High lipids have recently surpassed the trade volume of permanent exchange Dydx, reaching $1.5 trillion. Despite being a much newer platform, Hyperliquid’s token buyback and lack of cash incentives have resulted in long-term stability.

To be fair, Hyperliquid has also been involved in much larger controversy, and is well known for abolishing Jellyjelly earlier this year in response to a shorter squeeze. Nevertheless, the platform has rebuilt its reputation and produced a massive amount of its production.

High lipid trading volume exceeds dydx

Hyperliquid, a high-performance L1 trading blockchain, has enjoyed many successes recently. Earlier this month, it won over 60% of the permanent trade market, and its hype token reached three months high soon after.

Yesterday, analysts noticed Hyperliquid’s highest ever trading volume exceeded DYDX, reaching $1.5 trillion today.

Dydx is a decentralized, permanent exchange that has been active for five years, but the Hyperliquid platform was launched in 2023 only.

Nevertheless, the young protocol overtook it. After launching the native token in 2021, Dydx began adopting it to refund users’ transaction fees and increased its volume. He then built community hype around unofficial “trading contests” with his competitors.

High lipids, on the other hand, were not dependent on Dydx’s incentive strategies. After last year’s own TGE, we were able to accumulate a huge amount through features, word of mouth and product quality.

2024 was the peak year for Crypto Perpetuals Trading, and the hype took advantage of the moment. This clearly proves to be a more durable approach.

Additionally, Hyperliquid is directed towards token repurchase, which is the smallest amount of transaction fee measured in a few months, to a small extent.

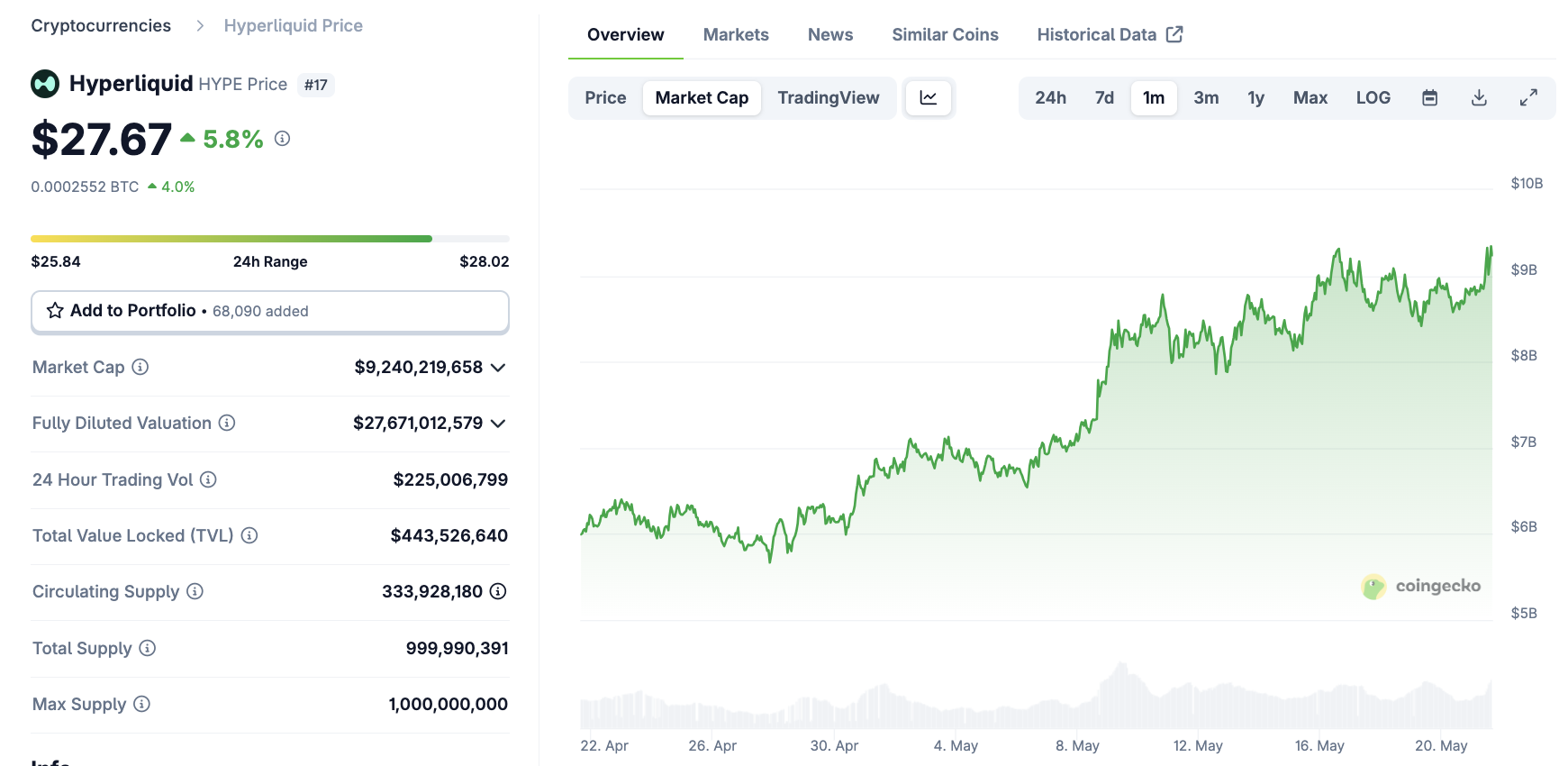

This has resulted in the company repurchasing 17% of its circulating hype tokens, offering some important benefits. Last month, Hype’s market capitalization has steadily risen to $10 billion.

Market capitalization of high lipids (hype). Source: Coingecko

Despite its strong rise, high lipids have seen some major controversy. For example, despite clear on-chain evidence last year, it denied claims of the Lazarus Group’s security breaches.

It unleashed a major scandal when it listed Jerry Jerry in March 2025 in response to a short squeeze. This has resulted in accusations of market manipulation and heavy losses.

Dydx has not suffered from such public conflicts for months, but the high lipids acted quickly to rebuild its reputation. So far, this seems to have worked.

Today, high lipids have reached a new history of open interest, exceeding $8 billion. If this momentum can be maintained, the exchange can build a lead that will lead Defi’s permanent market.