreasing ETH holdings, decreased from 31.278 to 30.964, a 1% drop from the recent three-month peak.

ETH holders take a step back and reduce their coin accumulation: Glassnode

Want more token insights like this? Sign up for editor Harsh Notariya’s daily crypto newsletter here.

This decrease means that fewer addresses are adding ETH even as the price rises, suggesting that traders are being cautious or waiting for a better entry.

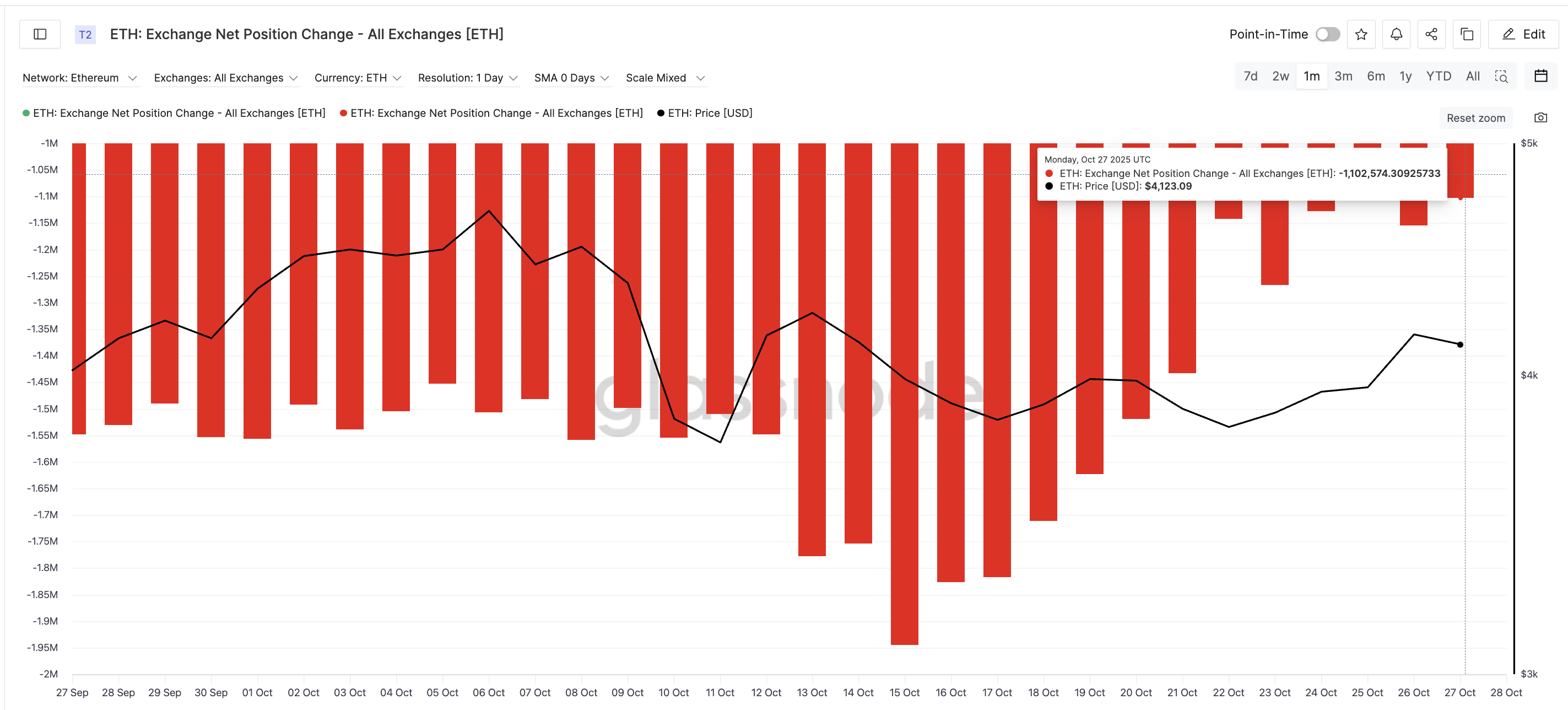

At the same time, currency flows confirm the change in sentiment. The change in an exchange’s net position, which measures how much ETH is leaving the exchange, is no longer so negative. On October 15th, the outflow amount reached nearly 1.94 million ETH, but by October 27th, the outflow amount had shrunk to 1.1 million ETH, a 43% decrease.

Ethereum Seller Returns: Glassnode

Decreasing outflows typically means holders are leaving more ETH on exchanges, which is a sign of increased short-term selling interest. Putting these two factors together explains why Ethereum’s breakout attempt failed to maintain momentum.

Supply clusters contain rally

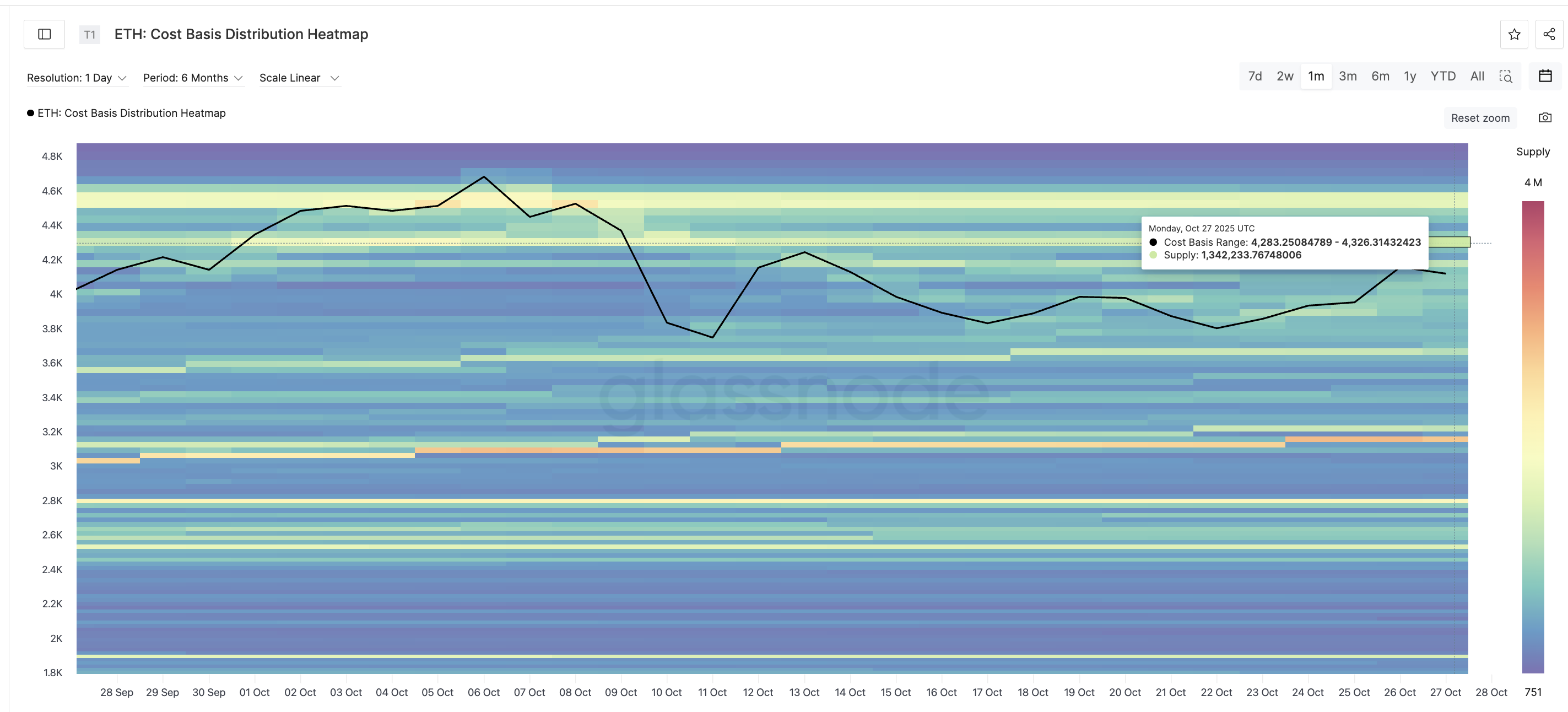

The cost-based heatmap highlights where large batches of ETH were last purchased, showing the strongest supply cluster between $4,283 and $4,326, totaling around 1.34 million ETH.

This is the same zone where Ethereum’s rise stalled, namely the $4,254 to $4,395 range seen on the chart (highlighted later). Therefore, whenever ETH approaches this area, pressure can increase as previous buyers start selling to lock in profits.

The strongest ETH cluster: Glassnode

Until this wall is overcome, Ethereum’s rally is likely to continue to fail. But not everything looks weak.

Ethereum pricing remains balanced

Ethereum continues to move inside the symmetrical triangle that has been in place since October 7th. The latest rejection at the upper trendline on October 27th confirmed strong resistance but did not break the broader setup.

For Ethereum price to regain momentum, it will need to close firmly above the upper bound of the triangle and maintain its movement. That would pave the way for the next major resistance zone. The first level crossed is $4,254 and then $4,395 (an increase of nearly 7%).

Breaking above these levels by a 12-hour candlestick close also means breaking out of the cost-based cluster mentioned above.

Ethereum Price Analysis: TradingView

There is good reason to believe that the cluster (resistance zone) may eventually break. The Smart Money Index, which tracks wallet trading activity and is known for historically outperforming the market, has been making new lows since October 22nd.

This means that while prices are rising, these wallets continue to accumulate, indicating confidence in a short-term rebound.

However, if the price falls below $3,918, the pattern weakens and exposes $3,711 as the next support. That would shatter the bullish outlook and smart money optimism.

The post Ethereum sellers halt breakout — but one group still expects price to rise appeared first on BeInCrypto.