Open interest in Top Altcoin has been recovering recently, with Ethereum contributing to the biggest part of the swing.

Ethereum, XRP, Solana, and Dogecoin have seen an increase in open interest

In a new post from X, on-chain analytics firm GlassNode talks about the trends in open interest in the futures of four top altcoin: Ethereum (Eth), Dogecoin (Doge), XRP (XRP), Solana (SoL).

Open interest in futures here refers to a metric that tracks the total amount of futures market positions associated with a particular asset or group of assets currently open on all centralized derivative exchanges. We consider both shorts and long.

When the value of the metric increases, it means investors are opening fresh positions in the market. This trend can be a sign of increasing speculative interest in the coin. Meanwhile, the indicators registering the drop suggest that the holder is either pivoting to unrelax or being forced to be liquidated by the platform.

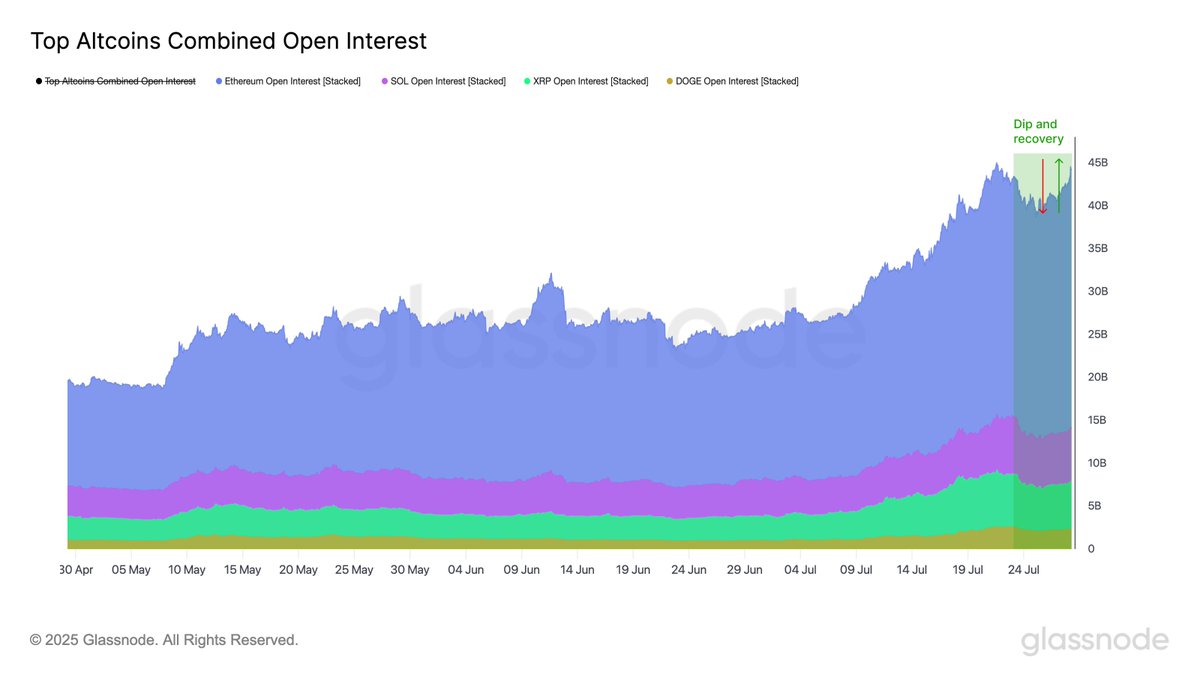

Well, here’s the chart shared by GlassNode. This shows the trend of open interest in futures for Ethereum, Solana, XRP, and Dogecoin over the past few months.

The market seems to have seen fresh positioning in recent days | Source: Glassnode on X

As shown in the graph above, the total futures of these top altcoins reached a high of $45 billion last week, but speculative interest has cooled and metrics have witnessed a decline.

Traders appear to be on a full recovery this week, with the indicators recovering almost completely, reaching $44.5 billion following a sharp rebound. It also appears on the chart that while Ethereum saw the biggest part of the swing, Solana and XRP were more stable. Dogecoin has more or less avoided roller coasters with a near-flat trend.

In general, an increase in open interest in futures can be a hint that the market may be likely to become more volatile. Given that Ethereum saw the sharpest rise in speculative interest, there may be a tendency to see violent leveraged flashes.

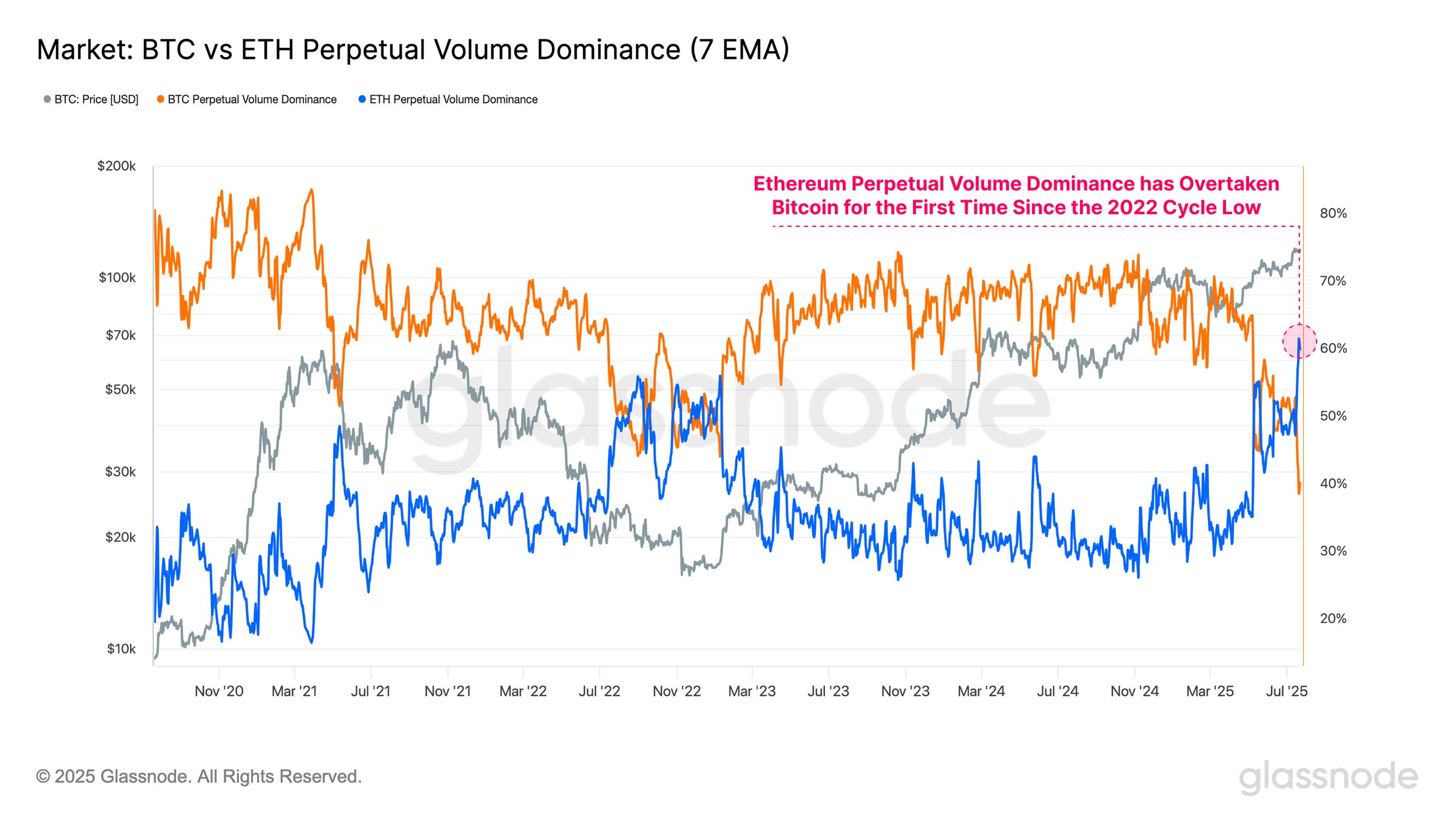

In related news, Ethereum dominates the permanent futures market, as the analytics company points out in another X-post.

The Perp Volume share of Bitcoin and Ethereum compared over the last few years | Source: Glassnode on X

As GlassNode highlights on the charts, Ethereum’s permanent futures volume dominance recently kicked out Bitcoin for the first time due to its low 2022 cycle. “This shift confirms a meaningful turnover of speculative interest in the Altcoin sector,” the analytics company said.

BTC price

Bitcoin continues its recent lateral movement trend as prices still trade at the $118,900 level.

Looks like the price of the coin has been stuck in consolidation recently | Source: BTCUSDT on TradingView

Dall-E, Glassnode.com featured images, tradingView.com charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.