The major Altcoin Ethereum surged over 40% last week, spurring new optimism across the cryptocurrency market. At press, the coin is resting more firmly than the psychological $2,500 price mark.

However, the rally may be losing steam, especially as it appears that US-based investors are cashing out. How will this affect ETH price performance in the short term?

ETH price rallies face risk as US investors come out

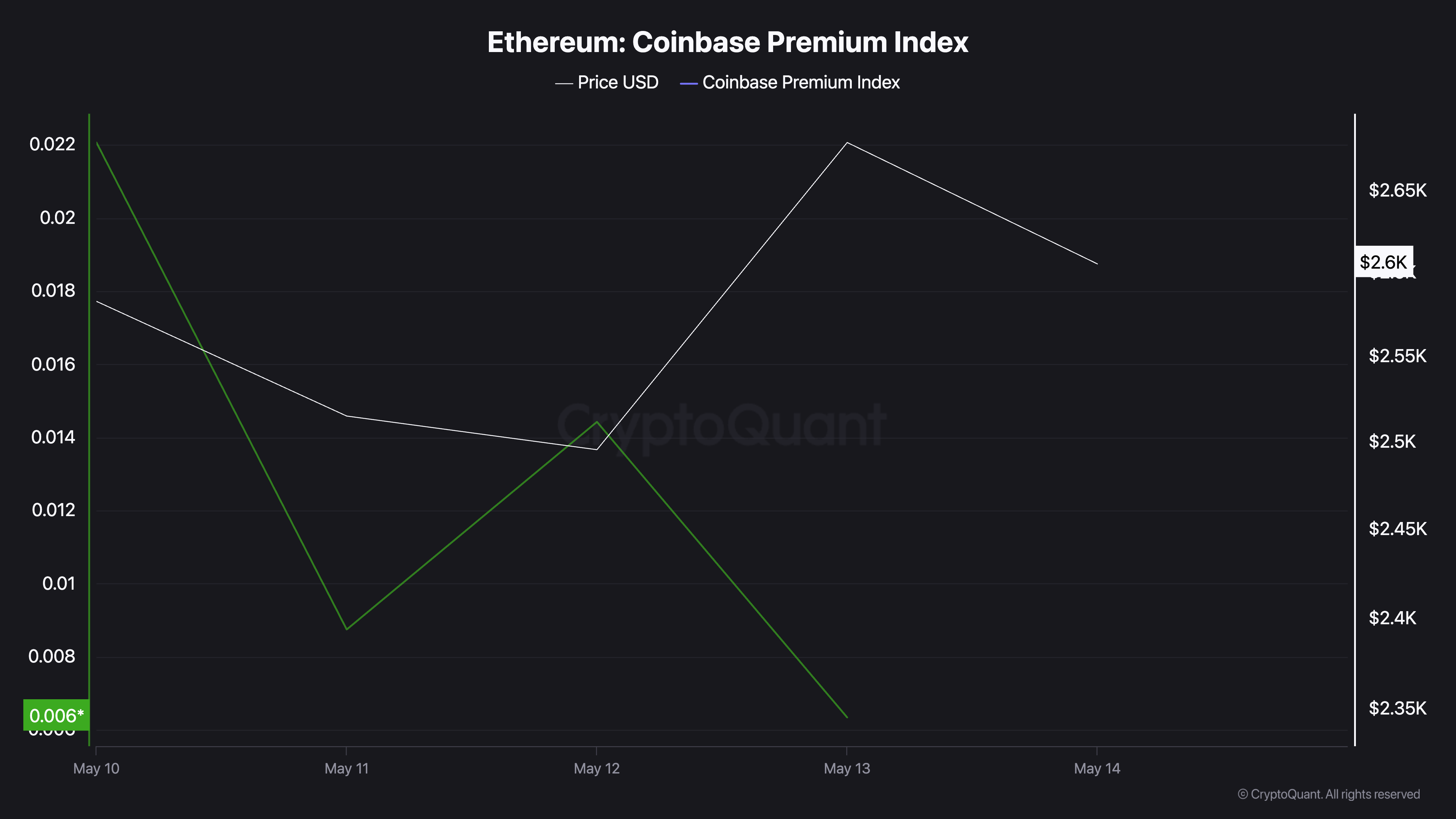

According to Cryptoquant, Eth’s Coinbase Premium Index (CPI) peaked at 0.022 each week on May 10th, then headed downwards. At the time of writing, the metric is at 0.0063.

Ethereum Coinbase Premium Index. Source: Cryptoquant

This metric recognizes a decline despite a 5% price rallies for ETH over the same period. This suggests an increase in sales pressure from US investors. This is a trend towards price-oriented Altcoin.

ETH’s CPI measures the difference between Coinbase coin prices and Binance. This is a good indicator for tracking US investor sentiment.

As CPI rises, ETH is trading at Coinbase premiums compared to international exchanges, reflecting stronger purchase pressures from US-based institutional investors.

Conversely, if CPI falls or even worse, negative, there is a signal that Coinbase demand is lagging behind the global market due to profit or decline interests of US buyers. The decline in ETH’s CPI during the price rally shows that American investors are leaving their position and realizing profits, rather than buying for the rally.

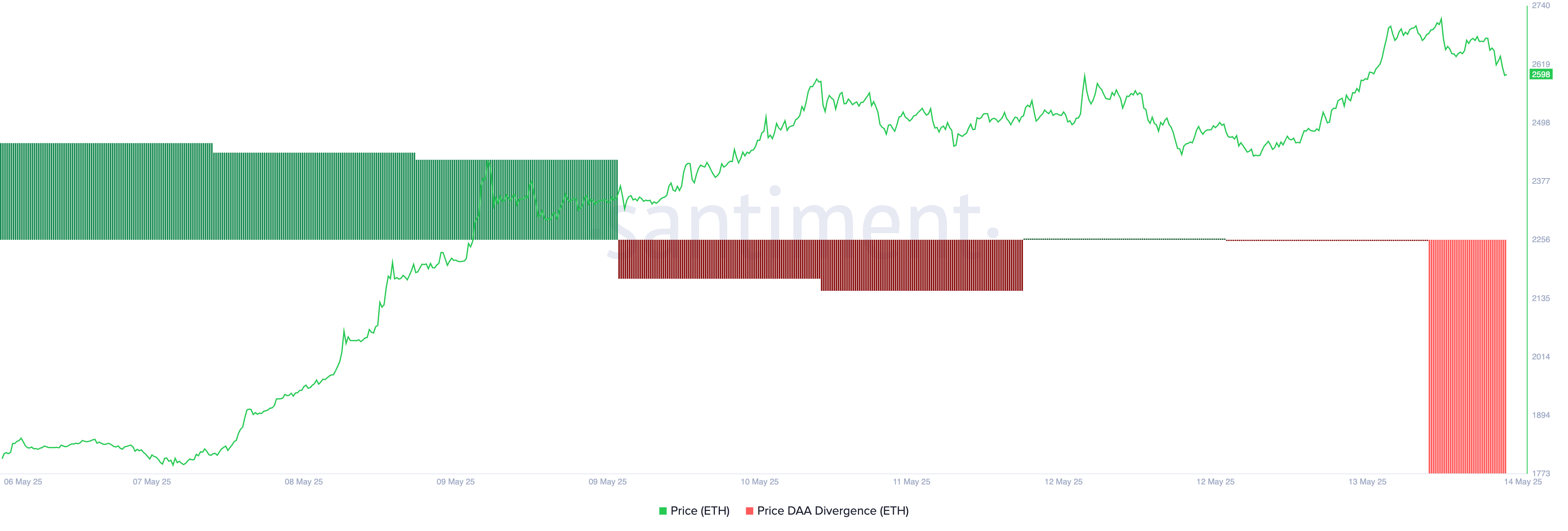

Furthermore, readings from the divergence of active addresses (DAAs) from ETH prices are a chain metric that compares price movements with network activity, confirming this bearish view. According to santiment, even as ETH prices rise, the metrics have been negative over the past few days. At the time of writing, it is -58.2%.

Ethereum Price Daa Divergence. Source: Santment

This negative value indicates that the corresponding increase in user engagement does not support the recent price rise of ETH. Essentially, the demand driving ETH gatherings is not sufficient, which puts pullbacks at risk in the short term.

Will the Bulls regain $2,745 or a deeper drop?

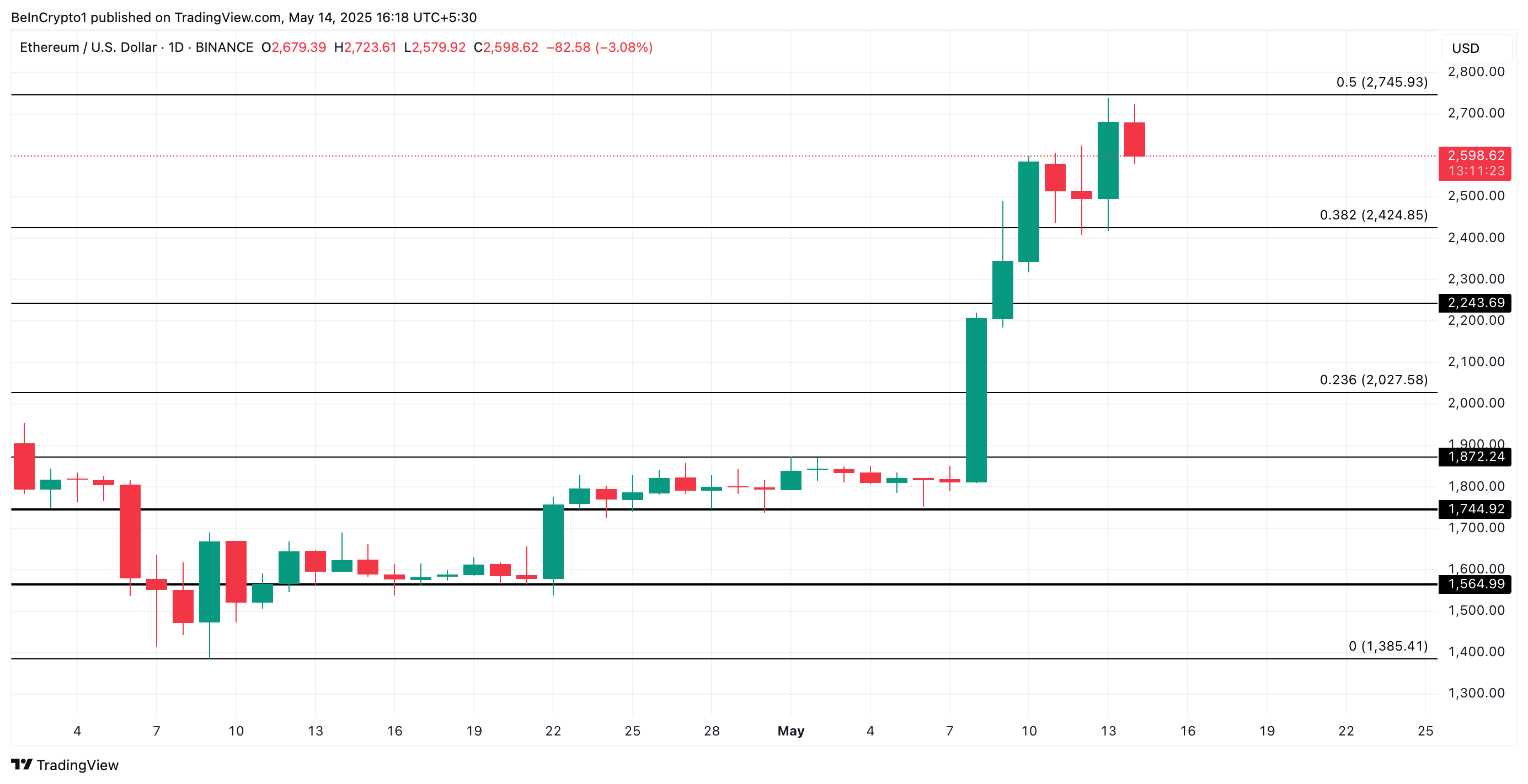

The ETH traded at $2,598 at press and is just under the multi-month resistance formed at $2,725. As US-based investors lock in profits, downward pressure on ETH has intensified, allowing prices to rise to $2,424.

If the Bulls don’t follow this level, the coin’s price could plummet to another $2,243.

ETH price analysis. Source: TradingView

However, if bullish pressure is increased, ETH could make another attempt to return to $2,745.