Ethereum has pulled back from the $3,240 level and is currently testing the $3,150 zone as support, making it a key area for traders to watch. Bulls are looking to defend this level after a modest pullback, but uncertainty remains high as the market attempts to establish direction after weeks of volatility and aggressive selling pressure. While some analysts see this trend as the early stages of a recovery, others warn that ETH could still fall further if momentum does not strengthen.

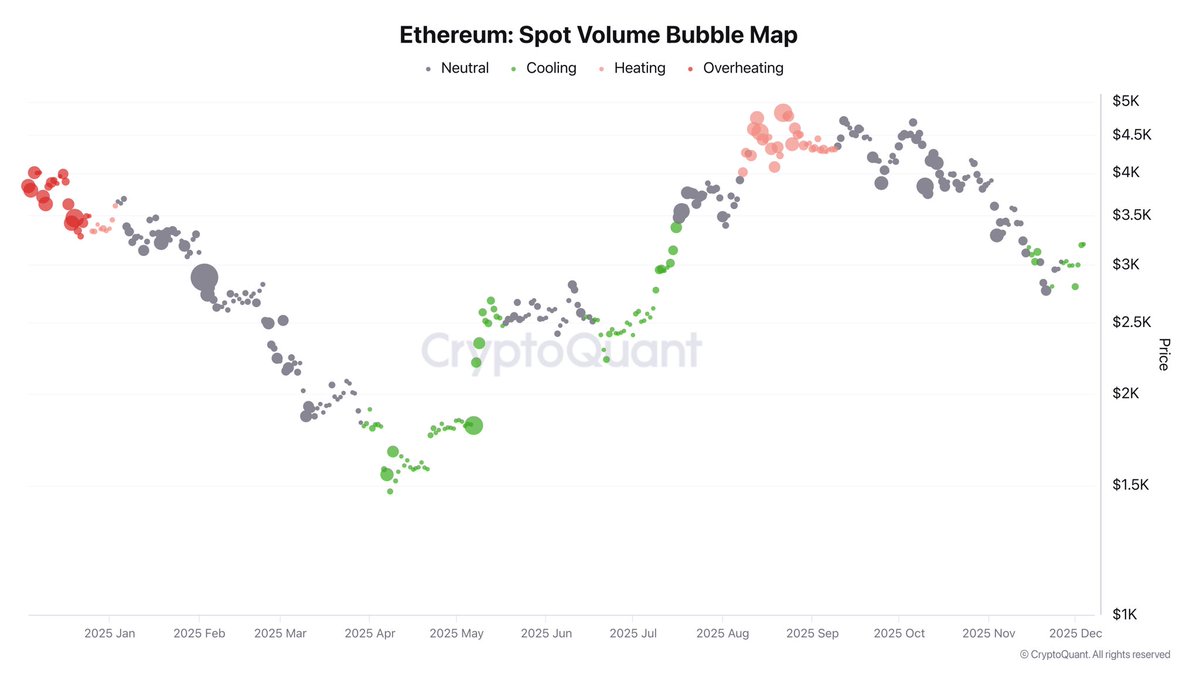

According to top analyst Dirkforst, Ethereum’s recent price movements have been shaped by significant changes in market structure. Over the past few days, spot trading volumes continued to decline even as prices attempted a slight recovery. This weakening of spot activity reduces the impact of actual buying and selling on the underlying asset, making the futures market increasingly influential in determining short-term price direction.

As Dirkforst explains, when spot volume thins out, futures often become the dominant source of volatility. This dynamic can accelerate both upside and downside movements, depending on the trader’s positioning. Ethereum is currently at an important support level, and the market is waiting for clearer signals to determine whether this pullback develops into a sustained recovery or simply marks a pause in the downtrend.

Ethereum stakes rise with futures-led momentum

Dirkforst further elaborates on this move by noting that when spot volume weakens to the extent seen over the past few days, the risk of increased volatility increases sharply. Thin spot liquidity means there are fewer buy and sell orders available to absorb sudden movements, and futures-driven momentum has a greater impact on prices. This environment often results in sharper swings and rapid changes in direction as leveraged traders and algorithmic strategies dominate short-term market action.

For now, the futures market is tilted to the upside, providing constructive force for Ethereum to break above the $3,150 support zone. Dirkforst highlights that this upward pressure from futures could work in the bulls’ favor, as the spot market could follow the same trajectory if volatility expands to the upside.

In other words, a sustained futures-led rally could serve as the catalyst needed for a broader recovery, especially if spot buyers gain confidence and begin to re-enter the market.

However, this setting has a two-way effect. Unless spot participation strengthens, a reversal in futures positions could quickly lead to accelerated downward pressure. For now, Ethereum is in a delicate stage where volatility is both a potential catalyst and a potential threat, and the next few sessions will be crucial in determining the near-term direction of the market.

ETH weekly structure holds important support

Ethereum’s weekly chart shows that the market is attempting to stabilize after a sharp decline from the $4,500 area. ETH rebounded towards $3,140 and regained its 100-week moving average (green line). This is a historically significant support level that often defines the boundary between bullish and bearish phases in the medium term. This rally indicates renewed demand in key zones, especially after the strong core rejection seen around $2,700 where buyers intervened aggressively.

However, Ethereum still faces significant resistance overhead. The 50-week moving average (blue line) is currently hovering around $3,400-$3,500, but it has turned into resistance and remains the next big hurdle for bulls. If the recovery of this zone is successful, it will significantly improve the technical structure of ETH and open the door to higher-level challenges. Until then, the weekly trend remains neutral to slightly bearish.

Volume is providing encouraging signals. The recent rally comes with a notable increase in buying activity compared to the previous week, suggesting strength of interest at these lower levels. However, the broader structure shows a pattern of high declines since August, meaning ETH needs to show follow-through to avoid reverting to deeper consolidation.

Featured image from ChatGPT, chart from TradingView.com

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.