On-chain data shows that the Ethereum network saw a sharp increase in weekly whale volumes.

Ethereum’s large transaction volume has reached its highest since 2021

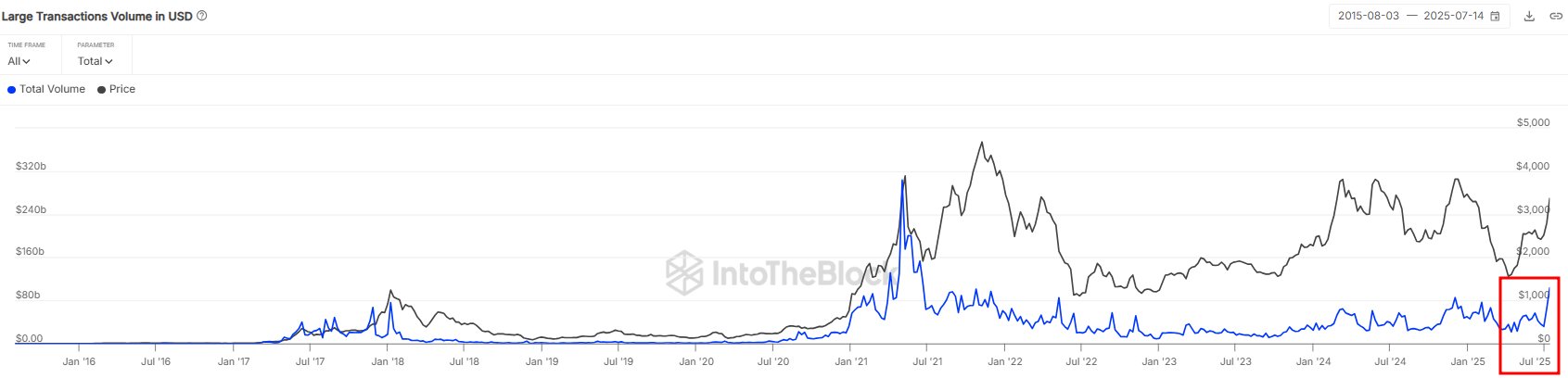

In a new X post, Institutional Defi Solutions Provider Sentora (formerly IntotheBlock) talks about the latest trends in large transaction volumes in Ethereum.

“Large transaction volumes” here refers to an indicator that tracks the total volumes being moved across the ETH network by transactions over $100,000.

Generally, only whale-sized investors can shift this size in a single transfer, so the amounts associated with these movements can be assumed to be expressions of the activities carried out by large-money investors.

A rise in the metric means that the whale is increasing transaction activity. Such a trend can be a sign of increased interest in assets. On the other hand, the indicator means going down. This means that large holders may be losing interest in cryptocurrency.

Now, here is a chart showing trends in Ethereum’s large transaction volume regarding the history of coins.

The value of the metric appears to have been rising in recent days | Source: Sentora on X

As shown in the graph above, large transaction volumes in Ethereum have recently observed some rapid growth, suggesting that whales have significantly increased their transaction activity.

Last week, the metric totaled more than $100 billion. This is the highest level since the 2021 Bull Run. This latest wave of activity from whales has come alongside ETH breakouts, and now prices are at a high level of $3,000.

This is certainly a sign of growing interest from popular entities, but it’s hard to say whether it’s positive or not. Large transaction volumes do not contain information about splitting the moves of buying and selling, so that spikes say nothing about which moves are more dominant.

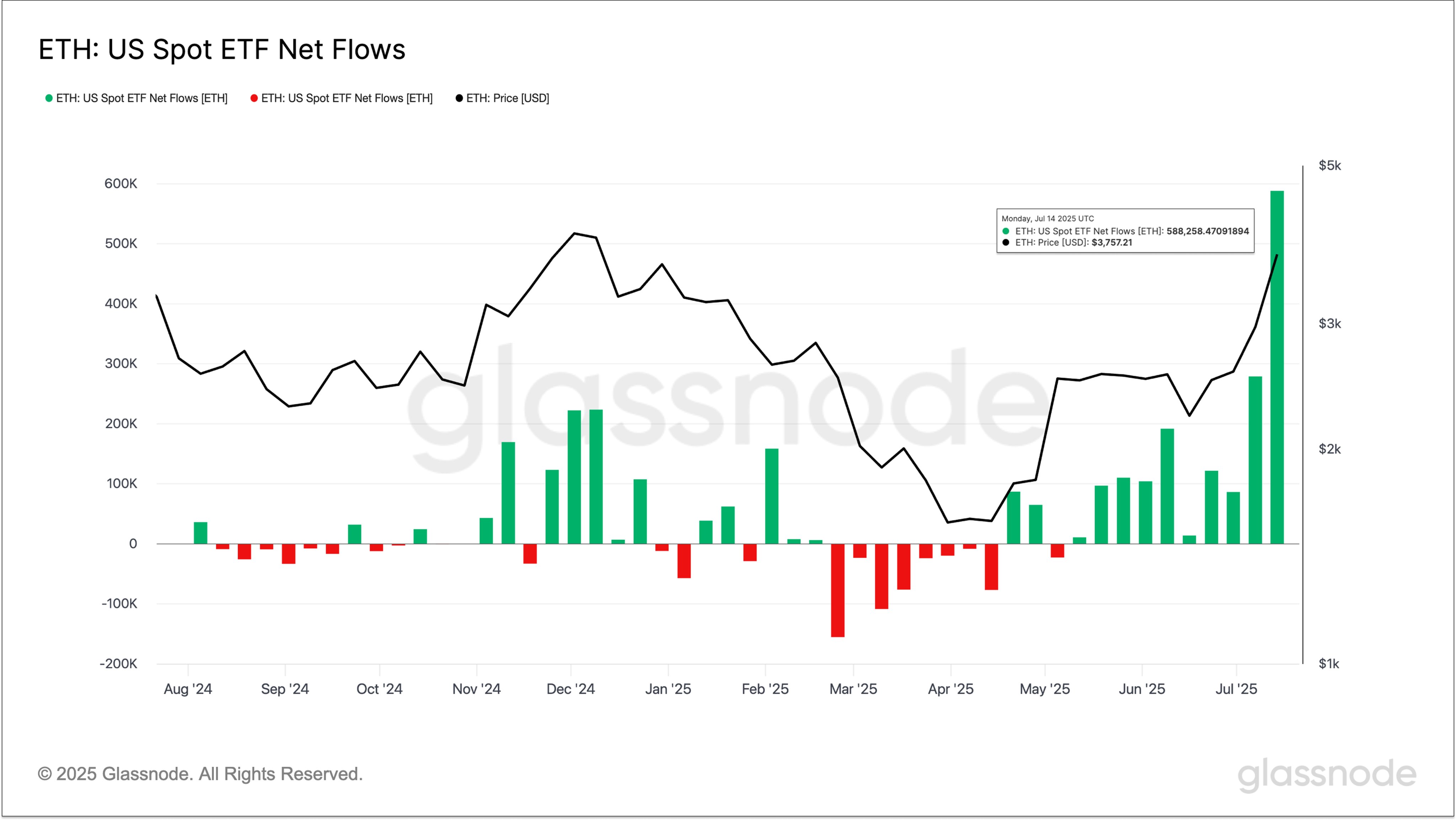

In other news, as analytics company GlassNode pointed out in the X Post, the US Ethereum Spot Exchange Trade Fund (ETF) has just seen a record-breaking week.

The trend in the netflow associated with the US ETH spot ETFs | Source: Glassnode on X

The chart shows that the Ethereum Spot ETF has been watching a few green weeks for some time, but the latest one stands out with the enormous scale of influx seen during that time.

“Last week, the Ethereum Spot ETF saw an influx of ETH of over 588k, almost 17 times the past average and more than twice the previous record,” GlassNode said.

ETH Price

At the time of writing, Ethereum has traded around $3,730, up 2% last week.

Looks like the price of the coin has been climbing up recently | Source: ETHUSDT on TradingView

Featured images from charts on Dall-E, Glassnode.com, IntotheBlock.com and cradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.