In crypto transactions, large profit promises often involve the risk of large losses. Over the years, several well-known crypto traders have made bold bet headlines, but we can only see their fate falling apart when the market opposes them.

From Bitcoin (BTC) to Ethereum (ETH), the crypto market has proven to be a double-edged sword. Millions can be made or lost in just a few hours, leaving traders left to deal with fallout from risky moves. Here is the story of three crypto traders who have wiped out millions.

James Wynn

High-lipid pseudonym trader James Wynn has become one of the most discussed numbers on Crypto Twitter (now X) due to his high-risk, high-reward trading style.

Wynn began trading on Hyperliquid in March 2025. He has collected considerable profits through his bold trading strategy.

“I’ve made a total profit of $41,696,589.75 (on-chain) since I started trading high lipids this year. My next goal is $1 billion. But not for legacy. But I’ll do this cycle. May 9th.

Traders had some successful trades. On May 24th, he booked $25.18 million from KPEPE’s long position and $16.89 million from the long Bitcoin position. Other notable transactions included $4.84 million in profits from Fartcoin (Fartcoin) on May 13 and $6.83 million in profits from Official Trump (Trump) on May 12.

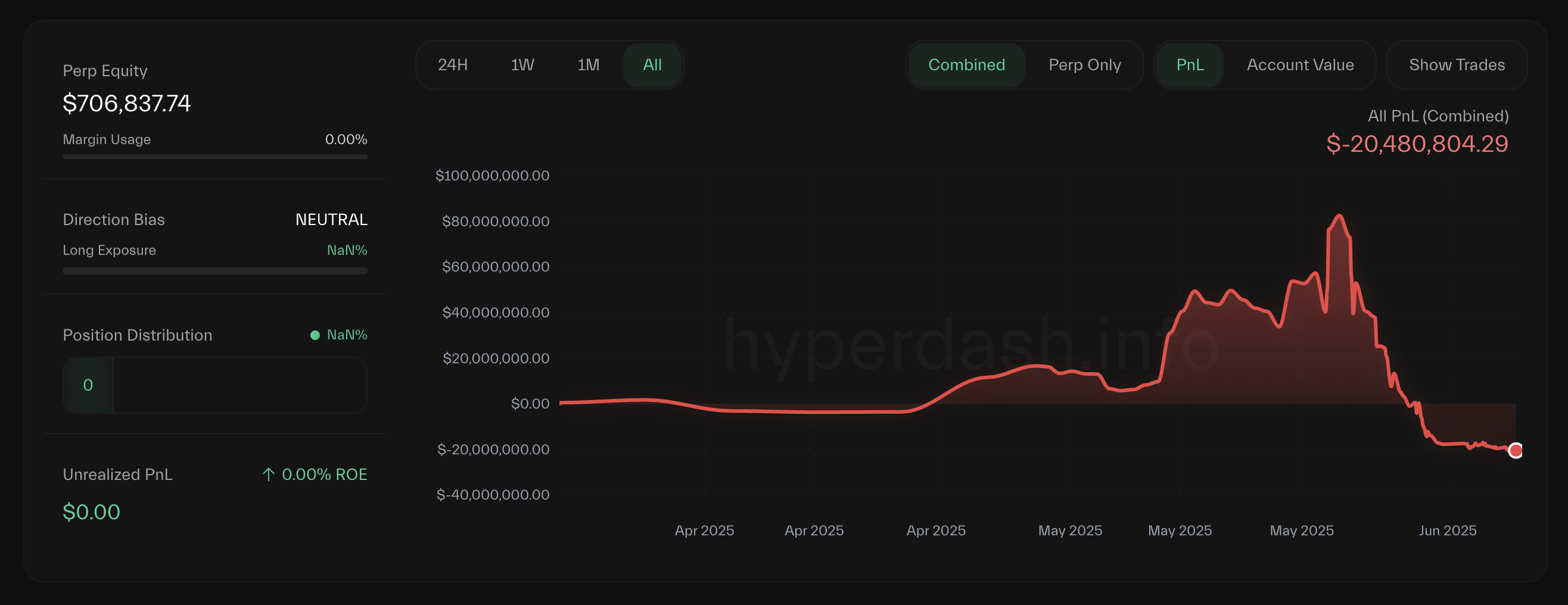

Wynn’s profit peaked at over $87 million in late May. However, this was short-lived, but soon the deal began to back up. Wynn faced a series of important setbacks.

On May 23, he lost $3.69 million from the long Ethereum position and $1.59 million from the SUI (SUI) long position. Two days later, on May 25th, he lost $15.86 million from a short position at BTC.

“James Wynn wiped out almost all of his high lipid profits. It took him 70 days to earn more than $0 to $87 million.

Despite losing everything, Winn’s bet continued. The biggest hit came on May 30th, when BTC’s long position caused a loss of $37.41 million. Winn’s loss was extended until May 31, with another $12 million lost from another BTC long position.

Finally, on June 5th, Wynn lost $2.81 million in the BTC long position, bringing his total loss to $20.4 million.

“I closed my position and I was defeated.

James Wynn Hyperquid loss. Source: HyperDash

At the time of writing, Winn’s performance showed a win rate of 40.48%, with 17 successful deals out of 42.

Anonymous ETH Whale

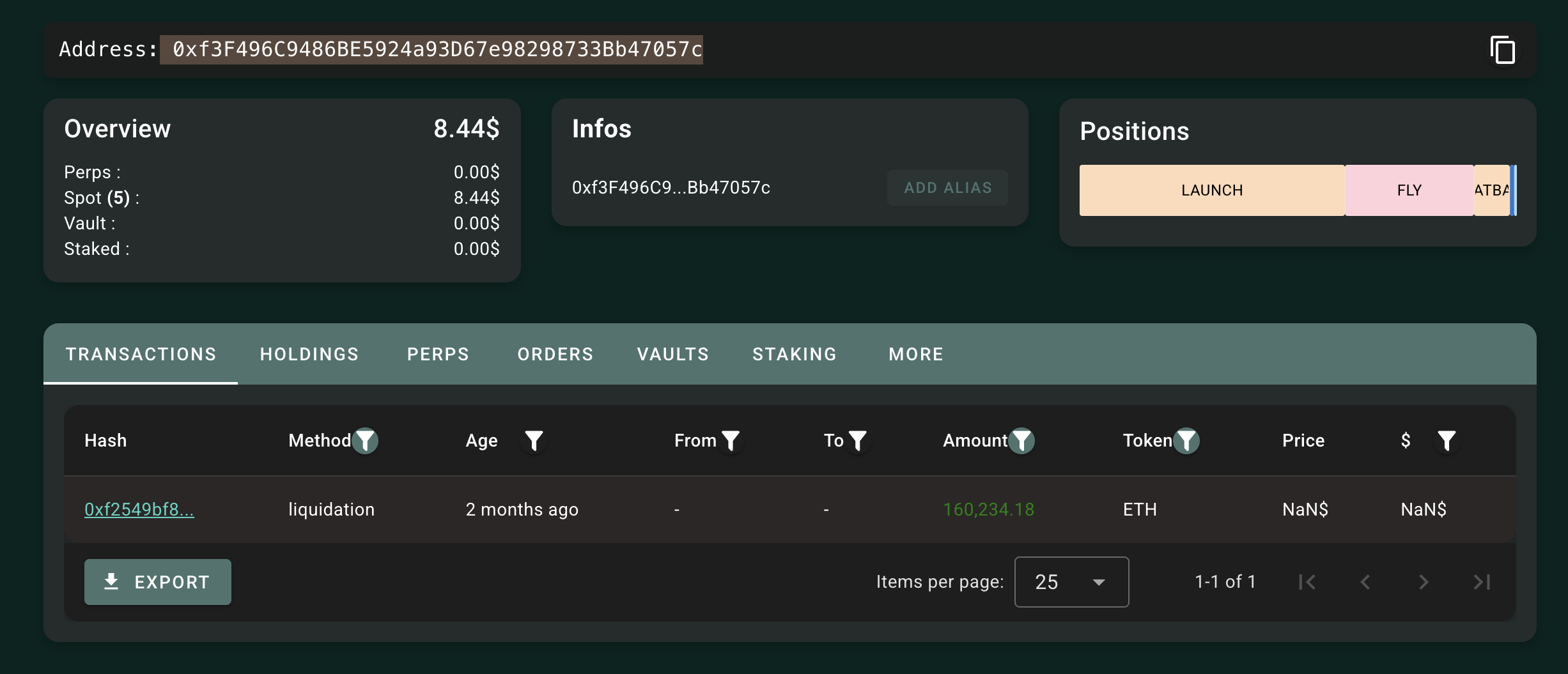

Winn’s downfall is part of a larger trend, with other crypto traders losing millions too. In March 2025, an anonymous cryptocurrency trader identified by wallet address 0xF3F496C9486BE5924A93D67E98298733BB47057C suffered an astounding loss of $308 million after ETH’s 50x leveraged long position was liquidated.

The trader opened the position when the ETH was trading at $1,900, and the liquidation price was $1,877. However, amid growing market volatility driven by global tariff concerns, ETH prices plummeted, liquidating 160,234 ETH.

160,234 ETH liquidation for anonymous traders. Source: Hypurrscan

Lookonchain reported that the whales have turned all Bitcoin Holdings into this exploited ETH trade, amplifying the risk.

“Crazy! This whale has switched all his long BTC positions to long ETH,” the post read.

Leveraged trading using borrowed funds to expand both profits and losses proved disastrous in this case, as it wiped out the entire trader’s position.

Meanwhile, traders have not opened high lipid positions since late March.

Hui Yi

Leveraged bets have resulted in massive financial losses, but they also tragically resulted in loss of life. In June 2019, Hui Yi, co-founder and CEO of Cryptocurrency Market Analysis Platform Bte.Top, reportedly took his own life.

Yi’s pain was thought to have been caused by his involvement in failing to take a 100x leveraged short position on 2,000 bitcoins. Extreme leverage amplified his losses and made his position extremely vulnerable to minor price fluctuations.

There was also speculation that 2,000 bitcoins could be part of the client. Some even suggested that Yi may have forged his death to avoid repayment. However, there was no evidence to support these theories.

The former partner confirmed Yi’s death. This tragic incident underscored the psychological sacrifices of leveraged trading and the risk of using excessive borrowed funds in a volatile crypto market.