Ethereum expanded its bullish gathering and rose sharply towards the critical multi-time frame resistance zone. The assets are showing strong momentum, but are now approaching the confluence of technical barriers that can cause continuous breakouts and healthy retraces.

Technical Analysis

Daily Charts

ETH has pushed multiple resistance zones and is currently testing regions between 2.6K and 2.7k. It coincides with the 200-day moving average and the lower boundary of long-term channels, and was divided into negative aspects a few weeks ago.

RSI is currently in the realm of over-acquisition, printing over 75, suggesting potential fatigue. Over $2.7k daily will see a bullish breakout and open the door to 3k+, but a refusal from this level could pull ETH back to the $2.2,000 support level.

4-hour chart

The four-hour chart shows textbook breakouts from the downward channel, followed by a strong bullish follow-through. The assets are consolidated just above the $2.6K zone after the vertical leg rises.

There is still room for growth towards the $2.8k area, but the combination of current sideways price action and RSI reductions suggests cooling momentum. A break below $2.6K could cause a short-term fix to the $2.1K before the next leg.

Emotional analysis

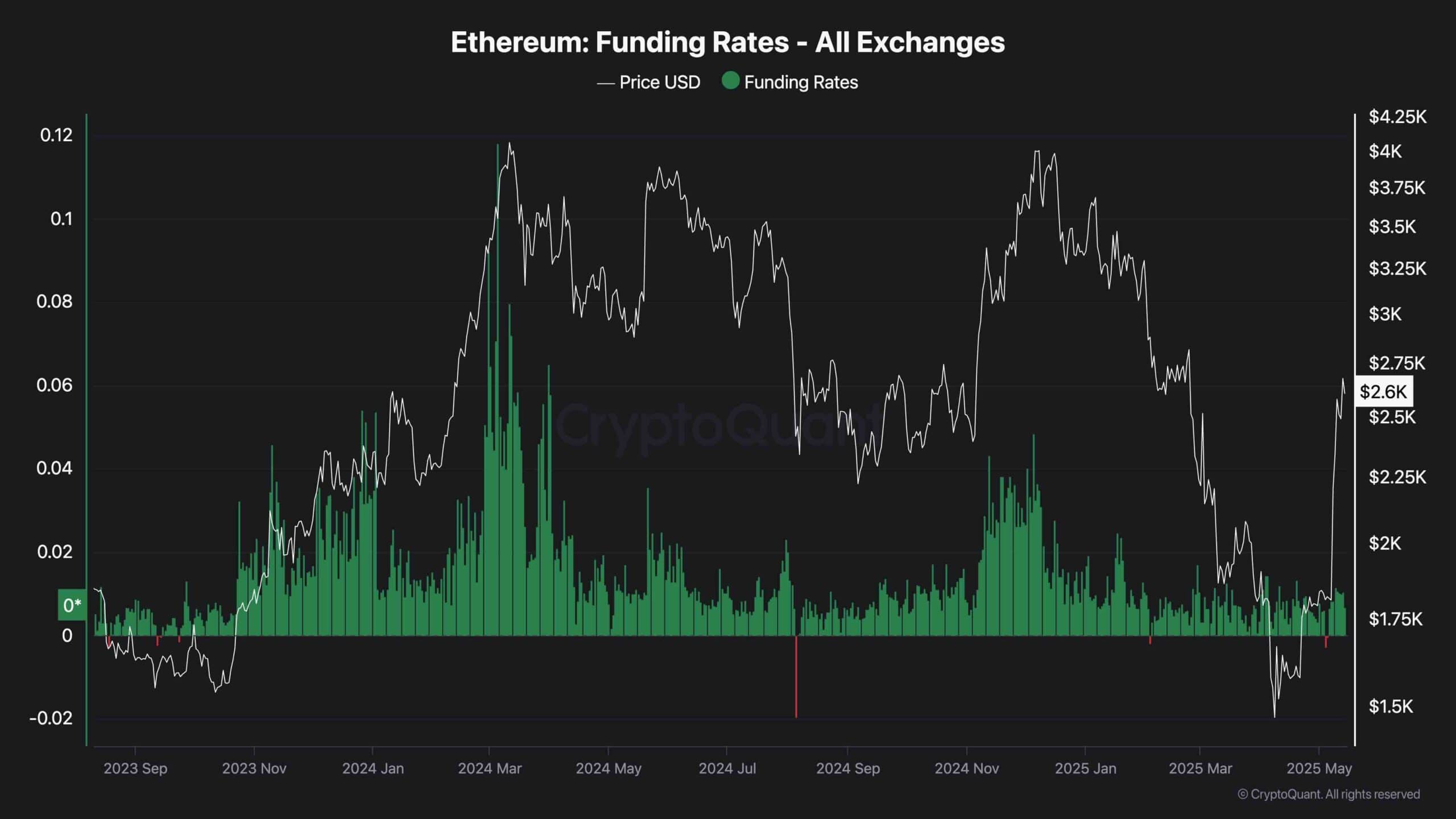

Funding rates across all major exchanges remain slightly positive, reflecting bull market sentiment. But they are not yet at an extreme level, indicating that there may still be fuel left at the rally. Also, Ethereum’s open interest has risen significantly along the price, suggesting that new positions are entering the market rather than closing shorts, which are usually a sign of true momentum.

That said, traders should be cautious. The busy positioning indicated by the rise in RSI on the daily chart and the rising funding rates could set a short-term flash stage if ETH is rejected with a critical resistance. Historically, such a surge in sentiment was followed by a local top or integration phase.

Over the next 24-48 hours, surge in funding and monitoring open interest behavior is important to measure whether this rally can be extended further and whether the pullback is on the horizon.