This is a segment of the Supply Shock Newsletter. Subscribe to read the full edition.

Eight years ago, around this time, only one thing was approaching turning Bitcoin overturned.

In June 2017, Bitcoin was in the final stages of warming up in search of a historic push of nearly $20,000 by Christmas.

The prices of Altcoin were eccentric. Bitcoin is flat for a week, but coins like Bitshares jump significantly by 250%. Others like Stratis and Digibyte have dropped by up to 50% over the same period.

Meanwhile, Ethereum was poised for an explosion of token projects. One study calculated that $7 billion had flowed into ICOs throughout 2017. This is likely four times higher than stock investments in crypto companies over the same period.

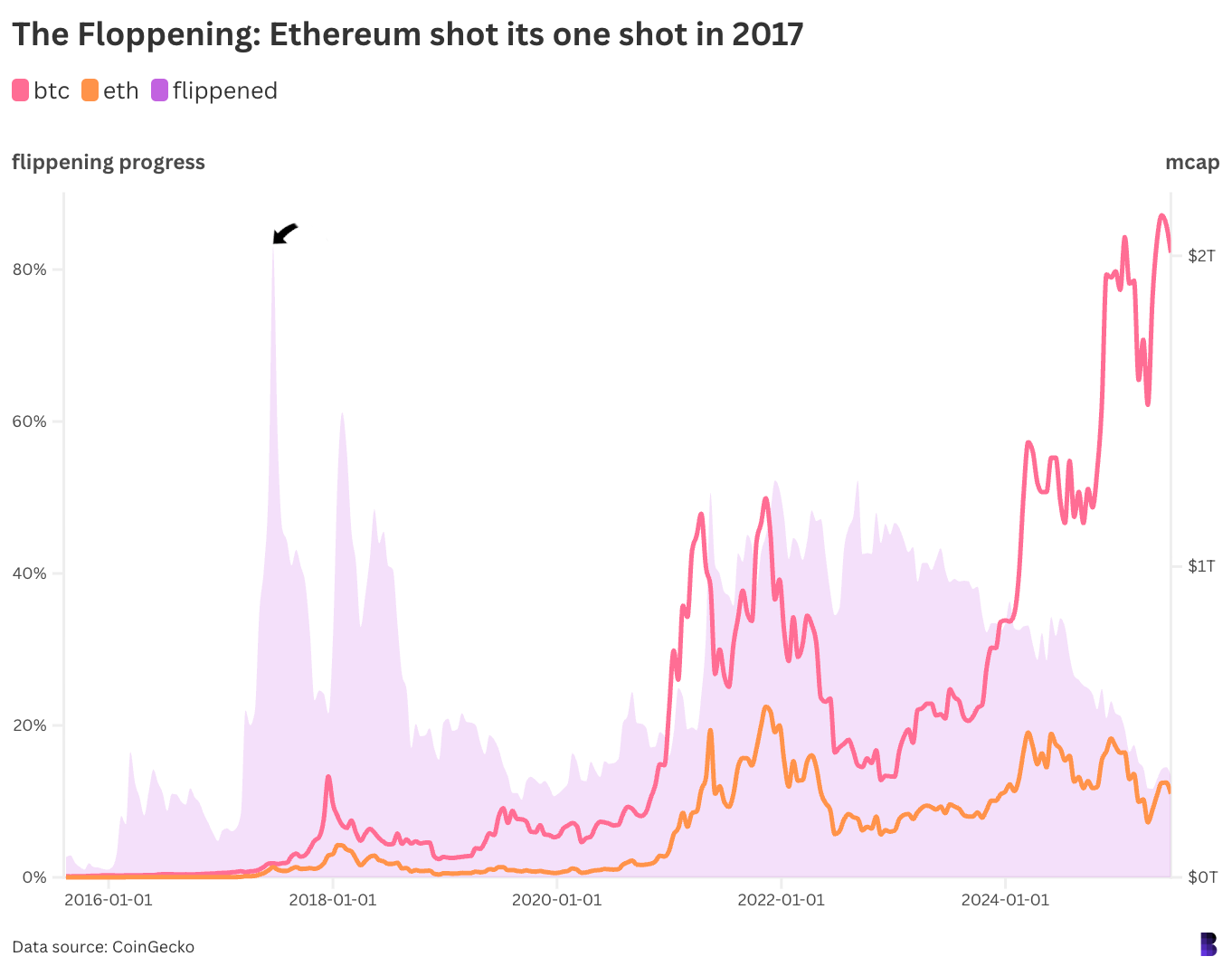

ETH prices rose as investors loaded into coin offerings through Ethereum’s native tokens. And on June 12th, ETH’s market capitalization was within 17% of Bitcoin, ranging from $36.8 billion to $44.3 billion.

Had Bitcoin stayed flat, ETH would have had to jump from $400 to $470 and slide to number one.

This New York-era banger was revealed a few days ago.

This New York-era banger was revealed a few days ago.

But that’s never the case: both BTC and ETH will drop 60% next month, leading the way to the end of the BTC bull market, but only nine times the case for ETH. The ether never retreated the ground.

By late June 2017 it was beginning to become clear that flipping was no longer realistic.

By late June 2017 it was beginning to become clear that flipping was no longer realistic.