Ethereum (eth)the world’s second largest cryptocurrency, is caught up in a global sell-off crossfire caused by the tensions of the tariff war. With President Trump’s aggressive tariff measures Shaking the global market, crypto again proves it is unimmunized to macroeconomic disruption. With ETH below the critical level, traders are rushing to assess the losses and ask very important questions. How low will Ethereum be in April this year?

Ethereum’s intimate analysis of daily and hourly charts provides insight into how vulnerable the assets have become and whether reversals are possible in the near future.

Ethereum price forecast: What is your daily chart about Ethereum trends?

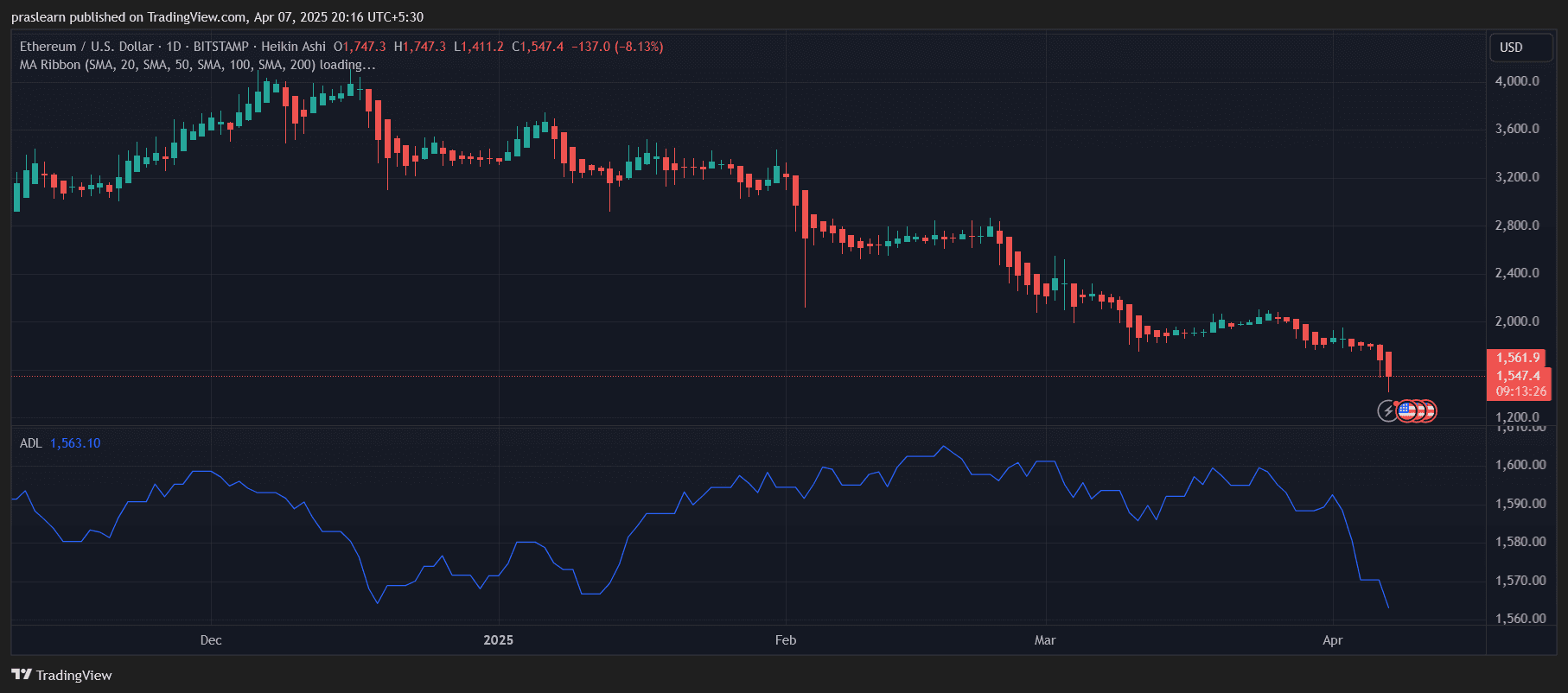

eth/usd daily charts – TradingView

Ethereum’s daily charts reveal accelerating steep downward trends. The hikin reed candle has long body red bars printed with little or no core at the top. It’s a sign of strong bearish momentum. Eth Price concluded its latest session at around $1,547 per day. The move follows the days of losing for several days in a row, not only fixing, but also deeper breakdowns.

Assets are well below all significant moving averages. Although the full MA ribbon data was not loaded, it is clear from the structure and price action that Ethereum is usually below the 200-day SMA. This usually serves as a critical level of support for long-term investors. Breaking that line is a red flag of a historically extended bearish period.

Accumulation/Distribution Lines (ADLs) are added to your worries. We are making sure that Smart Money hasn’t stepped in to buy this dip. Without accumulation, Ethereum is unlikely to set a meaningful reversal in the coming days.

Can an hourly chart give the Bulls hope?

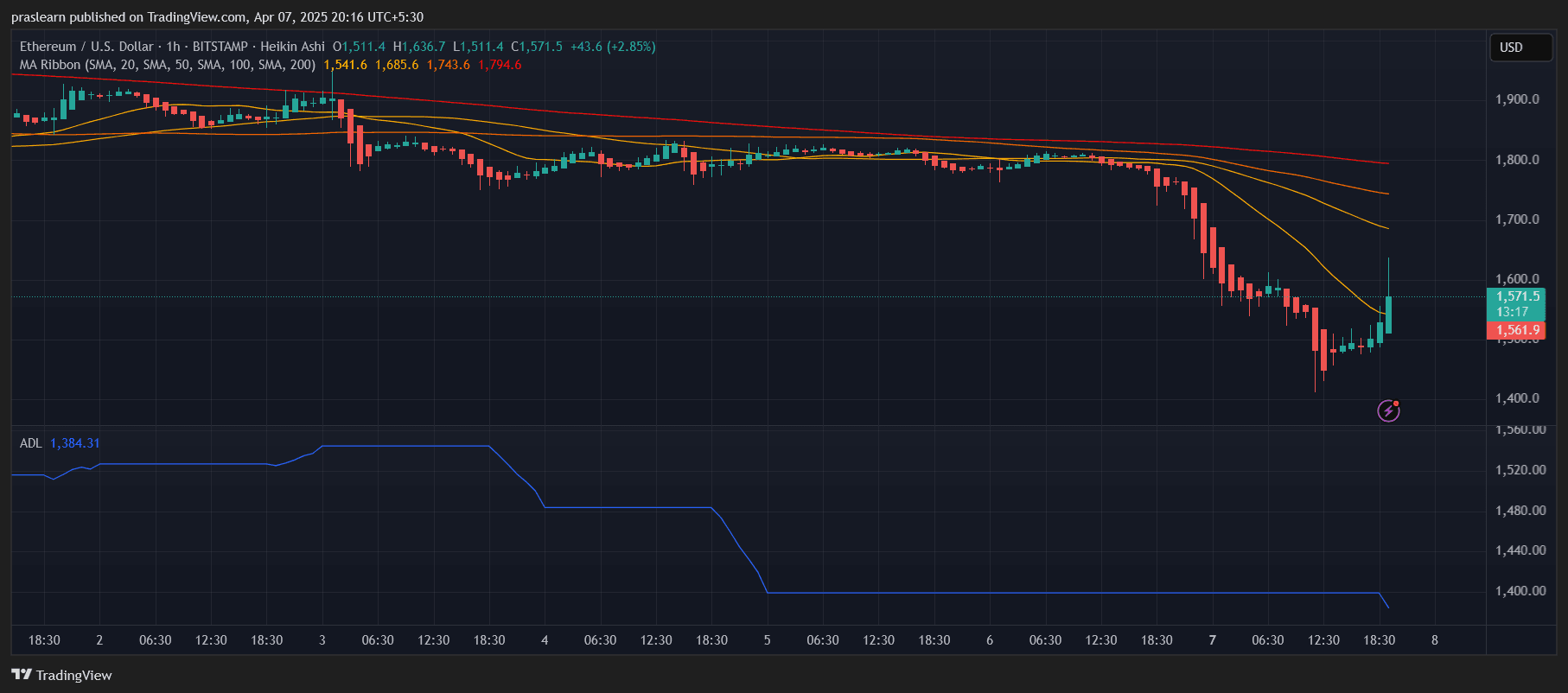

ETH/USD 1 hour chart – TradingView

On the hourly chart, Ethereum has shown a slight bounce from its recent low of nearly $1,411 at the time of writing, returning to $1,571. While this may seem like a bullish response, the rebound comes after an extended downward cascade and is below all major moving averages, including SMAs of 20, 50, 100 and 200. The $1,794 $200 SMA is particularly far away, showing how far prices are growing.

The hikin ash candles in the hourly time frame have turned green, but recently they have not had a strong upward momentum. Recent candle spikes suggest that you get shorter or benefits rather than reversing the actual trend. The ADL here shows that even shorter time frames do not show actual accumulation.

In short, hourly charts offer a temporary suspension of sales rather than a reliable indication of bullish recovery.

Where are the main support and resistance levels for Ethereum?

Ethereum’s next major support level is $1,400, supported by the latest decline. If this level breaks again under stronger sales pressure, the next target will be near $1,320 and $1,200, which previously served as demand in the 2022-2023 Bear market.

The advantage is that Ethereum should collect $1,685 (50 SMAs on the hourly chart) to neutralize short-term trends. However, the true change in momentum occurs above $1,800, where 200 SMA and key resistance converge. Without these levels breaking, the assembly remains suspicious and vulnerable to rapid rejection.

What does the chart indicator tell us?

Moving Average: ETH prices are below all major moving averages for both time frames. The downward nature of SMA strengthens the bearish momentum. This alignment usually precedes the further downsides unless it is disabled by a volume collateral breakout.

Hikin Reed Candle: Daily candles are very bearish, with hourly candles showing bouncing, but lack of consistency and volume weakening bullish interpretations. The bull needs to see a smaller, higher, lower candle to see a reversal that has not yet formed.

ADL (Accumulation/Distribution Line): ADLs on both charts are one of the most annoying signs. The ADL decline amid falling prices suggests that whales and institutions are leaving bad news for bullish continuation, with no accumulation.

Ethereum price forecast: How low will it be in April?

With a bearish momentum continuing and a $1,400 break, Ethereum prices could be raised to $1,200 or $1,000 in April. This marks a complete yield movement and creates a potentially long-term bottom.

However, if ETH starts steadily regaining $1,685-$1,700 above $1,500, the short-term relief rally could put rallies between $1,800-$1,850 on the table. However, without strong volumes and rising ADL, even such rallies are vulnerable to rejection.

Is Ethereum heading for a deeper collapse?

Ethereum is at a critical time. The drawbacks are very real as its long-term trends have broken, facilities have been confirmed and macro headwinds have been intensifying due to the tariff war. Short-term bounces may offer hope, but the broader trends clearly remain bearish unless a volume inversion pattern appears.

So how low will Ethereum be in April? If the $1,400 level is not retained, then $1,200-$1,000 is the real possibility.