The influx of Ethereum into centralized exchanges surged sharply in early July. This could cause concern for investors who want to recover ETH.

Below are some chain signs that suggest that many whales may be trying to sell.

Ethereum moves to exchange – what do the analyst say?

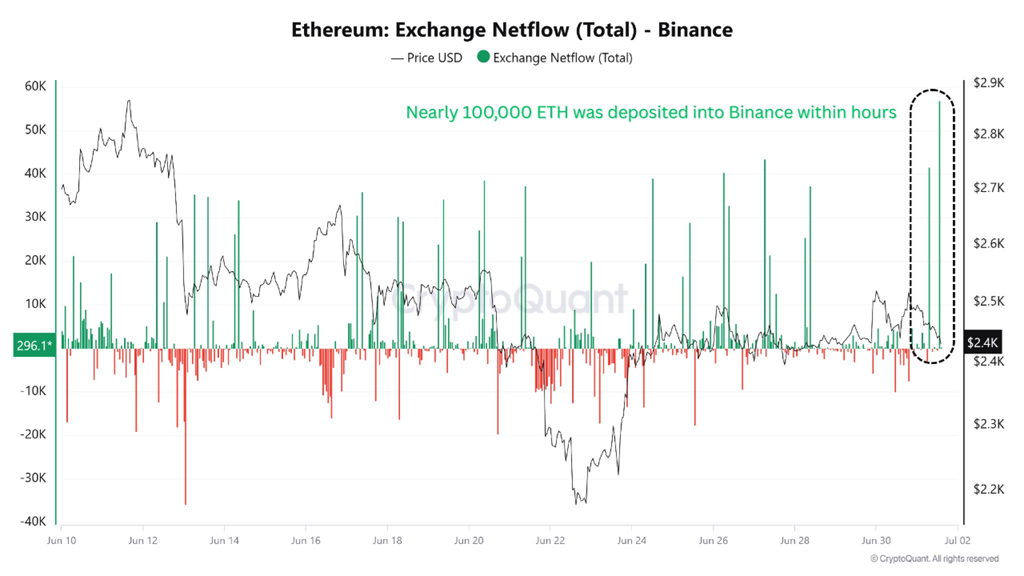

Nearly 100,000 ETH people were deposited in Binance on July 1, 2025, worth approximately $250 million, according to data from Cryptoquant. This shows the highest daily influx of exchanges over the past month.

Ethereum Exchange Netflow – Binance. Source: Cryptoquant.

Compared to recent price behavior, large daily influxes often lead to corrections in ETH prices or maintain price transactions within close, lateral ranges.

Additionally, on-chain observers noted that over the past three weeks, large entities have withdrawn 95,313 ETH from staking contracts using two wallet addresses. The entity then moved 68,182 ETH (approximately $165 million) to centralized exchanges such as HTX, OKX, and BYBIT.

The average staking price was around $2,878 per ETH, and the current price was close to $2,431, with the entity losing about $42.6 million. This action suggests a halt strategy or a restructuring of the portfolio, increasing the sales pressure in the market.

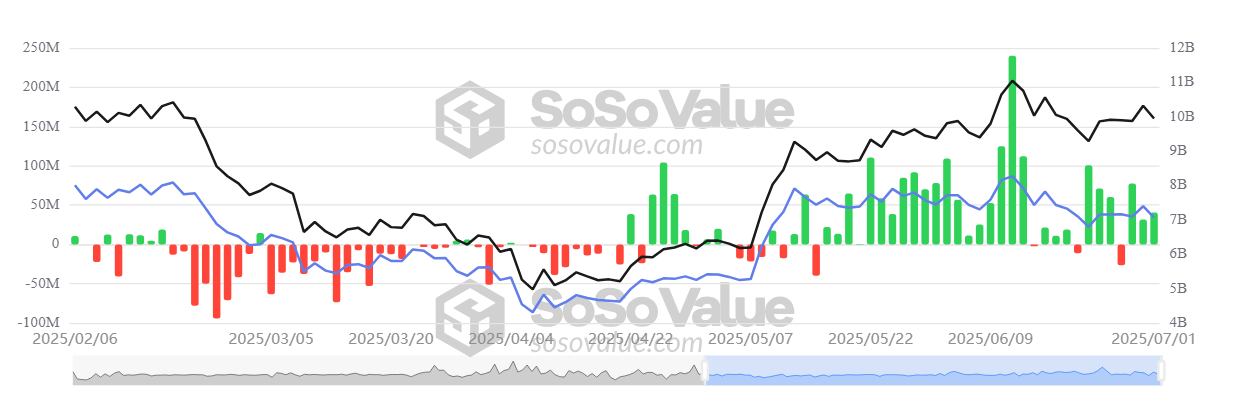

Meanwhile, data from Sosovalue shows that net influx into US spot ETH ETFs is slowing, while remaining positive.

All Ethereum spot ETF net flow. Source: SosoValue

Specifically, netflows for these ETFs fell from over $240 million on June 11 to over $40 million on July 1. This reflects a slower ETF purchase momentum.

All these data points can be weighed and priced for ETH in the first week of July. At the same time, Coinglass statistics show that Q3 is historically the weakest quarter of ETH, with an average return rate of just 0.59%.

“In response to the improved broader macroeconomic conditions, Ethereum’s long-term bullish outlook remains intact. However, Ethereum could face a slight short-term pullback.”

Experts show consensus on the long-term benefits of ETH

Experts seem to be broadly agreeing with the long-term potential of ETH.

MEXC Research noted that Ethereum is taking on a strong recovery to improve staking efficiency and improve the clearer stubcoin regulations brought about by the Genius Act.

“Along with the risk appetite slowly returning to the market, stabilizing the geopolitical situation and improving global liquidity, ETH appears to be well positioned for further benefits over the coming weeks. MEXC’s research told Beincrypto.

Meanwhile, Bitget’s chief analyst Ryan Lee highlighted core factors such as clearer regulatory signals and strong chain activities that can increase ETH prices through the Genius Act.

“Ethereum has gained significant momentum and is supported by upgrades in its validator backbone, improving staking efficiency and contributing to a decline in ETH supply. In a near-view, Ethereum could test the $2,800-$3,000 range by mid-July.”