Hong Yea, co-founder of GRVT, left a rising executive career with Goldman Sachs, launching a hybrid crypto exchange as the market collapsed.

Four months after Mainnet, we processed more than $5 billion. Yes, his Wall Street roots tell beincrypto how they helped design a decentralized trading powerhouse.

A leap of belief in a burning market

When Hong Yea left his 10-year career with Goldman Sachs, Crypto Markets rose to executive director. In the second half of 2022, FTX had just collapsed.

Trust in the centralized platform had evaporated. But yes, collapse was not a deterrent. That was a verification.

“FTX crystallized our paper. The centralized counterparty is a single point of systemic disorder. We saw it coming.

That belief is tested. The former coworker moved to managing director promotions and thick bonuses, but YEA built the next generation exchange from scratch. It combines facility-grade speed with the spirit of decentralization of Web3.

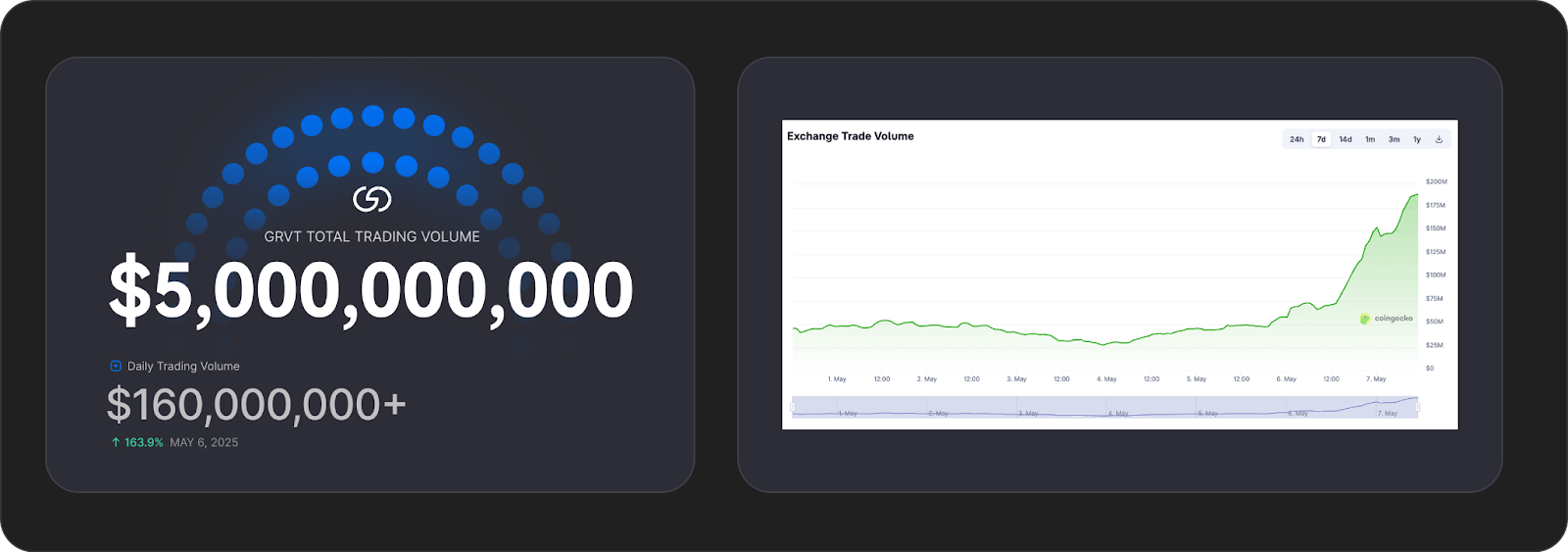

Just four months after today’s launch of the public mainnet, GRVT has processed more than $5 billion in trading volume.

GRVT $5 billion trading volume milestone, four month mainnet

that First licensed distributed exchange (DEX) under Bermuda’s Class M framework And one of the few platforms that bridge the strictness of Wall Street to the unauthorized infrastructure of blockchain.

Why Goldman executives bet on blockchain

Yes, the pivot wasn’t sudden. The training trader has been watching promising financial products die behind a walled garden for years within Goldman.

“We saw great tools and strategies that don’t get past institutional silos, and at the same time, Defi lacked the risk control, performance and compliance needed to scale.

The Sparks came at the 2022 crypto conference held in Barcelona. Yes, I clearly saw that blockchain is not just speculative, but a great substrate for finance.

“It’s like the smarter internet. It’s just for the logic, not just for data. It’s immutable, programmable, global. That’s what finance needs,” he clearly states.

Hybrid benefits: CEX speed meets Dex reliability

In the interview, Hong Yea presented the GRVT as a dedicated hybrid rather than a central exchange using traditional DEX or Web3 Gloss.

He said the platform separates matching and risk logic off chains from chain restraints and custody. This allows users to obtain centralized venue speeds without having to control their assets.

“All transactions run with sub-millisecond latency, but we solved on-chain via smart contracts that don’t touch user funds. That’s an institutional speed and unreliable execution.”

Users use SecureKey technology to sign encryption to make the most of Multi-Party Computation (MPC) and biometrics. At the same time, onboarding feels like web2, email, password, and 2FA.

Behind the scenes, GRVT Zero knowledge The chain ensures privacy while keeping the settlement transparent. Importantly, the platform allows users to instantly reposition margins across the market.

GRVT’s “Cedefi” architecture uses Validium chains with private ZKs to combine off-chain order matching with risk management and on-chain independent payments. Eliminate intermediaries, avoid custody fees on the chain, and allow users to maintain only control of their assets.

“Trades run with sub-millisecond latency, but they become unreliable and clear in your own wallet,” says Yea.

This design directly targets both CEX and DEX weaknesses.

- CEXS offers convenience and speed, but forces users to waive custody and introduces counterparty risk.

- Dexs offers transparency and control, but suffers from delays and fragmented fluidity.

The splitting GRVT bridge. Users sign transactions with Biometrics via SecureKey while all assets remain in their wallets.

“We will blend Web2 login flow, encryption controls and one-click trade signatures,” Yea explained. “It’s the speed of Uniswap’s independent self, and a trade-off.”

$5 billion in 120 days with regulations as a blueprint

According to Hong Yea, the explosive growth of GRVT was designed through raw performance, ecological incentives and early partnerships. That matching engine runs at less than 10 millisecond latency, surpassing Ethereum-based DEX, Solana (SOL), and even the new Layer 2 solution.

However, it’s not just speed. GRVT rewards market makers, community contributors and liquidity providers to create a balanced multi-stakeholder system.

More than 40 institutions reportedly trade on GRVT, including Coin Route and Top Prime Brokers, currently injecting deep liquidity from day one.

Furthermore, timing is appropriate for post-FTX stadiums. Retail users demand transparency. The agency requires compliance. GRVT meets both requirements without compromising.

“We are not a niche. We are a bridge. Retailers want safety. Institutions want access. We provide a platform where both can trade on equal footings,” YEA added.

Most Dexs are trying to dodge the regulations, but GRVT leaned in. It became the world’s first license index under Bermuda’s digital asset framework.

“We treat compliance as code. Our chain implements KYC and trade oversight at the protocol level. It’s not just policy.

GRVT reportedly is currently in active discussions with regulators in Asia, Europe and North America, working towards a multijudicial licence for globally compliant rollouts. Yes, I think that this regulator’s adoption is not a constraint, but a key enabler.

“The rules are not the enemy. They are the gateway to institutional trust,” he said.

Meanwhile, GRVT’s vision doesn’t end with crypto transactions. Yea is looking at a future of tokenized real-world assets (RWAs), including stocks, funds, and institutional strategies, peer-to-peer (P2P) trade on a decentralized, configurable platform.

Wall Street is watching

While some traditional finance (cradfi) remain skeptical of crypto, institutional trends are changing. The window is reopening with a softening of the tone of European MICA (Cryptocurrency Market), promoting Hong Kong’s digital assets, and US regulations.

“Wall Street is warming up, but this time they’ll come to integrate, not dominate.”

Building long-term trust in blockchain may seem like a dramatic leap for traders who once gained risk in microseconds. But for Hong Yea, it was a calculated transaction, but so far it has paid off.