Ethereum prices have risen 5% over the past 24 hours amid widespread market recovery. The major Altcoin is currently trading beyond the psychological $2,500 price range, reinforcing short-term bullish sentiment.

However, key technical and chain signals suggest that upward momentum may be waning.

The technical setup of ETH is bearish

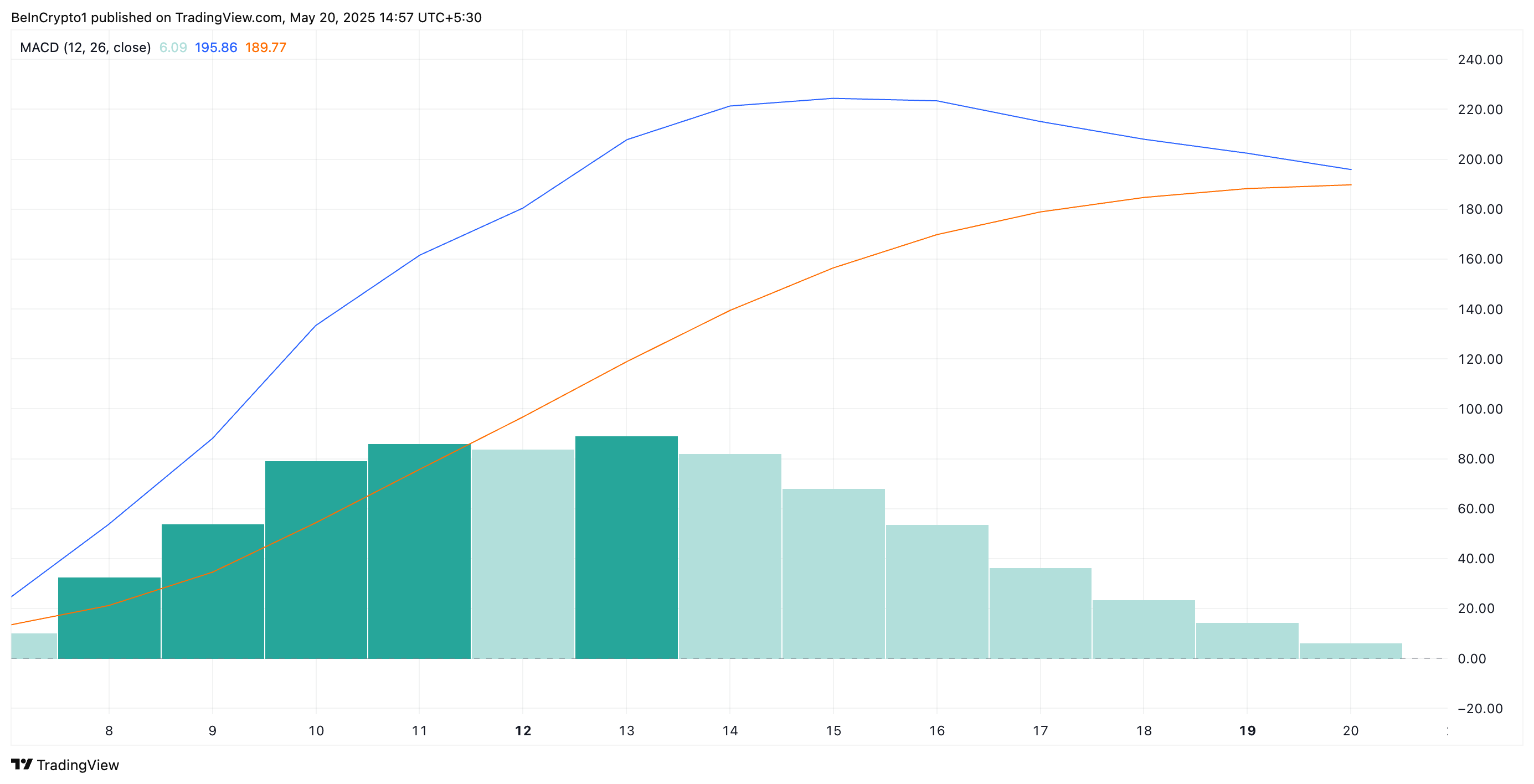

Evaluations of the ETH/USD one-day chart reveal the potential formation of death crosses in the moving average convergence bifurcation (MACD) indicator.

This bearish pattern appears when the asset’s MACD line (blue) breaks beneath the signal line (orange), indicating a transition from bullish to bearish momentum. Such patterns often precede a significant price drop, especially when it involves weakening positive emotions.

At the time of writing, ETH’s MACD line is about to fall below the signal line. If this occurs, the Death Cross will confirm the pressure on brewing sales and signal the onset of an extended downward trend.

Ethereum Macd. Source: TradingView

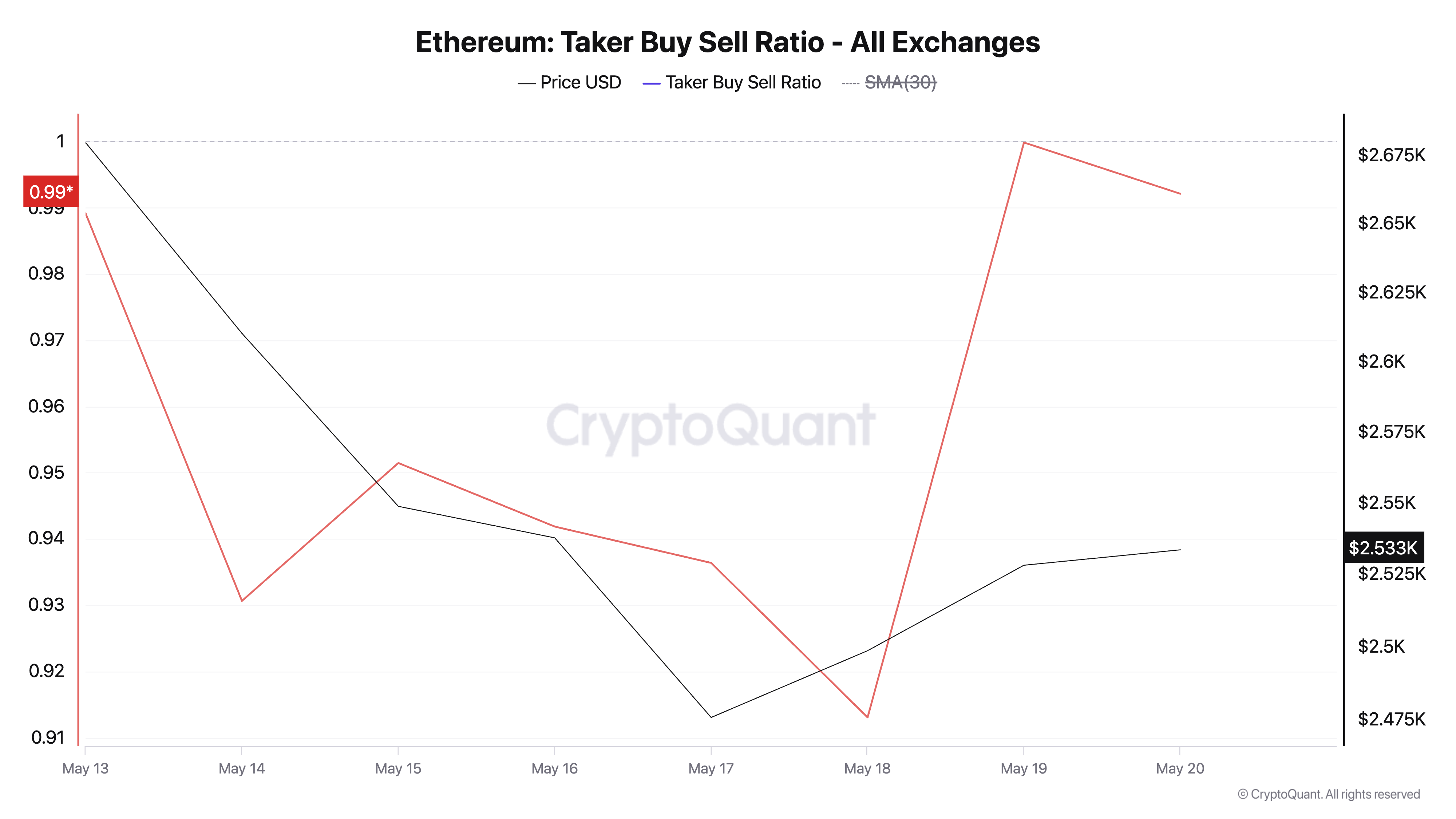

Furthermore, ETH’s Taker Buy-Sell ratio is below 1 at press time, indicating its sustained sales advantage in the derivatives market.

Ethereum Taker buying and selling ratio. Source: Cryptoquant

This metric measures the ratio of ETH’s futures market buying and selling. Values above 1 suggest that more traders are buying ETH contracts more aggressively than selling, while values below 1 indicate dominant sales pressure.

The ongoing prevalence of taker sales volume suggests that fundamental demand remains weak in the ETH market despite price increases.

ETH prices drop deeper as sellers target $2,027

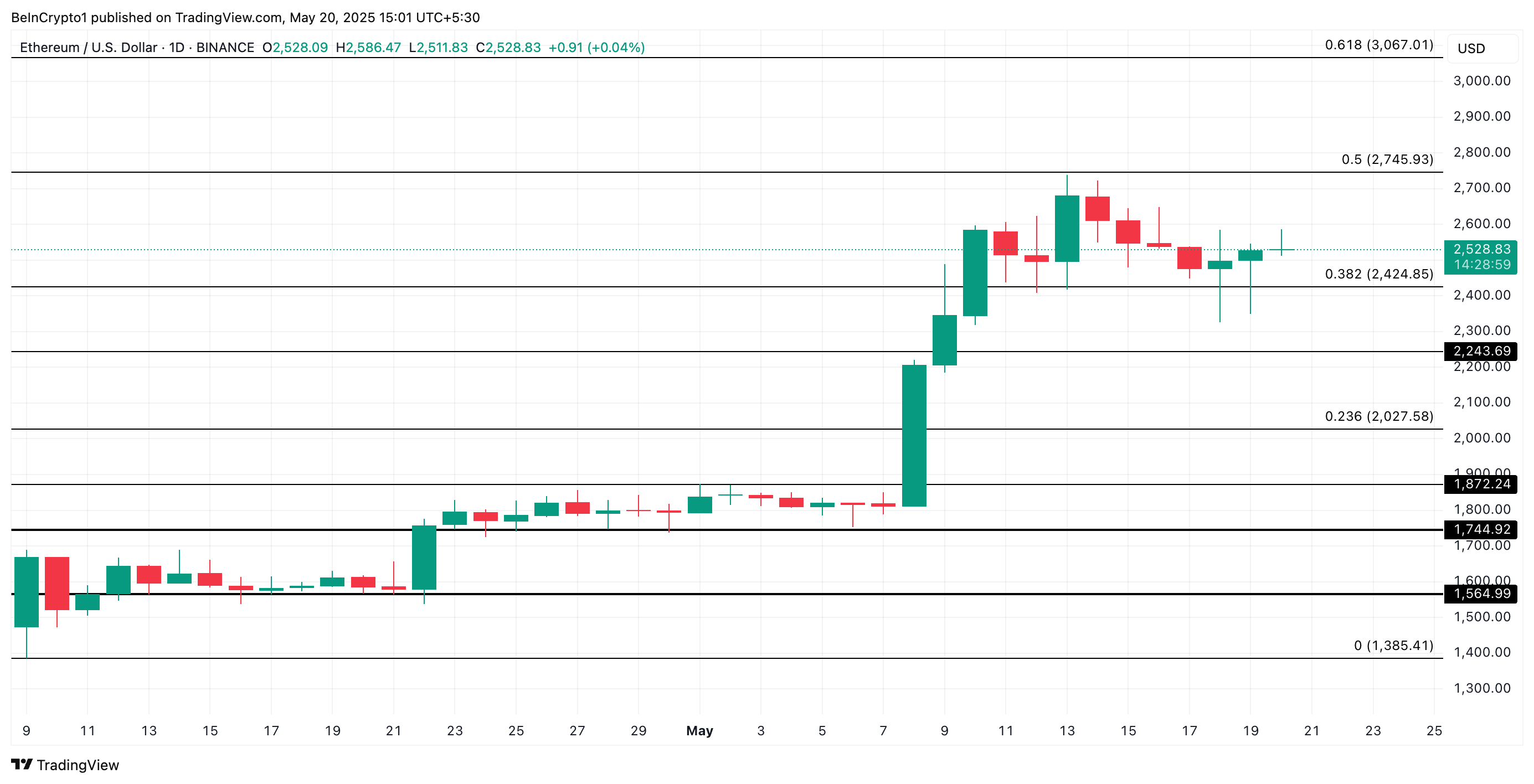

At press time, ETH trades for $2,528. With the underlying purchasing pressure reduced, major altcoins drop towards support at $2,424.

If bear pressure is increased at this level, ETH sellers could violate this support floor, further reducing to $2,027.

Ethereum price analysis. Source: TradingView

However, once the Bulls regain control and regain new demand for ETH spikes, their prices could regain strength and rise to $2,745.