The publicly available logistics company has signed a $20 million deal with institutional investors and has become one of the first companies to pinned the US president’s controversial digital asset strategy for cryptocurrency business to buy Trump’s official memo coin.

Cargo Technology CEO Javier Selgas proposed the move as part of an effort to grow US-Mexico Commerce. The U.S. Government Ethics Office will also invest in whether President Donald Trump is violating federal ethics regulations by providing exclusive access to top investors in the coin.

What is FR8Tech?

Cargo technology, known as FR8Tech, is a Houston-based company launched in 2015 and trades on NASDAQ. The company aims to use new technologies such as artificial intelligence to optimize supply chain processes.

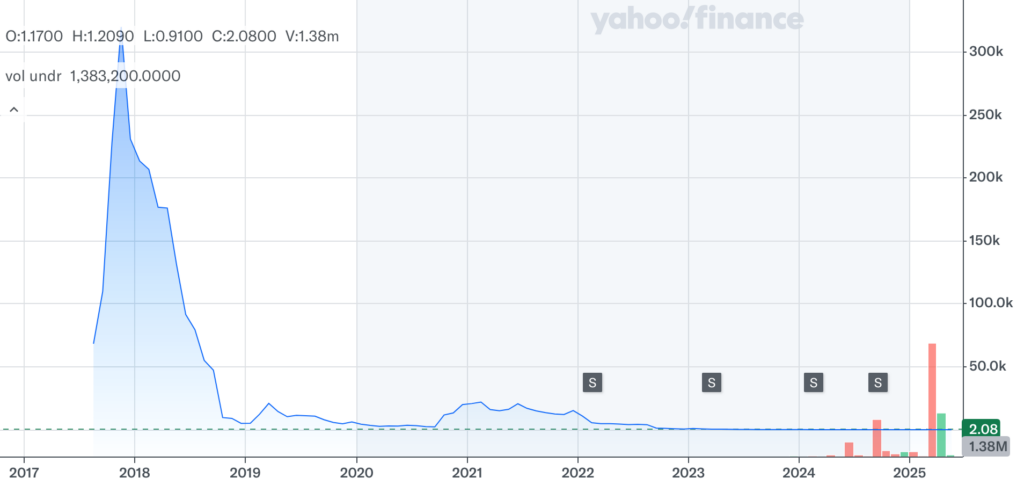

The company’s stock, trading on the Nasdaq under the Ticker FRGT, fell sharply in prices in 2018 during Trump’s first term. Like many other companies, freight technology is currently moving forward in digital asset reserves, deviating from the standard of making Bitcoin (BTC) a major asset and accepting Memocoin instead.

Social media influence and crypto commentator Mario Norfal called it the “first-ever” Trump Treasury Department.

There are no major headlines yet, but the move for $FRGT to return to the Treasury with $Trump has caught the eye of CT. Even as the token price action is cooled, social talk surrounding $Trump is strong. $frgt is still under the radar, with little volume or data…

-ALVA (@AlvaApp) April 30, 2025

A costly trick?

On April 30th, Freight Technology announced the creation of the Ministry of Cryptocurrency.

The company has agreed to issue convertor bonds worth up to $20 million to institutional investors. The capital is reserved solely for the purchase of official Trump (Trump) tokens. The first tranches will be $1 million.

In a prepared statement, Selgus referenced Trump’s “America-First” principles and linked efforts to trade between Mexico and the United States.

At the heart of FR8Tech’s mission is to promote productive and aggressive commerce between the US and Mexico. Mexico is the top US commodity trading partner, Mexico is the main destination for US exports and the top source for US imports. As US Treasury Secretary Scott Bescent recently stated, “I want to be clear: America doesn’t just mean America. It’s a call for deeper cooperation and mutual respect among trading partners.”

Buying Trump is outlined as “an effective way to defend fair, balanced and free trade between Mexico and the United States.” Still, the company has not elaborated on how Trump’s Memocoin acquisition will help support transactions between the two countries or alert readers to risks.

After all, the card token, like most memecoins, is extremely volatile. Its prices have risen by about 2% in the last 24 hours, but have been on a downward trajectory since its launch in January.

Source: Coingecko

Trump makes strange choices

As corporate cryptocurrency ministry becomes trendy, well-known companies like BlackRock recommend allocating up to 2% of their corporate assets to Bitcoin. They argue that BTC is a better store that is worth more than most other digital assets.

According to the Bitcoin Treasuries website, 101 public companies hold Bitcoin.

Given the deflationary design and long-term valuation of Bitcoin has been demonstrated throughout its 15-year history, it is understandable why some companies choose Bitcoin as one of their corporate assets.

So far, the official Trump has not been used for anything other than encouraging investors to buy to be invited to a private dinner with Trump on May 22nd.

Critics also warn that official Trump’s “pay for play” aspects raise ethical concerns and can also be used as a bribery tool.

“What’s not much discussed – creating many personal memo coins opens the door to foreign buyers trying to curry their influence with our leader,” said Nick Carter of Castle Island Ventures in January on X. “If you don’t like Hunter Biden’s anonymous art sales, you don’t like this either.”

Not much discussed – creating lots of personal note coins opens the door to keeping foreign buyers secrets trying to curry their influence with our leaders. If you don’t like Hunter Biden’s anonymous art sales, you’d hate this either.

– Nic Carter (@nic__carter) January 20, 2025

Last month, Democrats Adam Schiff and Elizabeth Warren called for a federal ethics investigation into Trump’s Coin promotion. In a letter to the U.S. Government Ethics Office, the senator argues that Trump may have violated federal ethics rules by providing access to his administration in exchange for financial investments.

Cargo technology does not show that it wants access to the White House by holding Trump’s Memecoin. In the days after the company’s announcement, FRGT shares rose 111.21% on May 2nd. The shares closed at $2.08 per share on Friday.

The price of Trump Memocoin appears to have not been affected by the news.

You might like it too: Trump family’s double coin launches fire conflicts of interest and cash hands

Signs of a bubble?

It makes sense that a bubble bursts, so it’s too early for the company’s Cryptocurrency to say it’s a bubble. However, some observers feel that a sudden surge in interest in crypto among public companies compared to the dot-com bubble.

It is worth reminding that the only *real* public company that has adopted Bitcoin as the Ministry of Corporate Treasury is $TSLA, $COIN, $XYZ

Everyone else is sitting somewhere in the spectrum between Charles Ponge and https://t.co/3cghbtay3b

– Pledditor (@pledditor) May 2, 2025

If you look closely, you can see that it is quick to talk about strong trends and prominent crypto fever among public companies. As more companies acquire Bitcoin, most are relatively small businesses that spend a humble amount on it.

The strategy, which owns over 500,000 Bitcoin, began accumulating BTC in 2020. Tesla invested in Bitcoin in 2021, driving the price of assets. The strategy has become the dominant Bitcoin buyer among public companies. The rest of the public companies hold smaller BTC bags. There’s no need to panic.

As for FR8Tech News, we currently have “allocated” funding to buy official Trumps, so we’ll see what happens when the purchase is officially made.

read more: More and more companies choose Bitcoin as a major asset in corporate preparation