Bitcoin prices have risen above $105,000 after a recent sharp drop, but the key $110,000 level remains a significant resistance zone.

The market shows a mixed signal, and the underlying on-chain metrics suggest strength, but there is risk when there are a large number of short-term holders of profits.

On-chain metrics show both strength and risk

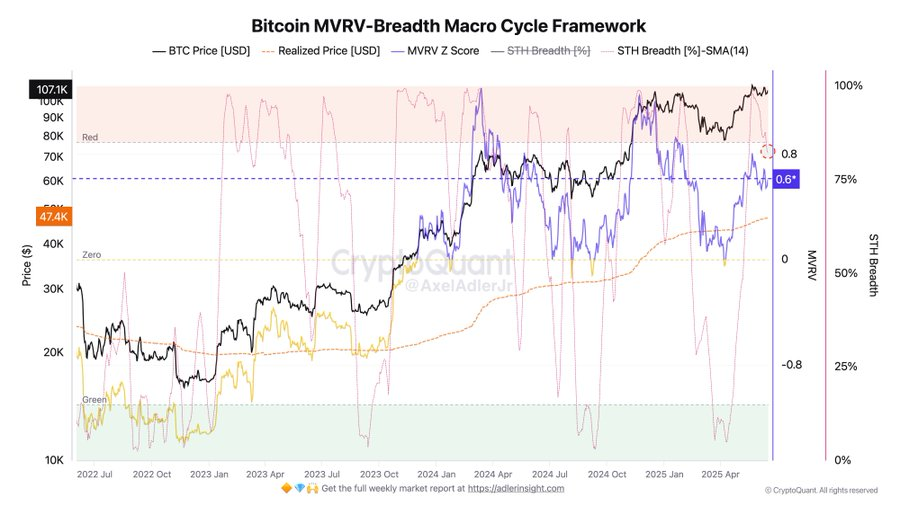

Market metrics show mixed signals, according to analysts. The MVRV Z score helps to measure whether Bitcoin is overrated or underrated, but is currently +0.6. This suggests buying strength in the market without any signs of overheating.

Source: Axel

Meanwhile, 83% of short-term Bitcoin holders are still profitable. “The market has a bullish trend with moderate excess levels and strong interest from short-term holders,” the analyst wrote. However, he warned that if so many short-term holders start selling, there is a high risk of about $110,000 if people start selling for profit.

Bitcoin is currently stuck in range

Between June 9th and 11th, BTC was about to rise above $110,000. But it failed. For now, Bitcoin remains in the lateral range between $104,000 and $110,000. According to analysts, pullbacks from current levels could be temporary fixes within a larger uptrend.

Source: TradingView

Bitcoin is probably at the final stage of this bull cycle, but there is still room for even more price increases. Some models suggest that Bitcoin could reach $130,000 in this cycle. But before that happens, the market may see short dips, especially around the resistance area.

Source: TradingView

At the moment, the key levels of Bitcoin monitoring are $108,822 and $110,550 resistance, while the support is $106,220 and $102,780. If the price exceeds resistance, you could open the door for a move towards $113,000. Meanwhile, if Bitcoin falls below support, it could potentially return to the $92,800-99,200 range that analysts have marked as a possible pullback zone.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.