Data on the chain shows that Ethereum whales have recently increased accumulation.

Ethereum whales are buying big

According to data from on-chain analytics company GlassNode, Ethereum whales have participated in a very substantial accumulation over the past week.

“Whale” refers to ETH investors who hold 1,000 to 10,000 tokens of cryptocurrency. In the current exchange, this range converts to about $2.5 million at the bottom and $25 million at the top.

This range does not cover the absolute top end of the market, but includes huge investors who may be considered an important part of the ecosystem. So, given this role, movements associated with these holders are worth monitoring.

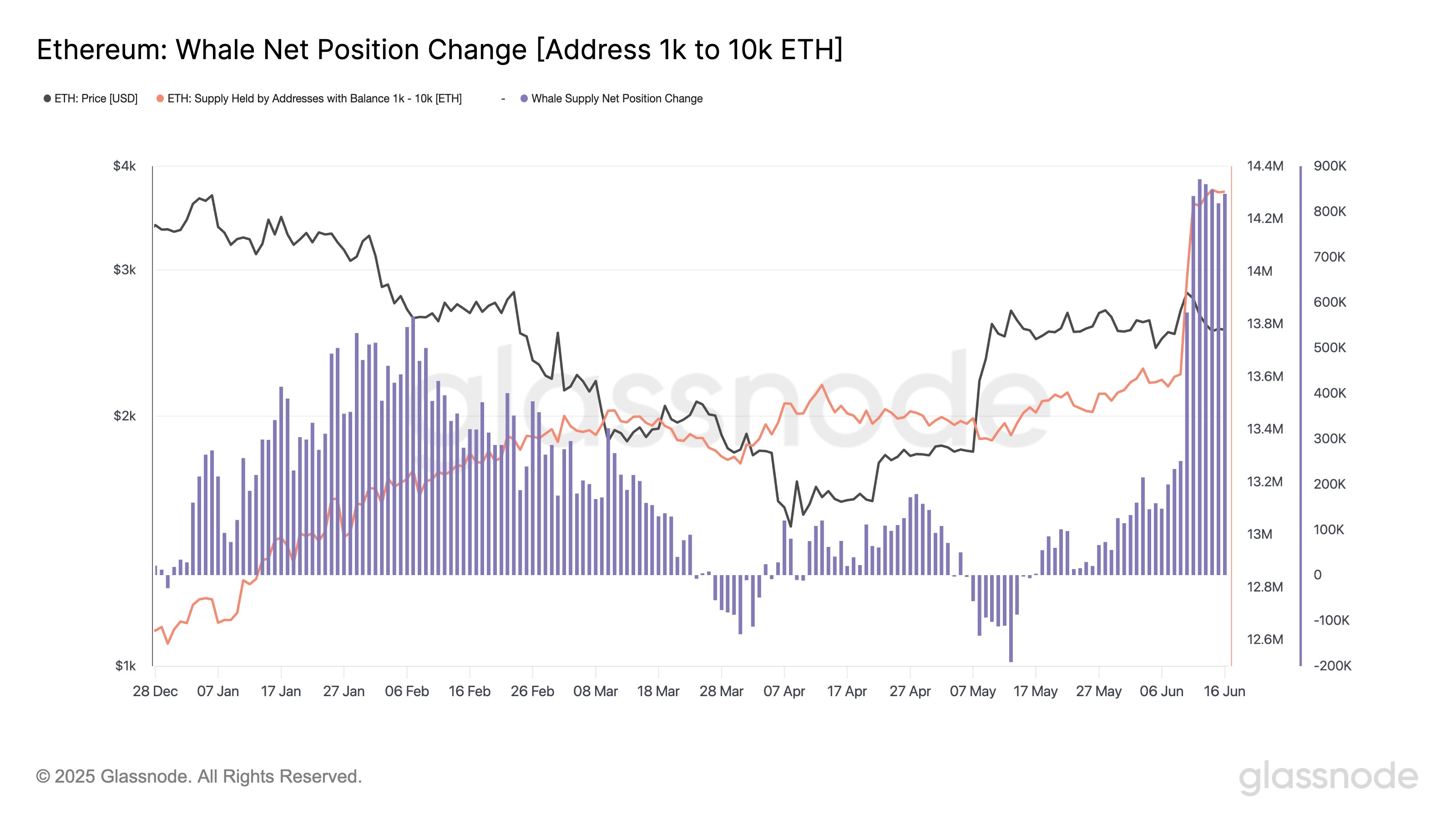

One way to watch whales’ behavior is to use the total amount of Ethereum supply they have. Below is a chart shared by GlassNode, which shows trends in this metric over the past few months.

The value of the metric appears to have seen a steep climb in recent days | Source: Glassnode on X

As seen on the graph, the supply of Ethereum whales was recently shot. This is an indication that large-scale investors are accumulating cryptocurrency. “For almost a week, the daily whale accumulation has exceeded 800k ETH, pushing 1k-10k wallet holdings to ETH above 14.3m,” the analytics company said.

It is clear from the chart that a particularly large spike occurred on June 12th. On this date, ETH whales added more than 871,000 ETH to their holdings, the highest influx of the annual cohort.

The latest accumulation is not only noteworthy from a year perspective, but also impressive in historical contexts. “This buying scale has not been seen since 2017,” GlassNode said. Naturally, the extraordinary buying push from these investors could be a potential indication that they are confident about the future of the coin.

This powerful accumulation activity has been discovered on the chain, but demand has also been seen in other aspects of the sector: Spot Exchange Sales Funds (ETFs). Spot ETFs are investment instruments that provide a way for investors to be exposed to Ethereum without directly owning assets.

Spot ETFs are traded in traditional exchanges, making it easier for holders who are not familiar with cryptocurrency wallets or exchanges to invest in coins through coins.

There has been a high demand for US ETH Spot ETFs recently as a Netflow chart shared by GlassNode in the X-Post Showcase.

The trend in the netflow of the US ETH spot ETFs since their inception | Source: Glassnode on X

“Last week, 195.32K ETH was flowing into the US spot ETH ETF, the third largest weekly net inflow on record,” the analytics company explains.

ETH Price

Ethereum turned its eye on $2,700 on Monday, but it appears to have shifted in a bearish after that, as prices have been trading around $2,470 since.

Looks like the price of the coin has plunged over the last 24 hours | Source: ETHUSDT on TradingView

Dall-E, Glassnode.com featured images, tradingView.com charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.