While the Ethereum Ecosystem continues to expand with multiple Layer 2 (L2) networks designed to improve scalability and reduce fees, the data shows that it is not always financially viable for a distributed financial (DEFI) protocol to deploy iterations across all these networks.

Defilama’s data shows that for the most expanded protocol across the Ethereum Ecosystem, more than 90% of fees or revenue comes from the mainnet, with L2S contributing only a small share.

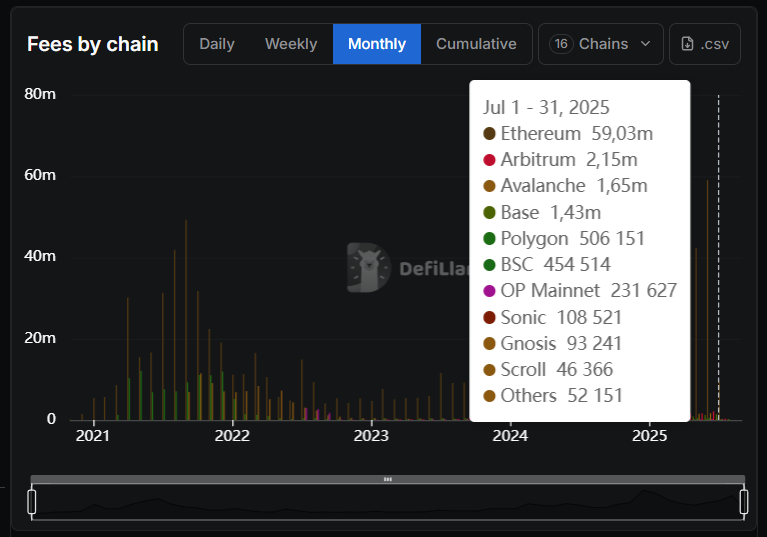

Aave, the largest Defi Money Market, which generated more than $65 million in fees in July 2025, converted roughly $9 million into revenue. But most of it came from Ethereum Layer 1, which locked a total of $29 billion.

Aave fees via blockchain

Meanwhile, the combined TVL (arbitrum, avalanche, base, polygon, optimism, Sonic, scroll, celero, soneum) of Layer 2 chain constellations pales in comparison, and also contributes to fee revenue.

Scroll, for example, generated only $46,366 on Aave in June, under $1,500 per day, with Gnoss slightly better at $93,241.

I’ll talk about the same with curve finance numbers. Over the same period, the fees were about $2 million, with about $1 million being converted into revenue. Ethereum pool dominated that tally, leaving only a small L2 with a small portion of the pie. Although there are few granularity failures due to the chain, the available data draws a conservative picture of returns for many of these new developments.

Saturation point

Ignas, co-founder of Defi Creative Studio Pink Brains, said in an X post on August 1 that the industry could have hit “L2 saturation point.”

It has already raised concerns that some Layer 2 are barely cutting the $1,500 a day fee. In Curve’s forum, users under the alias “Phil_00llama” suggested stopping all new Layer 2 development. It takes a lot of developers’ time and resources, but it only brings about $1,500 a day to charge, which is too little to cover the high maintenance costs of these rapidly changing chains.

However, the discussion on the proposal was quiet and there were few responses. Those who responded expressed skepticism about halting L2 development completely, suggesting that these chains may be worth pursuing.

The actual cost of running a protocol on L2 is not always clear, making it difficult to measure profitability. For example, expanding Aave to scroll required committing $500,000 worth of Aave tokens in the safety module, but moving to GNOSIS required up to $5 million in capital to support GHO liquidity. Gho is Aave’s native Stablecoin with a market capitalization of around $300 million.

Already low prices and even lower revenues – projects aiming to be anywhere in Ethereum may need to rethink their strategy. Because some deployments can require more effort than they are worth it.