Over the past few sessions, the leading altcoin Ethereum has remained flat around $4,700. This indicates that market momentum is waning as both buyers and sellers slow down their activity.

ETH may remain in a narrow range for now as technical indicators are starting to suggest less market volatility.

Ethereum price remains stuck in a narrow range as traders wait for volatility to recover

The daily chart readings for ETH/USD show that the altcoin has remained within a narrow range over the past three trading sessions. Since Monday, ETH has faced resistance at $4,742 and found support near $4,426.

This sideways trend occurs when market volatility decreases, highlighting the relative balance between buying and selling pressure.

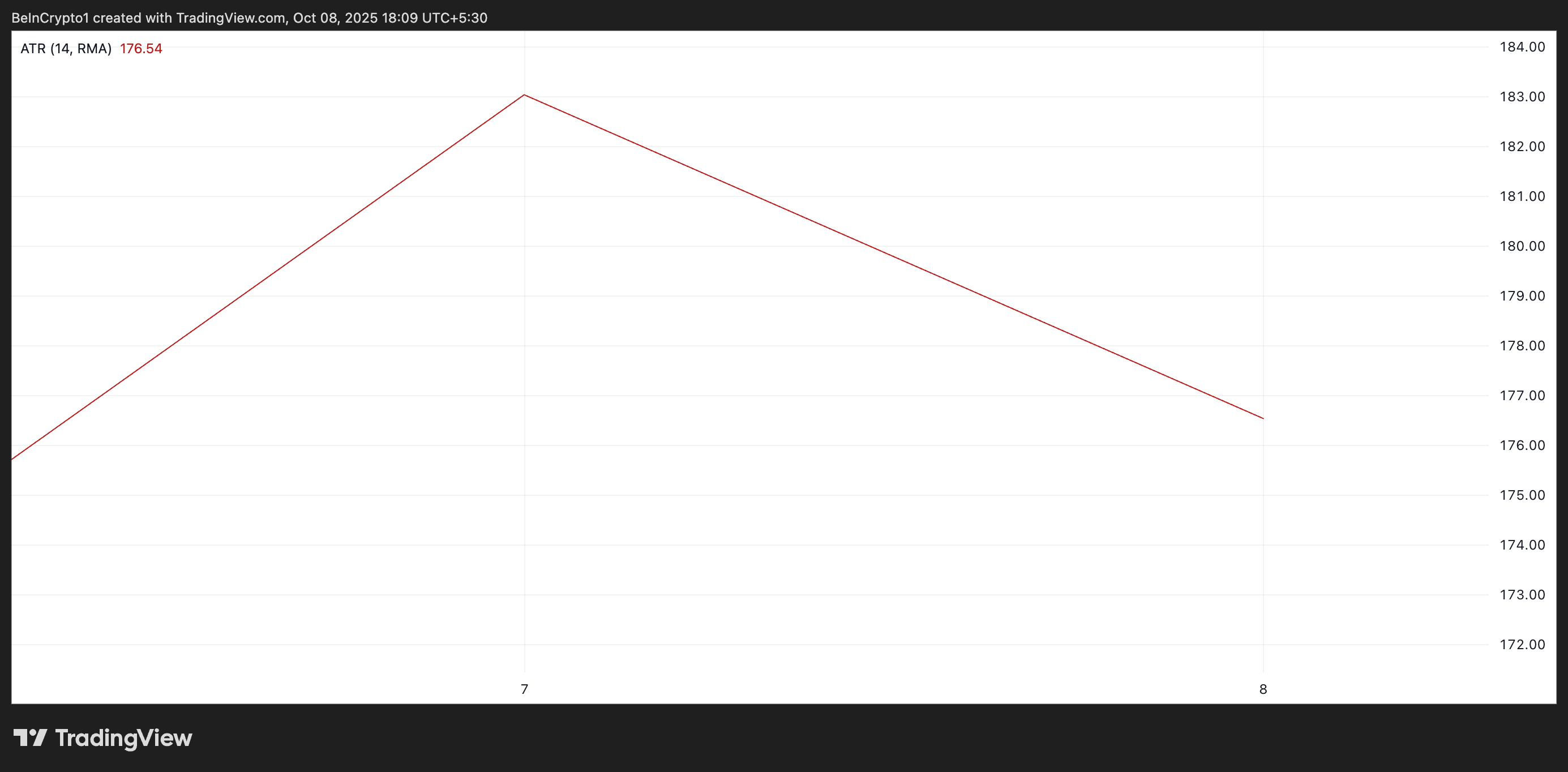

The drop in volatility is evident in ETH’s Average True Range (ATR), which has started to fall. This indicator, which measures the degree of price volatility over a period of time, is at 176.54 at the time of writing.

About the latest information on token TA and the market: Want more token insights like this? Sign up here for Editor Harsh Notariya’s Daily Crypto Newsletter.

ETH average true range. Source: TradingView

A decline in ATR suggests that market participants are becoming more cautious and less willing to take risks. This reduces price fluctuations, reduces trading volumes, and keeps assets within bounds.

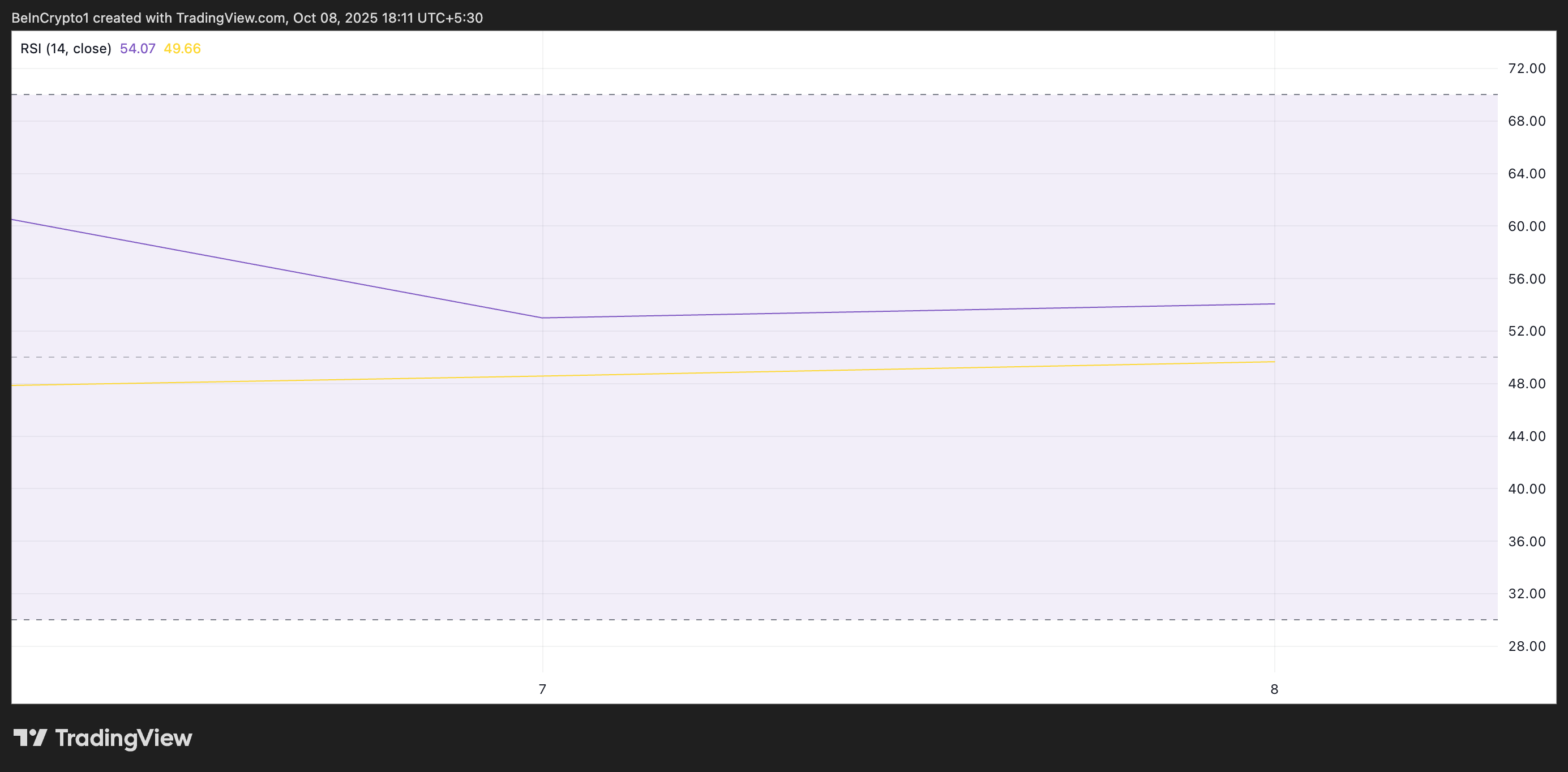

Additionally, ETH’s Relative Strength Index (RSI) is flattening, supporting this trend. At the time of writing, it is 54.07.

ETH relative strength index. Source: TradingView

The RSI indicator measures overbought and oversold market conditions for an asset. Values range from 0 to 100. Values above 70 indicate that the asset is overbought and there is a period of price decline, while values below 30 indicate that the asset is oversold and a rebound is possible.

A flat RSI indicates a relative balance between buying and selling pressure, highlighting that neither side currently has an advantage. This balance confirms the low volatility of the market. If this situation continues, the price of ETH may remain suppressed within a narrow range.

Ethereum Trader on the Edge

Periods of low volatility suggest stability in the market, but they also indicate that traders are becoming less active and often portend a sharp breakout in either direction.

Unless volatility picks up momentum, ETH is likely to remain range bound between the current support and resistance zones. Increasing sell-side pressure could trigger a breakout of this support floor and a price decline towards $4,211.

ETH price analysis. Source: TradingView

On the other hand, this bearish outlook will be invalidated if new demand enters the market. In that scenario, ETH price could break through the $4,742 resistance and attempt to regain its all-time high of $4,957.

The post Ethereum traders pause as $5,000 dream fades for now appeared first on BeInCrypto.