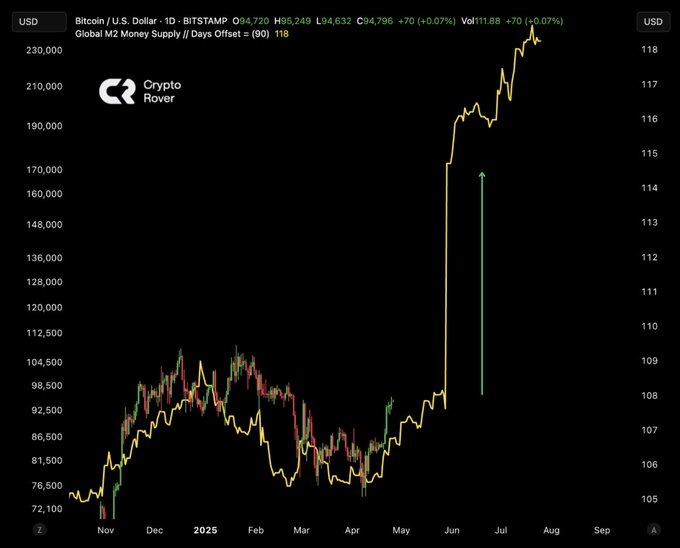

Bitcoin is approaching a key price range of $96,000. This is a level of resistance that has repeatedly challenged upward momentum during the integration phase. However, sentiment among analysts remains firmly and bullish, supported by a rapidly expanding global money supply.

Crypto Analyst Rover said “global liquidity is exploding” as the volume of circular finance capital continues to expand. Digital assets experience increased demand due to rising market liquidity, resulting in an increase in Bitcoin prices. The inflow of capital into the market creates favorable conditions for Bitcoin to potentially outperform its $96,000 resistance mark during a sustained breakout.

sauce: x

Bitcoin faces significant resistance at $96,000

Previous attempts at Bitcoin exceeding the $96,000 resistance level have attracted a lot of attention among investors. The market has shown support in this zone, making prices difficult to break through.

Related: Crypto campaign encourages Swiss National Bank to diversify with Bitcoin reserves

The next major goal for Bitcoin’s upward movement after a potential break of $96,000 is $101,000, followed by $111,000, suggesting a continuing bullish pattern. If Bitcoin can’t exceed $96,000, its price could fall.

sauce: x

Bitcoin’s market sentiment is heavily dependent on funding rates with increasing liquidity. When the majority of futures traders open up short positions and reflect bearish feelings, their funding rates go negative. Historically, such negative funding periods have preceded the rise in Bitcoin prices, indicating that current trends could lead to an upward movement.

Institutional profits strengthen the outlook for Bitcoin

Increased demand for Bitcoin ETFs has led to a dramatic increase in profit levels from financial institutions to Bitcoin. BlackRock’s recent $240 million Bitcoin purchase, along with the institution’s trust, means a positive outlook for Bitcoin. Growing institutional support and increased liquidity suggest that the potential for Bitcoin’s digital assets remains strong, supporting favorable price trends over the next period.

Related: Coin Share: Bitcoin All-in Mining Costs reached 137K for listed miners in the fourth quarter

The market value of Bitcoin is directly correlated with global financial expansion, along with increasing demand for liquidity-driven cryptocurrency. The cryptocurrency market shows that Bitcoin outweighs the key obstacles on the path to generating substantial price increases.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.