On-chain data suggests that Ethereum will not face a dominant resistance level up to $3,417. This could pave the way for the mark.

Ethereum cost-based distribution indicates greater resistance

In a new X post, on-chain analytics firm GlassNode talks about how he is looking for Ethereum today. “Cost-based distribution” is an indicator of what price level the amount of the asset’s supply was last purchased.

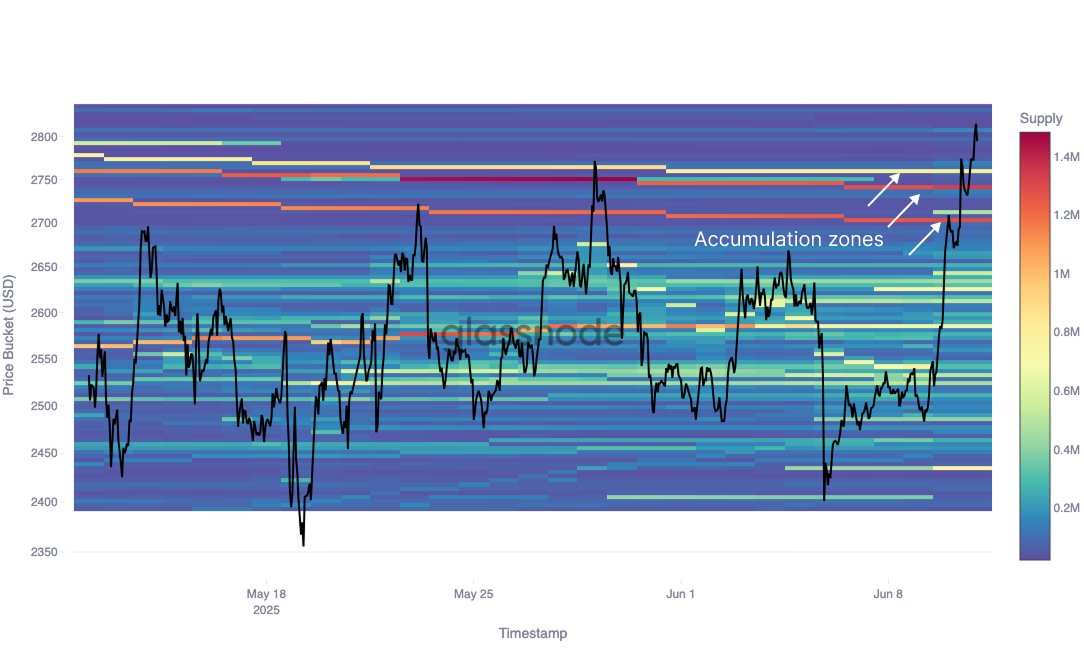

First, here is a chart showing what the latest breakouts of cryptocurrency were like in terms of this metric.

As shown in the graph above, Ethereum has been able to break through some notable supply levels with the latest price surge. Both the $2,700 and $2,740 levels hold a cost base of around 1.3 million ETH, while the $2,760 mark holds a mark of 800,000 ETH. Chain analysis believes that enriched levels in supply are important due to the simple fact that investors are likely to respond to price interactions with cost bases.

If this retest occurs from below, the holder may respond by selling the coin. Loss investors could be desperate to return to the green, so if they return after the price breaks, they can panic and leave from fear of returning underwater in the near future.

Naturally, the more investors share a cost base at a certain level, the stronger this type of sales response tends to be. Therefore, a level that holds a substantial supply can serve as a barrier to resistance to ETH prices. Ethereum was stuck under the aforementioned supply zone for a month, potentially due to this resistance effect, but now cryptocurrencies have finally got them back.

Just as how strong the above levels cause resistance, the following levels will instead become the center of support. This could change the role of the $2,700, $2,740 and $2,760 supply walls. “These investors accumulate during the consolidation and could now form a strong support zone,” GlassNode said.

Supportive effects can arise from bullish-minded holders, and want to protect the cost base as an opportunity to buy dip or simply protect the acquisition boundary.

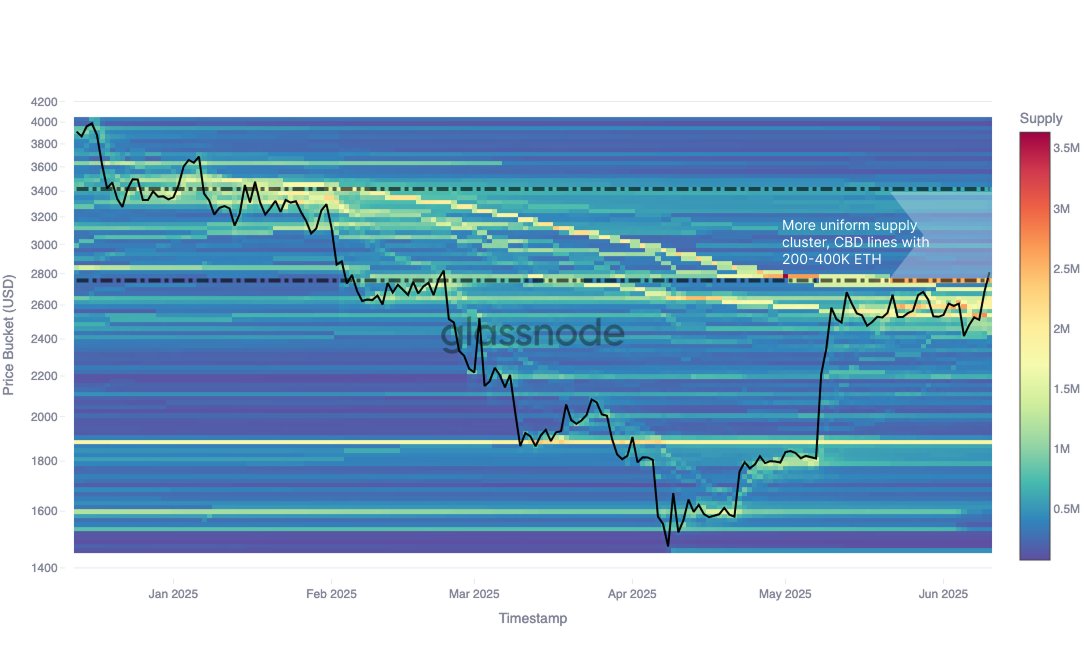

Well, here’s another chart shared by the analytics company. This shows how Ethereum cost-based distribution views the level before the latest spot values.

The graph shows that future levels are distributed in a more uniform way, with no strong clusters presenting up to $3,417. More specifically, the price levels before this mark include between 200,000 and 400,000 ETH for every $50 gap. In comparison, the $3,417 level currently holds a cost base of around 607,950 ETH.

“If a support range of $2.70K-2.76K is retained, the path to 3.42K remains technically open, but the answers from holders in the 2.8K-3.3K $3.3K range define the speed at which the ETH climbs.

ETH Price

Ethereum has briefly beaten over $2,830 in the past day, but has since faced a pullback as the coin has returned to $2,780.

Dall-E, Glassnode.com featured images, tradingView.com charts