The top institutional owners dominate Ethereum’s strategic preparations, with the Ethereum Foundation leading the pack.

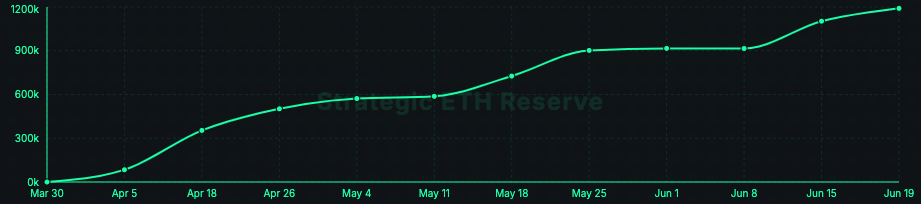

Corporate Bitcoin (BTC) strategic reserves have been a major trend over the past few months. However, Ethereum (ETH) is slowly catching up. On June 19, interagency strategic reserves rose to ETH 1.19 billion, according to the Strategic ETH Reserve website. These reserves worth around $3 billion are equivalent to more than 1% of the total ETH supply.

Growth of ETH Strategic Reserves | Source: Strategic ETH Reserves

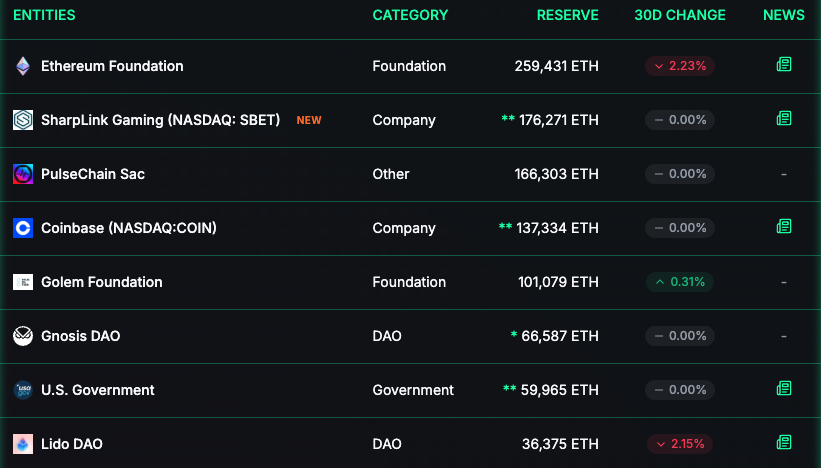

Top holders control these reserves, with the five largest entities controlling more than 70% of all institutional ETH holders. The Ethereum Foundation is the only largest owner with 269,431 ETH. It is followed by Sharplink, a NASDAQ-listed gaming company that acquired 176,271 ETH on June 13th and bets 95%.

The NASDAQ registered company acquired its reserves on June 13th and staking 95% of its ETH. The most recent participants are Ethereum Messenger and Wallet status, which earned 23,066 ETH, worth $2.9 million on June 19th.

The most Ethereum strategic reserves held entities | Source: Strategic ETH Reserves

Other important holders include the Layer-1 Network Parseshain, Crypto Exchange Coinbase, and the Golem Foundation, focusing on Ethereum. In particular, the US government has nearly 60,000 ETHs, primarily due to asset attacks.

read more: Ethereum Whale buys $127 million in ETH during dip, causing bullish emotions

More companies are considering ETH reserves

While Bitcoin remains a major asset in the strategic reserve, Ethereum is gaining growing interest from businesses and government agencies. As the most established Altcoin, it has emerged as the top choice beyond Bitcoin.

Among them, Michigan’s state pension scheme allocated $10 million in Ethereum. Public companies that own Ethereum include BIT Digital, BTC, Intchains Group, and KR1, KR1, and crypto assets.

The numbers come from the Strategic ETH Reserve Initiative, which tracks key institutional holders through publicly visible wallets. The initiative aims to promote transparency and promote wider adoption of Ethereum in its institutional portfolio.

You might like it too: Pro: Ethereum, Solana Key is Crypto Reserve Key