Rize, the native token for RWA tokenization Project T-rize, suddenly fell a day after it came out to the live show in major exchanges.

According to Coingecko, Rize plunged nearly 48% in 24 hours, trading around $0.046 as of the Asian era on the morning of May 16th. Price Action coincides with the release of the Tier-1 centralized Exchange Kraken, Token Generation Event (TGE) and Mainnet, one day after Rize secured its list of Tier-1 centralized exchange Kraken on May 15th.

The token was launched on the Base Blockchain, an Ethereum Layer 2 network developed by Coinbase.

Along with Kraken, the tokens also secured a list of decentralized Exchange Aerodrome and Dex Aggregator Matcha (base).

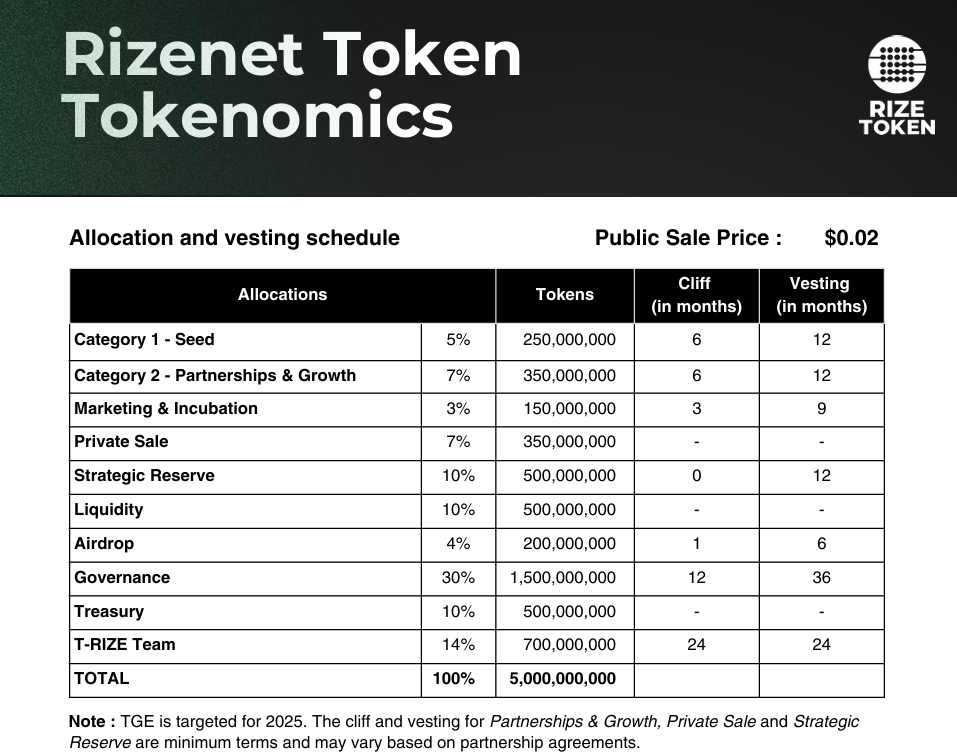

Following TGE, the token reported a $27 million circular supply. Of the maximum supply of up to 5 billion, 4% (200 million tokens) have been allocated to airdrops. However, these tokens are currently locked, with a one-month cliff and six-month vesting. This means that airdrop recipients cannot be sold immediately.

Source: Rize Whitepaper

However, private sales investors who were assigned 7% of their total supply or 7% of their tokens of around 350 million tokens face lockup and vesting restrictions, allowing them to trade tokens immediately after launch. This unlimited access could have played a key role in the early wave of sales pressure and the sudden drop in Rize prices shortly after it was realized.

You might like it too: PI networks violate support despite the emergence of rebound catalysts

Other large allocations, such as liquidity and the Ministry of Finance (10% each), are also unlimited, and probably contribute to early market dumps. Meanwhile, seed and growth investors are on a 6-month cliff, with the team’s share (14%) locked for two years. Governance tokens slowly unlock after 12 months of cliffs over three years.

Such a sale is a common occurrence within the crypto space, especially when tokens are listed in major exchanges during TGE. Early investors are often rushing to book profits, causing short-term volatility, even when the project has strong long-term potential.

Rize’s debut brought out a huge public interest with Google’s token trends, even if prices fell sharply.

Public interest can also lead to increased demand and intervention. This helps to absorb some of the sales pressure.

What is Rize Crypto?

For beginners, Rize is the native token of the Trize Group, a project that focuses on the symbolism of real-world assets such as real estate and infrastructure. Runs on Riizenet, a Layer 1 blockchain built on an avalanche, and is designed to support distributed machine learning and secure institutional asset tokenization.

Tokens are used to access governance, gas fees and exclusive investment opportunities. It also plays a role in federal learning, allowing participants to collaborate with data without compromising privacy.

The T-rize Group is based in Montreal, Canada, and has already secured a $300 million tokenization transaction. It is supported by Ecolede Technology Superiuer (éts), one of Canada’s top high-tech universities, and is supported by key players such as Canton Network, Hashlock and IBC Group.

read more: Solana faces rejection with a $180 resistance: Turning to $125 support

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.