Ethereum delivers more power than the $3,900 range, supported by strong derivatives market activity and increased trading volume.

Ether prices approach 4k$4k, and the future has open interest at record highs

On August 8, 2025, Ethereum (ETH) had a market capitalization of $470.8 billion, accounting for 12.2% of the $3.87 trillion crypto economy. Over the past 24 hours, ETH transactions have been recorded in the past $32.5 billion, with an intraday range of $3,806 to $3,972. The rally also led to severe derivative liquidation, with an ETH position totaling $130 million (of which $76.15 million was a short bet) leading the wider Crypto Market’s $28,458 million liquidation.

The four-hour chart shows Ethereum rebounds from $3,351 on August 3rd to nearly $3,972 today, showing stable upward grinding with a few massive breakout candles. Currently, consolidation is occurring near high prices. On the daily charts, ETH rose from $2,475 in late July, pausing at mild resistance levels before accelerating to the $4,000 mark.

ETH/USD via Deribit on August 8, 2025, 4-hour chart.

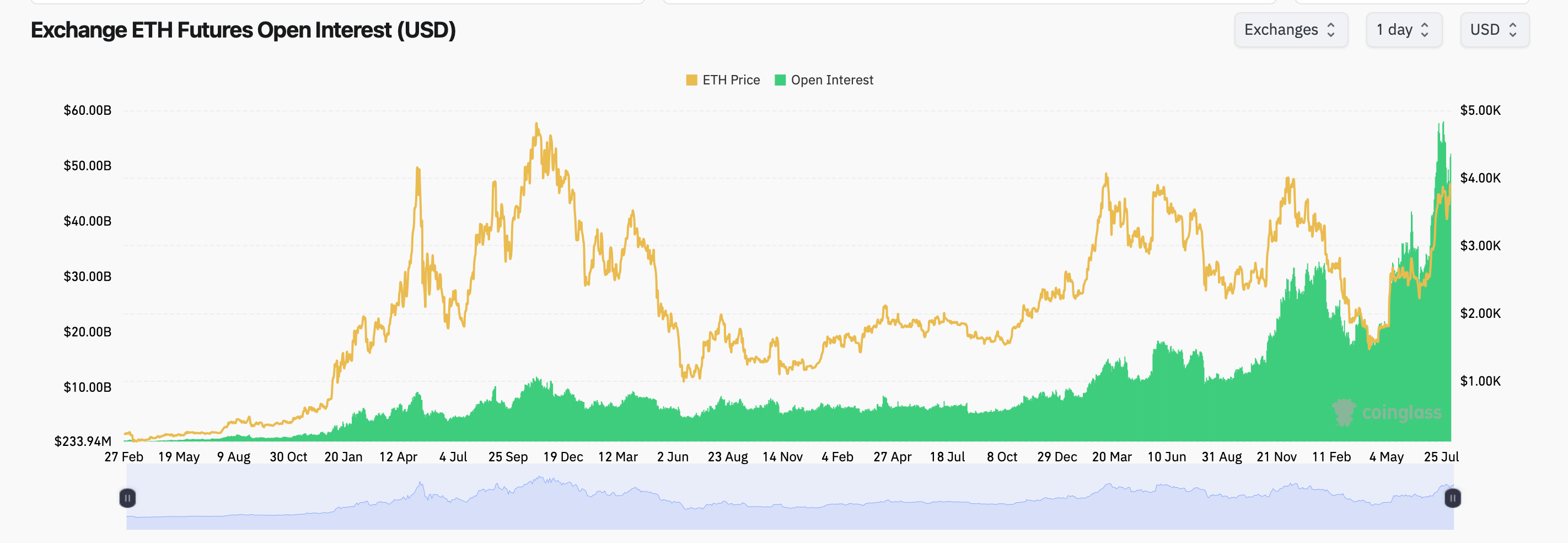

Open interest on ETH futures reached $521.9 billion (ETH of 13.38 million), with the biggest concentrations in CME, Binance and Bibit. CME holds 1.63 million ETHs with an OI ($63.5 billion), 2.64 million ETHs ($1.03 billion) and Bybit 123 million ETHs ($4.788 billion). Other top exchanges include OKX, GATE, BITGET, WHITHBIT, KUCOIN, BINGX and MEXC.

Open interest changes over the past 24 hours showed benefits for CME (+6.71%), Binance (+1.87%) and Bybit (+3.42%), with OKX, Gate and Kucoin recording a decline. The OI-to-volume ratio is highest in a CME of 1.6627, reflecting deep institutional positioning.

The ETH option distorts total open interest in calls at 67.46% (ETH 2.045 million) versus 32.54% of PUTS (986,253 ETH). On the last day, the call accounted for 57.11% (288,565 ETH) of the volume, making up 42.89% (216,753 ETH).

Top ETH options by Open Interest include $6,000 phones (60,644 ETH) on December 26, 2025 and $4,000 phones (54,738 ETH) on September 26, 2025. The most aggressively traded options in the last 24 hours were $4,000 phone (25,626 ETH) on December 26, 2025, and $3,200 (20,004 ETH) on September 26, 2025.

As both Futures and Options markets show a focused interest in Call, the derivatives structure suggests a bullish bias heading into the final quarter of this year. However, as price momentum changes, high open interest and rising liquidation activities can amplify volatility.