Ethereum is rising from the ashes, regaining the ETH token price of $4,000, and cruising with the total value of the chain locked into a new all-time high.

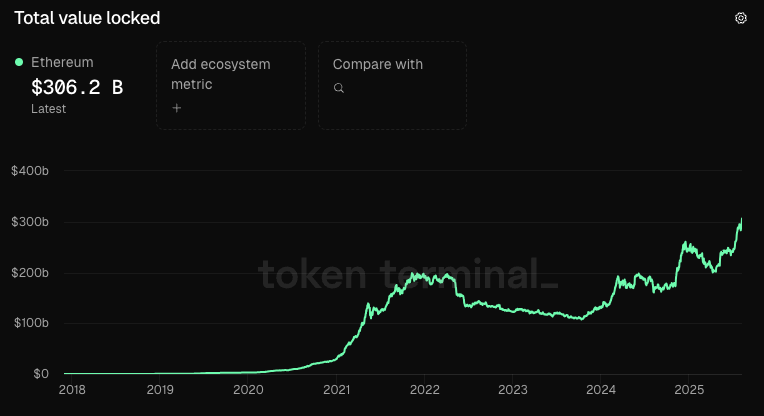

According to Tokenterminal, the chain’s Ecosystem TVL achieved a new high of just $300.6 billion, surpassing $253 billion in December 2024 and $195 billion in 202.

Ethereum Ecosystem TVL -Tokenminal

ETH is still an all-time high of 15% off at $4,700, but the ecosystem’s Stablecoin scene has exploded over the past two years, bringing the chain’s TVL to its new best. In December 2021, Circle and Tether accounted for 39%, or $75 billion in Ethereum TVL, but now in 2025, their total total has increased by 63% to $121 billion.

The growth of defi-native stablecoins such as Ethena’s USDE and Sky’s USDS has also contributed to the expansion, creating an additional $15 billion in economic value for Ethereum.

Return to glory

The structural changes in the Ethereum Foundation (EF) and the Pectra upgrade of Ethereum may have laid the foundation for second quarter token outperformance.

In June, EF announced a new financial policy in the first half of 2025, focusing on returning to Cypherpunk’s roots from the Ethereum community throughout 2024. The new roadmap focuses on financial transparency, active engagement with Defi, support for Ethereum Builder, and improving the dynamics of Layer 1 and Layer 2 ecosic systems.

While EF has focused on regaining trust from its crypto-native user base, the Securities and Exchange Commission (SEC) and BlackRock continue to work to make ETH more attractive to institutional buyers.

Interest began in May when BlackRock applied for redemption of the kind permitted within iShares eth etf and proposed that staking would be allowed.

Meanwhile, the SEC is relieving the tensions it set on defi during its previous administration. On Tuesday, the committee’s branch revealed that liquid staking activities are not considered securities, and last week SEC Chairman Paul Atkins announced “Project Crypto.”

The ETH/BTC ratio repulses after being crushed to most of this cycle. This ratio bottomed at 0.018 in April, with 78% down from the 2022 high of 0.085. ETH/BTC is back to 0.034 today, with 89% meetings from Q2 bottom.

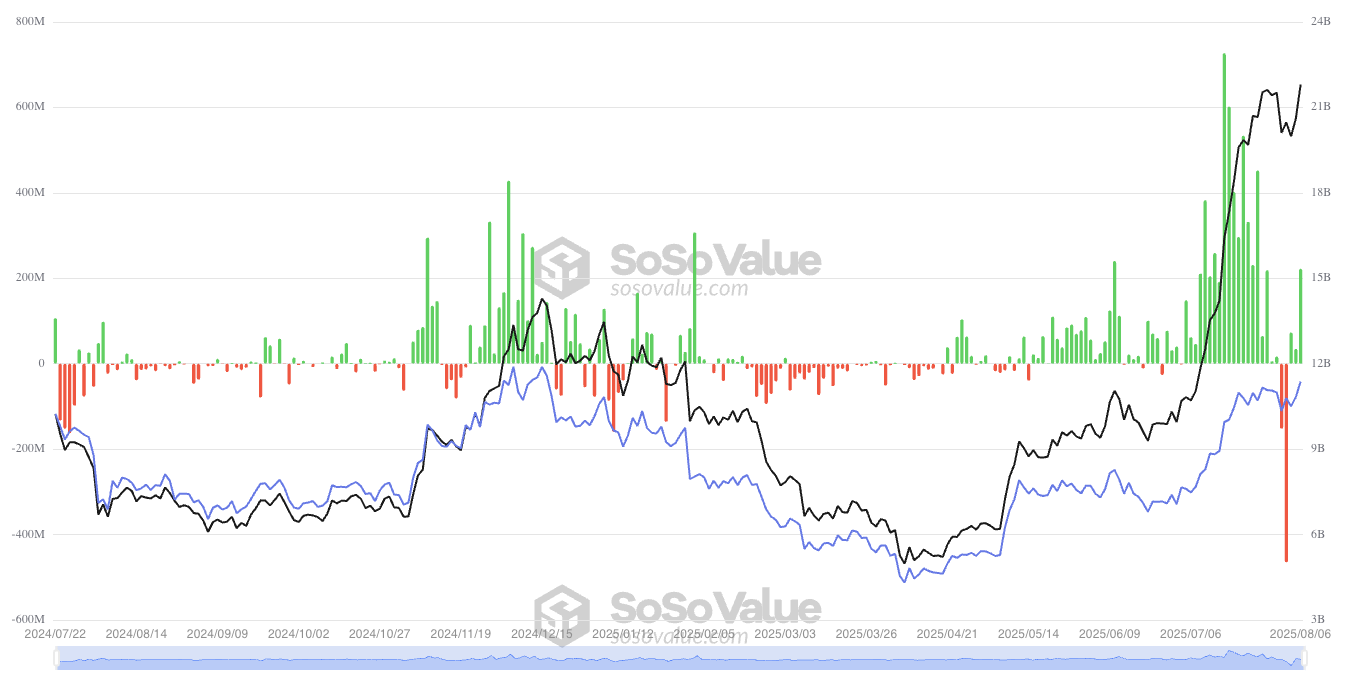

According to SOSoValue, ETF buyers could be driving a return, with ETF ETFs winning a new high of $21 billion in assets, up 300% from their April bottom of $5.25 billion.

ETH ETF Flow – Soso Value