The surge in gold on April 21st is over $3,390 as more investors flock to safe assets amidst economic uncertainty. Gold boosts could potentially show a similar pattern in crypto, especially Bitcoin.

According to latest Trading Economics data, Gold reached an all-time high among global economic volatility. On April 21st, gold rose 2%, well above the $3,390 threshold, reaching around $3,395 at 7:30 UTC. Analysts predict that the rise in performance could be due to rising global trade tensions and the weaker US dollar.

Just a week ago, President Donald Trump ordered an investigation into potential tariffs on new tariffs on important US mineral imports. This represents a significant escalation of trade disputes between the United States and other countries, particularly China. Additionally, investors are beginning to lose faith in traditional Fiat currency as the US dollar plunged to its lowest level in three years.

Meanwhile, the rise in the Gold meteor could mark the beginning of a bullish rally in the crypto market. Traders have noticed that gold and Bitcoin (BTC) prices are often closely related, taking into account that both are “safe haven” assets.

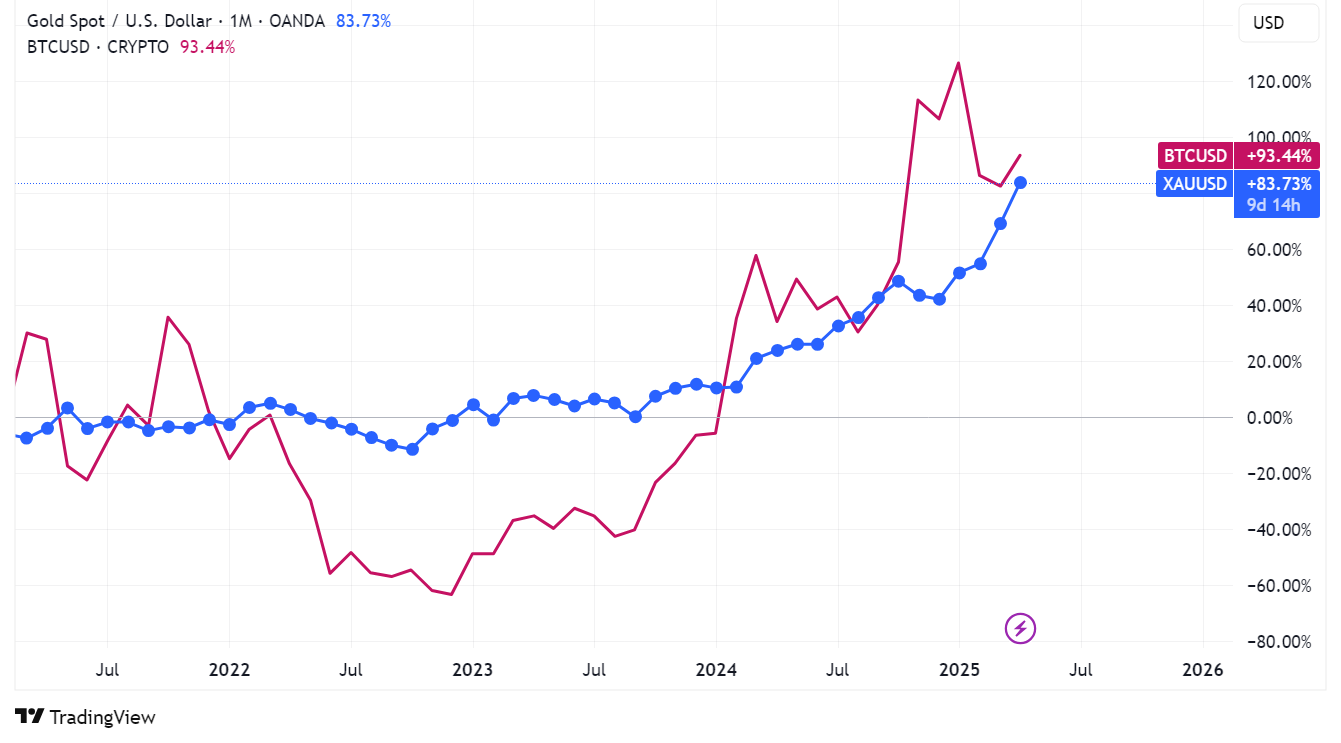

Price chart comparing Bitcoin and Gold movements in the market, April 21, 2024 | Source: TradingView

You might like it too: Futures trading that comes to tokenized gold spots and Bitget wallets

In fact, on the same day, Bitcoin reached a new monthly height of $87,570. At the time of pressing, BTC rose more than 3.2% in the last 24 hours of trading. Currently trading hands for $87,538. The last time BTC hit more than $87,400 came back on March 28th, but the recession broke out in early April.

What is the historical relationship between money and code?

Bitcoin is often compared to “digital gold” by market traders and investors. Federal Reserve Chair Jerome Powell said Bitcoin is a gold competitor, due to how both assets are used as value stores rather than as payment options.

Similarly, Cathie Wood, founder and CEO of ARK Investment Management, predicted that Bitcoin’s $2 trillion market capitalization could one day surpass Gold’s $15 trillion over time. Despite its long existence, the money was long before reaching $2 trillion.

“At $2,700, Gold is a $15 trillion market compared to just $2 trillion in Bitcoin. Even after breaking $100,000, Bitcoin is still in its early innings,” Wood said.

Historically, positive gold market movements have often followed the rise in Bitcoin prices. Aside from the fact that both assets are considered “safe shelters” to protect investors from the volatility of traditional Fiat currency, both have a finite supply that needs to be mined.

Despite these similarities, Bloomberg analysis found that gold still has a much lower volatility rate compared to Bitcoin. Gold’s annual volatility rate is around 10% to 20%, while Bitcoin is often over 50%. While this may be true, analysts also note that macro-bitcoin trends tend to follow gold within a few months.

You might like it too: Gold hits the best ever in bullish bitcoin for $2,700