Bitcoin’s recent surge suggests strong short-term inflow momentum, but longer-term data suggests momentum is recovering.

Bitcoin recently soared above the $89,000 mark and is trading at $89,042.27, up 1.1% in the past 24 hours. This price movement occurred after a volatile period in which Bitcoin’s value fluctuated between $87,655 and $89,542. The positive momentum is evident as the price continues to rise, showing a particularly strong increase after 02:00 UTC and showing steady growth towards the 10:00 mark.

Over the past seven days, Bitcoin posted a solid gain of 5.8%. In addition to daily gains, BTC has also shown consistent performance over the long term, gaining 2.4% over the past two weeks.

Bitcoin price prediction

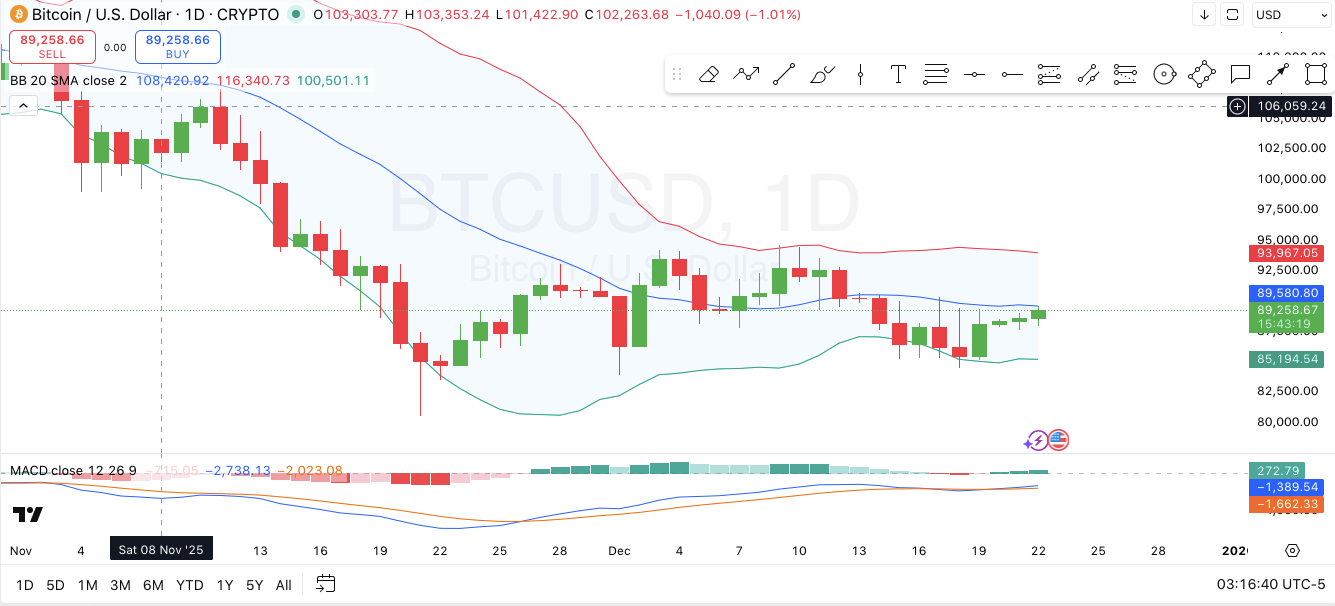

Notably, TradingView’s charts show Bitcoin’s recent price movements using key indicators such as Bollinger Bands and MACD. Specifically, the Bollinger Bands are widening, suggesting increased volatility and the possibility of a sharp rally.

Bitcoin predictions

This means Bitcoin is in a consolidation phase and could either breakout above the upper band (around $94,000) or retrace to the lower band (Approximately $85,000), both serve as important support and resistance levels. Price action shows that Bitcoin is testing a support zone around $89,000 that coincides with the 20-SMA, which could provide short-term support in the face of selling pressure.

MACD (Moving Average Convergence Divergence) also supports momentum analysis. Currently, the MACD line is above the signal line, suggesting a bullish trend, although the momentum has weakened slightly, as the histogram shows decreasing buying pressure.

If Bitcoin continues to maintain its price level above $89,000 and breaks through the resistance near $90,000 to $95,000, further gains are possible.

However, failure to hold the $85,000 support could result in a further decline to lower support levels, which could test the market’s strength in the short term.

Bitcoin futures data

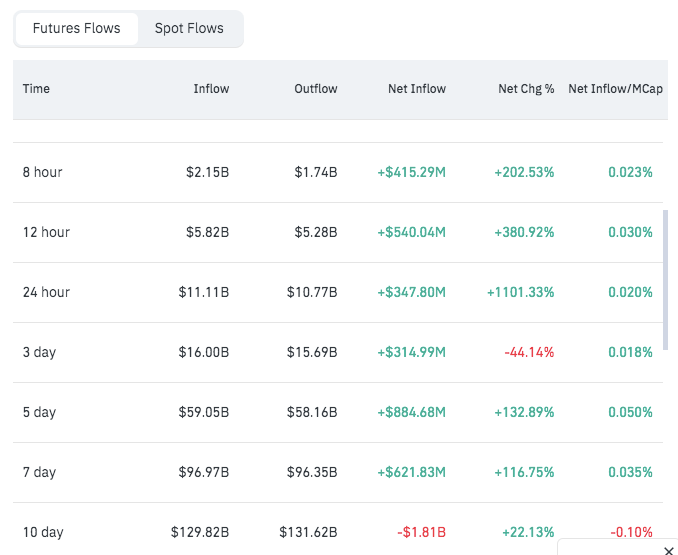

Additionally, futures data It shows strong capital inflows into Bitcoin, especially in the short to medium term, indicating bullish sentiment. Over the past 8 and 12 hours, Bitcoin saw significant net inflows of $415.29 million and $540.04 million, respectively, with the percentage increasing dramatically by 202.53% and 380.92%.

Bitcoin futures flow

This surge suggests growing market interest and investor confidence. Even in the 24-hour period, Bitcoin recorded solid net inflows of $347.8 million and a massive gain of 1101.33%, further confirming that buying pressure has been dominant in the market recently.

However, long-term data reveals a shift in sentiment. The 3-day and 5-day Bitcoin net inflows were $314.99 million and $884.68 million, indicating continued positive sentiment, but especially the 3-day net movement decreased by 44.14%.

The 7-day data shows net inflows of $621.83 million, reflecting a slowdown in inflows, while the 10-day data shows a negative change in net outflows of $1.81 billion.