Coinbase stock has had its best week since last November, but the company has moved from bad news to another.

Coinbase shares closed at $266. This is the highest level since February, 88% above this year’s lowest level. This will provide Coinbase with a market capitalization of over $67.8 billion.

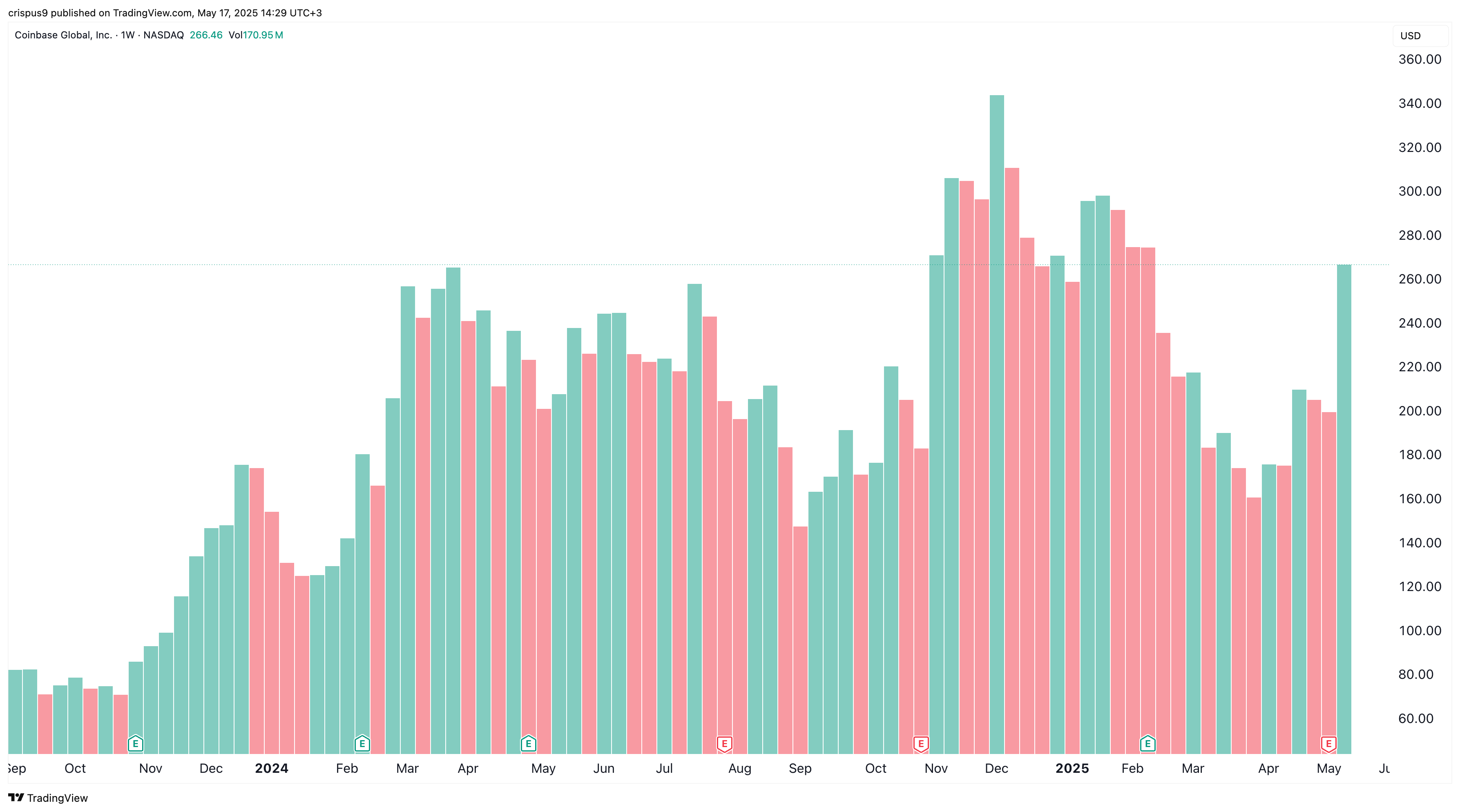

Coinbase Stock Price Weekly Performance | Source: TradingView

Coinbase experienced major headwinds

The rally took place in a difficult week for the company and the crypto market. Firstly, Crypto Market Rally has stagnated recently, with Bitcoin (BTC) stubbornly falling below $105,000, with many Altcoins crashing at double digits from their monthly highs.

Second, Coinbase has revealed major hacks that could cost over $400 million. The hackers worked with staff abroad to receive sensitive data and demand a $20 million ransom. Coinbase has revealed that it will not pay the ransom, but will instead pay tips that will lead to the hacker’s arrest.

Third, it has been revealed that Coinbase is under the SEC probe for incorrectly incorrect customer data in its disclosure. The investigation focuses on whether the company has over 100 million verified users, as argued in the submission. Coinbase claimed it had stopped reporting that number two years ago.

Why Coinbase stock price has skyrocketed

Coinbase stock price has risen despite these headwinds as these events will not have a major impact on the business. First, continuous pullbacks in the crypto market are likely to be temporary, with most analysts predicting more Bitcoin profits over the long term. Ark Invest expects BTC to reach $2.4 million in 2030, but BlackRock has a $700,000 target.

You might like it too: Bitcoin Price Eyes As Traders are looking for a “supply shock”

Second, historically, the impact of hacking on corporate performance is usually limited. For example, Equifax’s stock price has been hacked since 2017, stolen data on 147 million customers. Other companies that flourished after the hack were Target, Home Depot, Sony and Capital1.

Coinbase may also be covered by insurance that will help you with related payments.

Third, the ongoing SEC probe was launched under the Biden administration. This means that a Paul Atkins-led agency may decide to end it. The SEC has already finished many previous probes that Gary Gensler started.

Moreover, this week’s event did not lead to downgrades by Wall Street analysts. Some of the most bullish ones come from the benchmarks, Rosenblatt, Oppenheimer and Compass Points.

These analysts cite strong market share in the US and expanding into the derivatives market through the acquisition of derivatives.

Most importantly, Coinbase’s stock jumped ahead of its addition to the S&P 500 index on Monday. This addition means that all funds tracking the index will be forced to buy stocks.

read more: Coinbase hacks with S&P rising and investigators who saw it coming