This is a segment of the LightSpeed Newsletter. Subscribe to read the full edition.

Many of Crypto’s top 15 tokens by market capitalization were not first issued after the collapse of FTX. Two exceptions are SUI, which started trading in mid-2023 and hype. This has risen to over $110, more than $11 billion in market capitalization since its launch in the Air Force in November 2024.

The hype, the native token of the high lipid layer-1, has more than tripled in price since local bottoms on April 6th, surpassing the approximately 70% increase in SOL over that period. For crypto investors looking for the next Layer-1 token that can capture returns like Solana, hype has created a lot of hype. Even Mike Novogratz from Galaxy is on board.

Hypercore, Hyperliquid’s Core Layer-1 Appchain is dedicated to Hyperliquid’s order book exchange, generating fees and leading to token buybacks. According to Artemis data, this product is extremely popular. Hyperliquid also has an Ethereum virtual machine network called The HypereVM, but its adoption is much more muted than Hypercore.

Therefore, there is confusion in the hype. Should it be evaluated like PERPS DEX, which is maximizing demand in the PERPS DEX market, or should it be evaluated like Layer-1, which can compete with Ethereum or Solana?

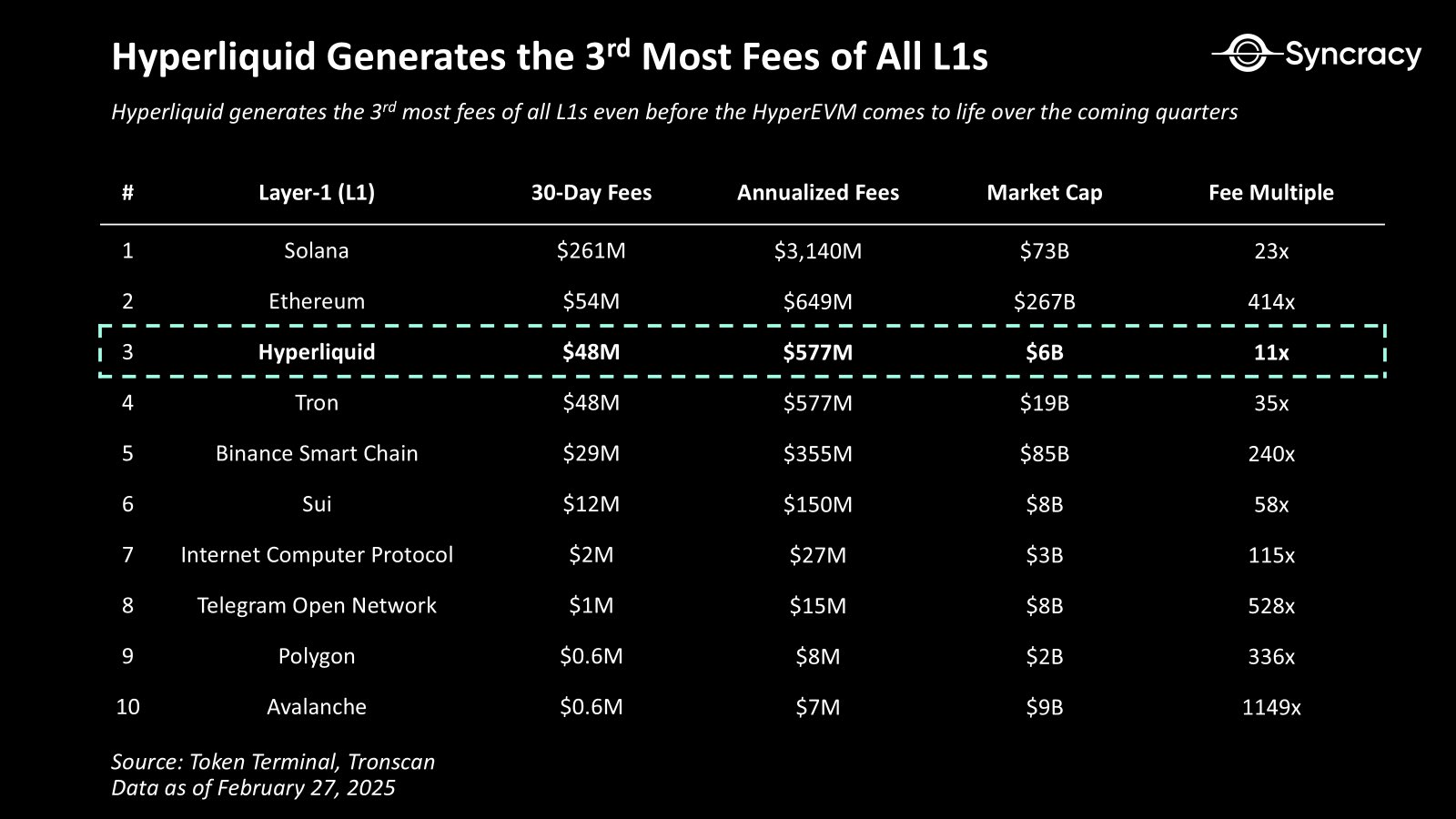

The hype is priced somewhere in the middle. Syncracy Capital’s Ryan Watkins has positions in both the hype and Sol, but posted a chart in early March showing how lipids were traded at lower prices than other L1s, including Solana.

However, as pointed out by research analyst Boccaccio at Blockworks, high lipid trading shows that it is more valuable to investors compared to simple Perps DEXS with higher full dilution ratings (FDV) and commission ratios compared to competitors DEXS and DYDX’s DEXS.

Bitise Research analyst Danny Nelson said Hyperliquid aims to create a vibrant blockchain economy like Solana, but that “is not yet at all.”