Fidelity’s tokenized money market funds are all on Ethereum and have surpassed $250 million in on-chain value nearly four months after their debut.

The fund, known as Fidelity Digital Interest Tokens (FDIT), is a tokenized share class of Fidelity’s Treasury Money Market Fund that provides on-chain exposure to U.S. Treasury securities and other short-term government-backed instruments.

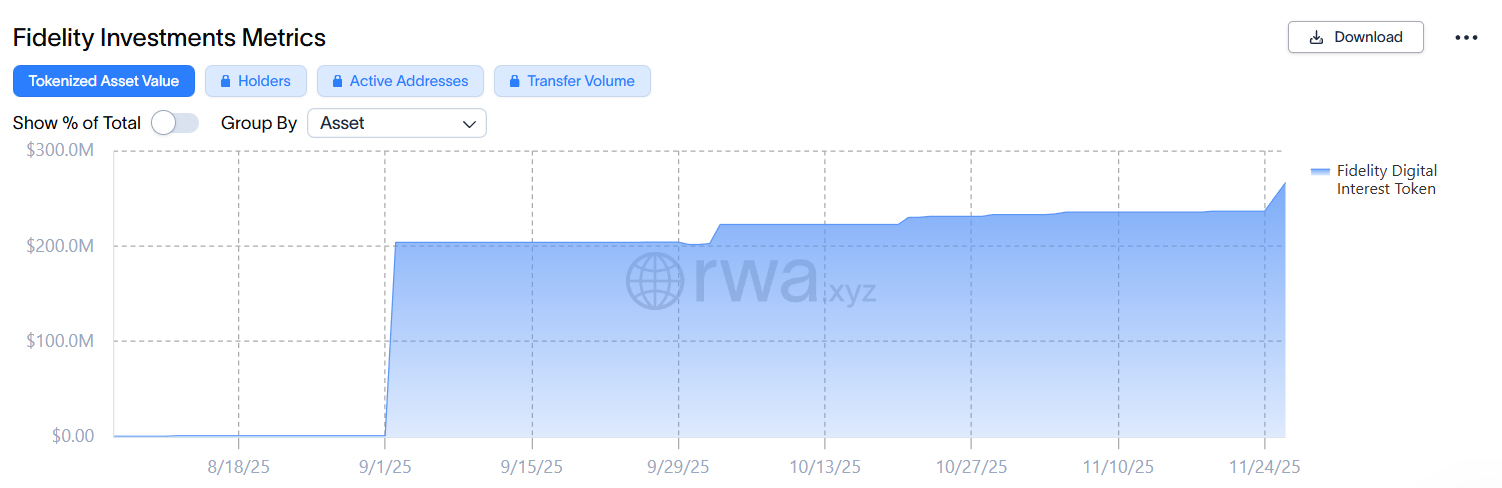

Fidelity Treasury Money Market Fund. Source: RWAxyz

As of this writing, FDIT’s asset value is over $266.2 million, up 15% from 30 days ago, according to data from RWAxyz, which tracks tokenized real-world assets.

Fidelity, which entered the tokenized fund space in early September, joins BlackRock. The company’s BUIDL Money Market Fund is currently the largest tokenized RWA product, with $2.3 billion in assets.

The majority of BUIDL’s total value was previously on Ethereum, but until last month its share on the main RWA blockchain had plummeted by 60%, with value now being distributed more evenly across the other blockchain networks supported by the fund.

Year of RWA

The total on-chain value of RWA now exceeds $36 billion, more than doubling since the beginning of this year.

Total on-chain value of RWA. Source: RWAxyz

The market consists of tokenized US government bonds, bonds, and private credit. Private credit accounts for more than half of the sector’s market capitalization, accounting for $18.7 billion. In terms of where these assets are tokenized, Ethereum dominates, holding $11.6 billion in RWA, representing over 63.7% of the total sector.

In a recent report, blockchain oracle provider RedStone predicts that total on-chain RWA will reach $60 billion next year.