Ethereum (ETH) faces increased pressure from whale activity as large holders continue to offload a significant portion of their holdings.

This ongoing sale has come in a challenging season for cryptocurrency, with Ethereum tackling a decline in price performance.

According to Beincrypto data, ETH has been depreciated by 51.3% since the start of the year. Macroeconomic factors have been heavily and heavily across the crypto market, but Ethereum’s struggle is particularly pronounced. In fact, last week, Altcoin hit a low that has not been seen since March 2023.

Nevertheless, the suspension of tariffs caused a modest recovery in ETH soon after. At the press conference, Ethereum was trading at $1,623.

Ethereum price performance. Source: Beincrypto

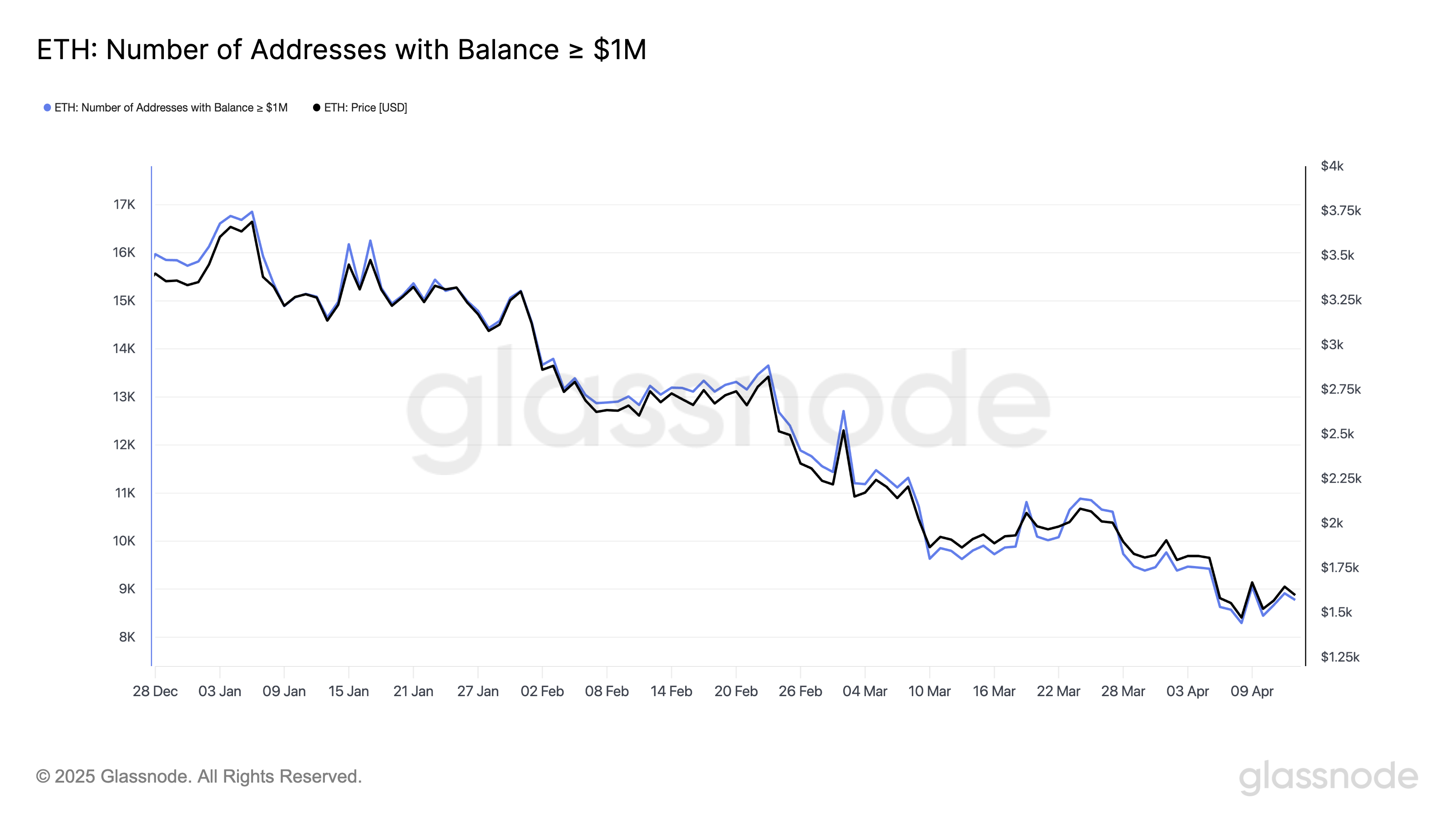

Nevertheless, overwhelming performance has thwarted investors. GlassNode data reveals that the number of addresses holding ETH at least $1 million has been declining sharply since the beginning of the year (YTD). Last week, these addresses fell to lows not seen since January 2023.

Holders with at least $1 million worth of ETH. Source: GlassNode

A closer look at the latest whale activity confirmed the decline. On April 14, the whales deposited 20,000 ETH, worth $32.4 million, with Kraken Exchange, presumably preparing for more sales.

“The whales still have 30,874 ETH ($50.7 million) remaining, with an estimated gross profit of $104 million (+52.4%),” said Chain on Chain.

Additionally, on-chain analysts revealed that ICO investors in early 2015 were consistently selling. On April 13, the whales offloaded the 632 ETH, worth about $10 million.

Since the beginning of April, the investor has sold 4,812 ETH, worth around $800,000. Surprisingly, the initial investment cost was as low as $0.3 per ETH, and the whales still owned a considerable stash of 30,189 ETH.

Additionally, another dormant ETH whale that has been inactive for years has also begun on sale. This address retracted 3,019 ETH from HTX between August and December 2020. The investors then moved their assets to their current sales address three years ago.

On April 11, the whales made their first deposit of 1,000 ETH to Binance. On April 13, the whales deposited an additional 1,000 ETH, raising concerns about a potential sale.

“Fortunately, the whales only have 1,018 ETH remaining, so we don’t put much sales pressure on the market,” analysts said.

The recent rise of dormant whales is noteworthy. Their sale still benefits, but their activities suggest that they aim to maintain this trend. According to GlassNode, only 36.1% of Ethereum addresses, which are currently beneficial, are profitable, indicating that the majority of owners face losses.

Ethereum holder of profit. Source: GlassNode

Meanwhile, the current situation at Ethereum has led analysts to draw comparisons to the decline caused by Nokia’s domination in the late 2000s. As reported by Beincrypto, analysts warned that more scalable and faster platforms like Solana (Sol) could take over, and Ethereum could head towards a decline.

Nevertheless, pessimism has not spread. Many analysts still predict the potential for recovery, citing upcoming technology upgrades and market underestimation of ETH.