Ethereum is approaching a key breakout from the triangular pattern, with the Bulls paying attention to the $2,000 mark.

For $1,623, Ethereum registered an intraday recovery of 1.60% at the time of writing. This bullish comeback is on the verge of eliminating Sunday’s 2.8% drop from the $1,650 mark. Ethereum recovery brought it to the vertices of the triangle pattern.

As we improve broader market sentiment, the likelihood of Ethereum’s breakouts is steadily increasing. Does this push ETH towards a psychological $2,000 level?

Ethereum’s Recovery Rally approaches a key breakout, with the Bulls targeting $2,000

On the 4-hour price chart, the bullish turnaround from the recent $1,418 level shows a major recovery for Ethereum. The high formation of Ethereum has created a local support trend line.

The overhead resistance, nearly $1,675, is consistent with a Fibonacci level of 38.2%, highlighting the top of the ascending triangle pattern. The long-standing trendline of resistance also creates symmetrical triangle patterns on the 4-hour chart.

Technical indicators also show bullish trends. The supertrend indicator suggests that the upward trend is moving, reflecting a strong bullish momentum as the four-hour RSI exceeds the mid-term mark. These metrics maintain Ethereum’s optimistic outlook.

As Ethereum approaches the triangle’s vertices, price action traders expect high instantaneous movements in both directions. According to Fibonacci levels, a bullish breakout could target a Fibonacci level of 78.6% at $1,948.

This increases the chances that Ethereum will reach a psychological level of $2,000. However, a potential breakdown could potentially retest the $1,418 support level.

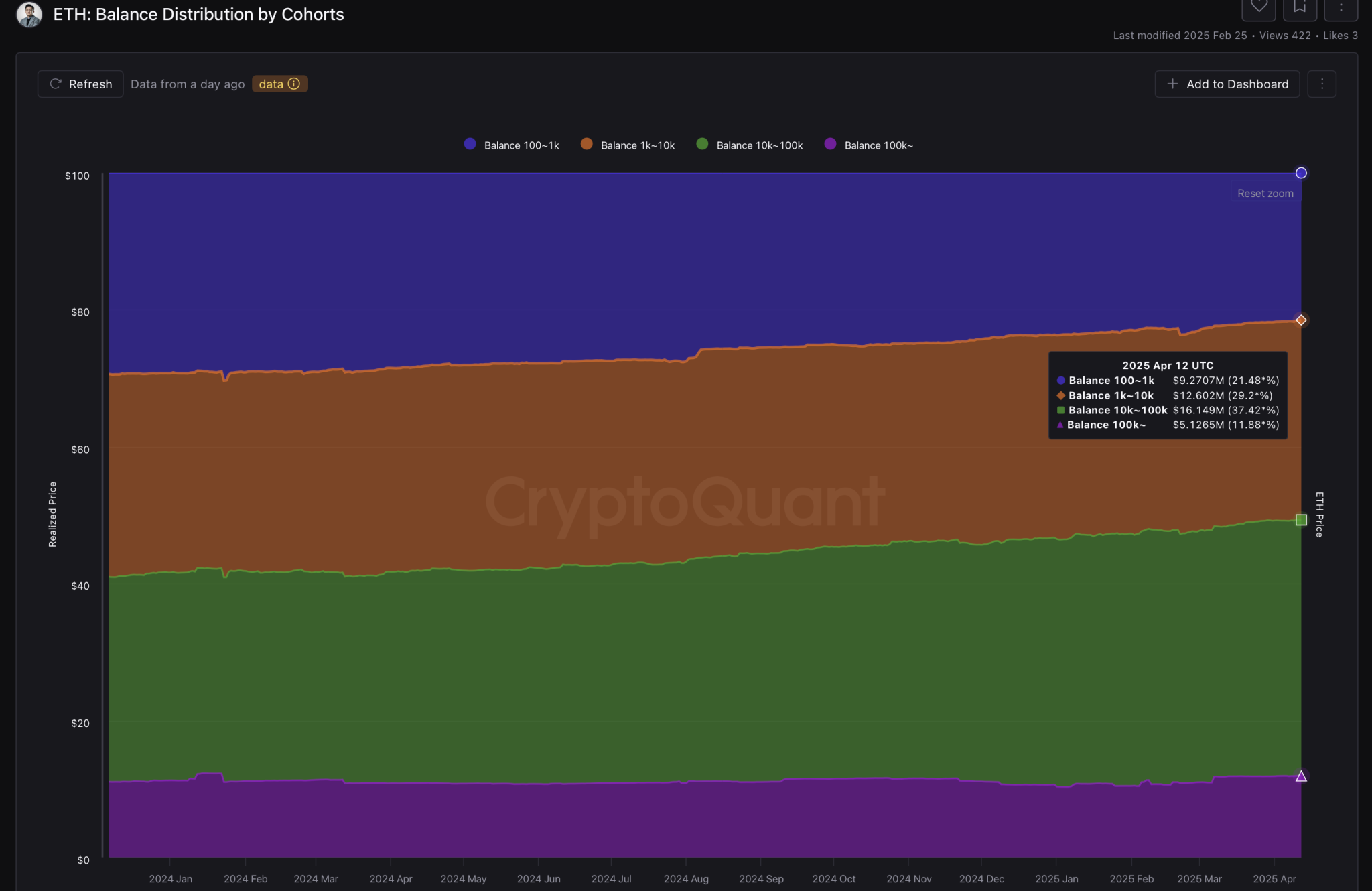

The balance of cohorts holding 10k-100k ETH is a new hit

Ethereum trades at relatively low levels, which means large investors are increasing their accumulation. According to Cryptoquant, the balance distribution of Ethereum by cohort indicates significant growth in large holdings.

Over the past year, the holding balance of 10,000-100,000 ETH has increased from 29.64% to 37.42%. The balance of wallets, which holds over 100,000 ETH, rose to 11.88% from 11% a year ago.

Meanwhile, the retail segment has reduced holdings, with wallet balances reducing ETH of 100-1,000 from 29.47% to 21.48%.

Nevertheless, strong support from large investors suggests that extended gatherings could be on the horizon.

ETH balance distribution by cohort

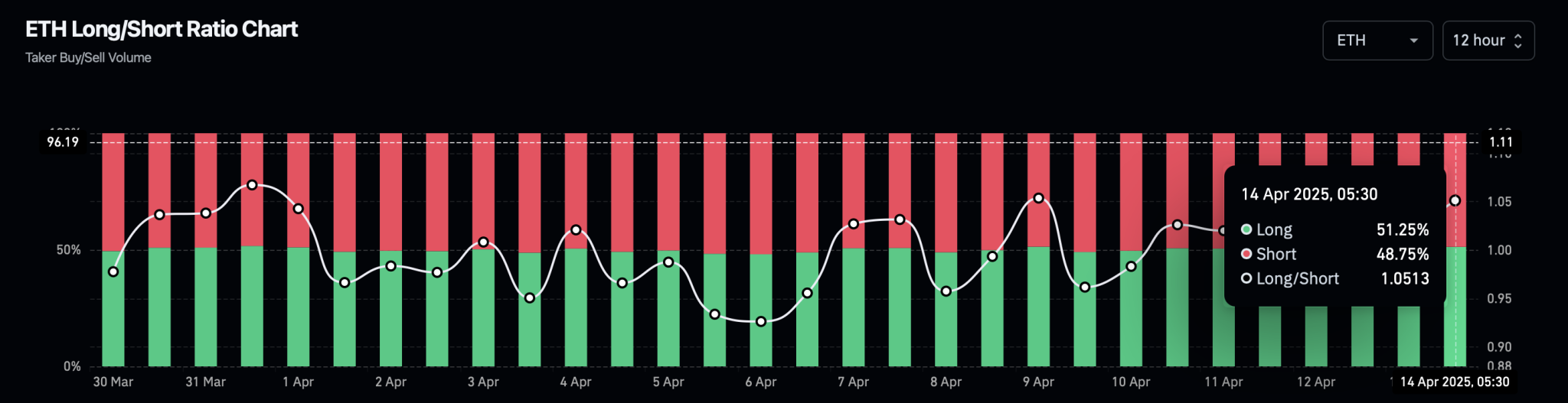

Crypto Traders Go Longer to Ethereum

As Ethereum approaches a potential breakout rally, bullish sentiment in the derivatives market has increased significantly. Ethereum’s long position has skyrocketed to 51.25%, increasing its long-term ratio to 1.0513.

Ethereum’s public interest rate is stable at nearly $17.94 billion, but the funding rate jumped to 0.0060%. A positive funding rate and a longer position increase will inform Ethereum’s optimism.

Ethereum Longshort Ratio Chart