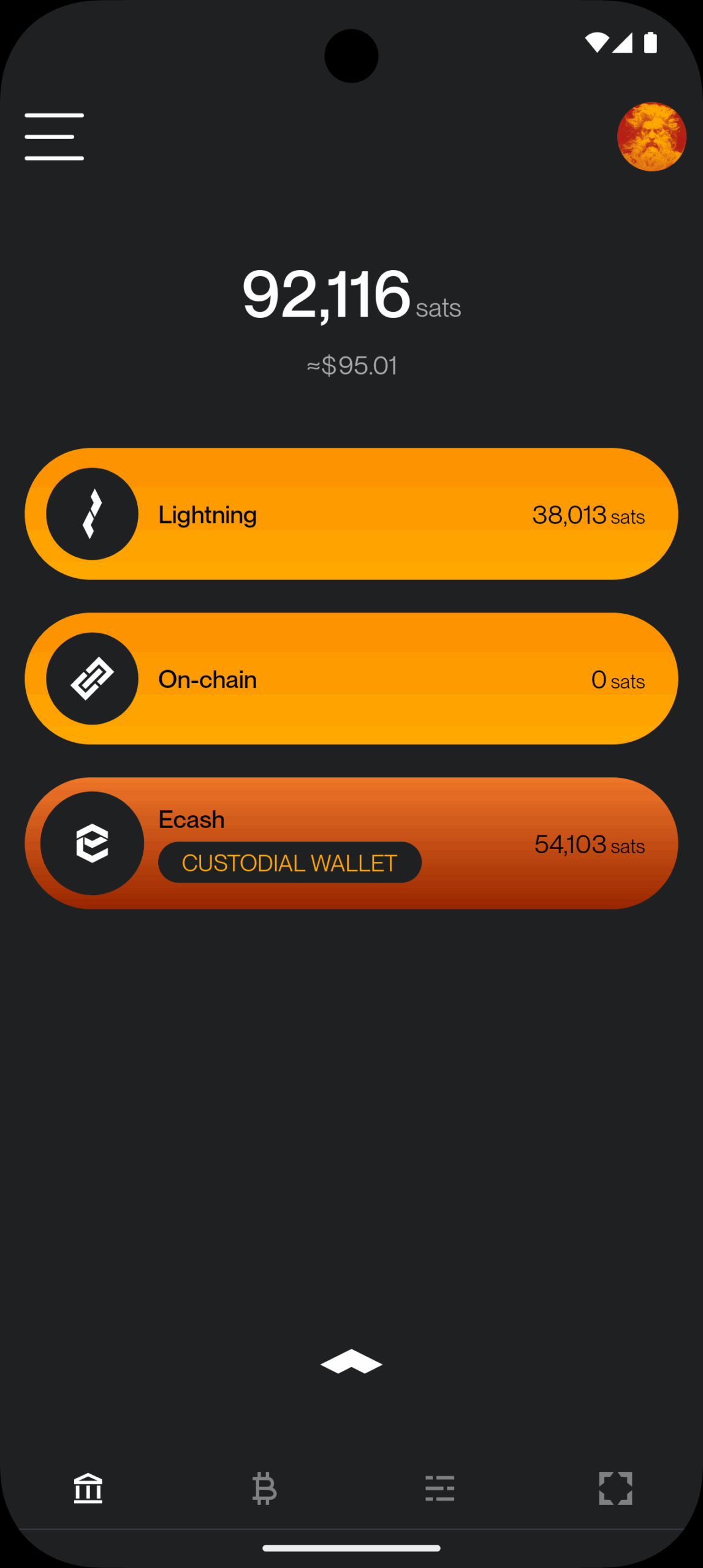

US-based Bitcoin and Lightning Mobile Wallet Zeus recently announced the integration of Cashu’s Alpha Release. The move marks ECASH’s first integration into the popular Bitcoin wallet, opening new ground for the recruitment of potential users into Bitcoin.

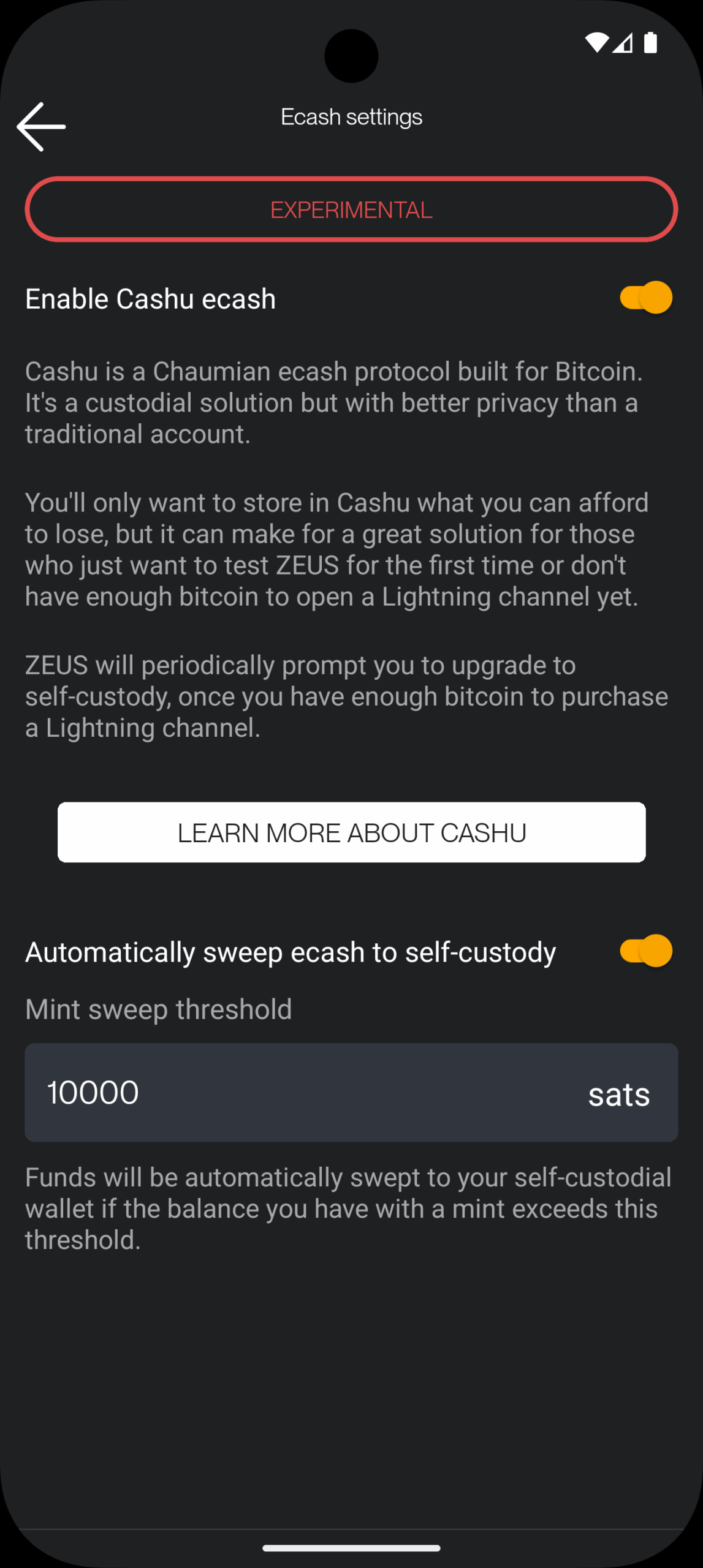

Cashu is a hot new implementation of Chaumian Ecash, a form of digital cache invented by David Chaum in the 90s, with incredible privacy and scalability properties, a radically centralized trade-off, and requires a substantial amount of trust in the publisher.

In a counterintuitive move from Zeus, known as a go-to tool for advanced lightning users trying to connect to a home node, Cashu’s integration acknowledges what the “last mile” challenge Lightning wallet faces when delivering Bitcoin to the masses.

“We basically started as a Cypherpunk wallet, right? You’ll need to set up your own lightning node and connect it with Zeus. For the past two years, you can do it all in a standalone app without a remote node with just one click.

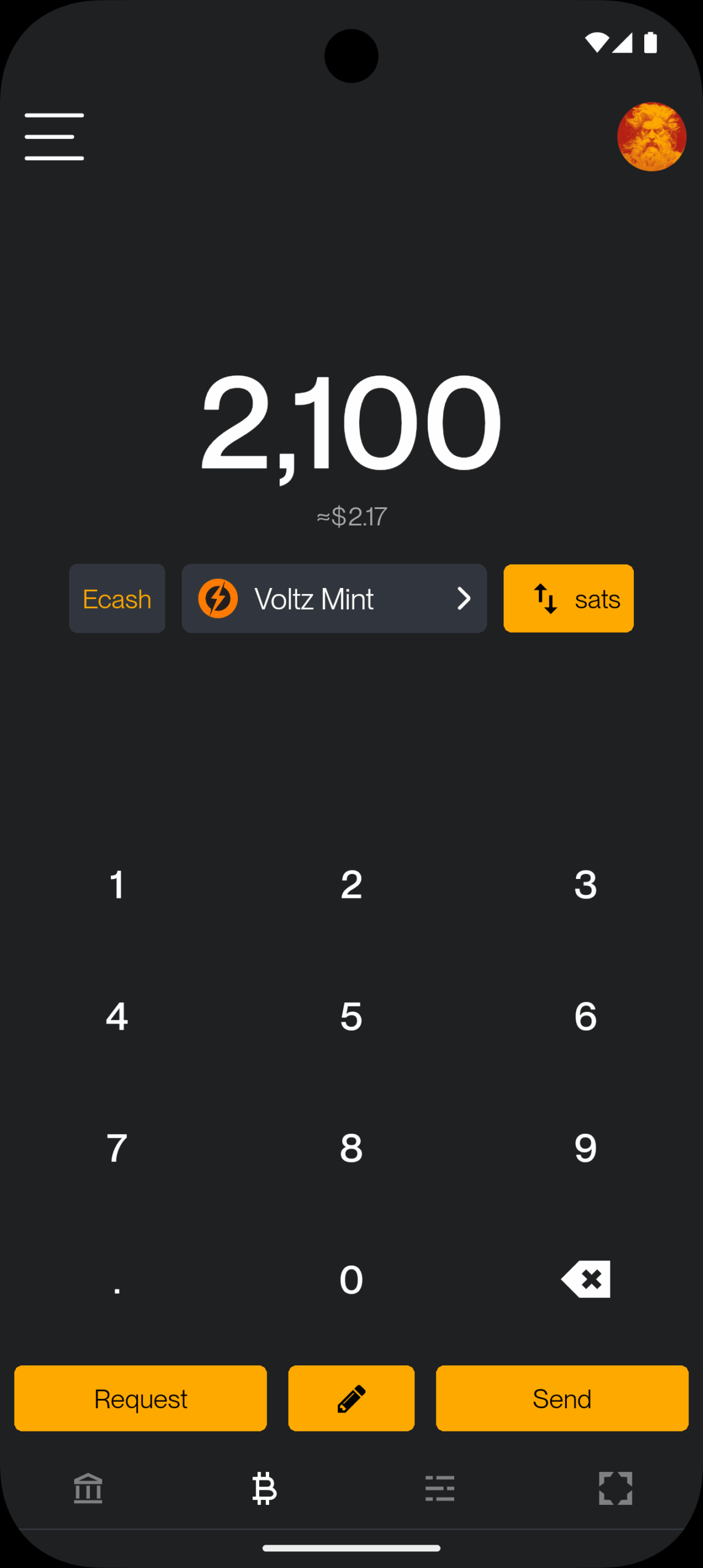

“Cashu deals with uneconomical self-denominations of small amounts of Bitcoin. In the chain, the dust limit is 546 Satoshis, and two systems like Lightning have the cost of a channel setup or unilateral exit that has not been widely discussed.” These esoteric aspects of the Lightning network have been largely abstracted since its invention in 2016, but these basic trade-offs continue to manifest themselves in the most sophisticated and user-friendly wallets.

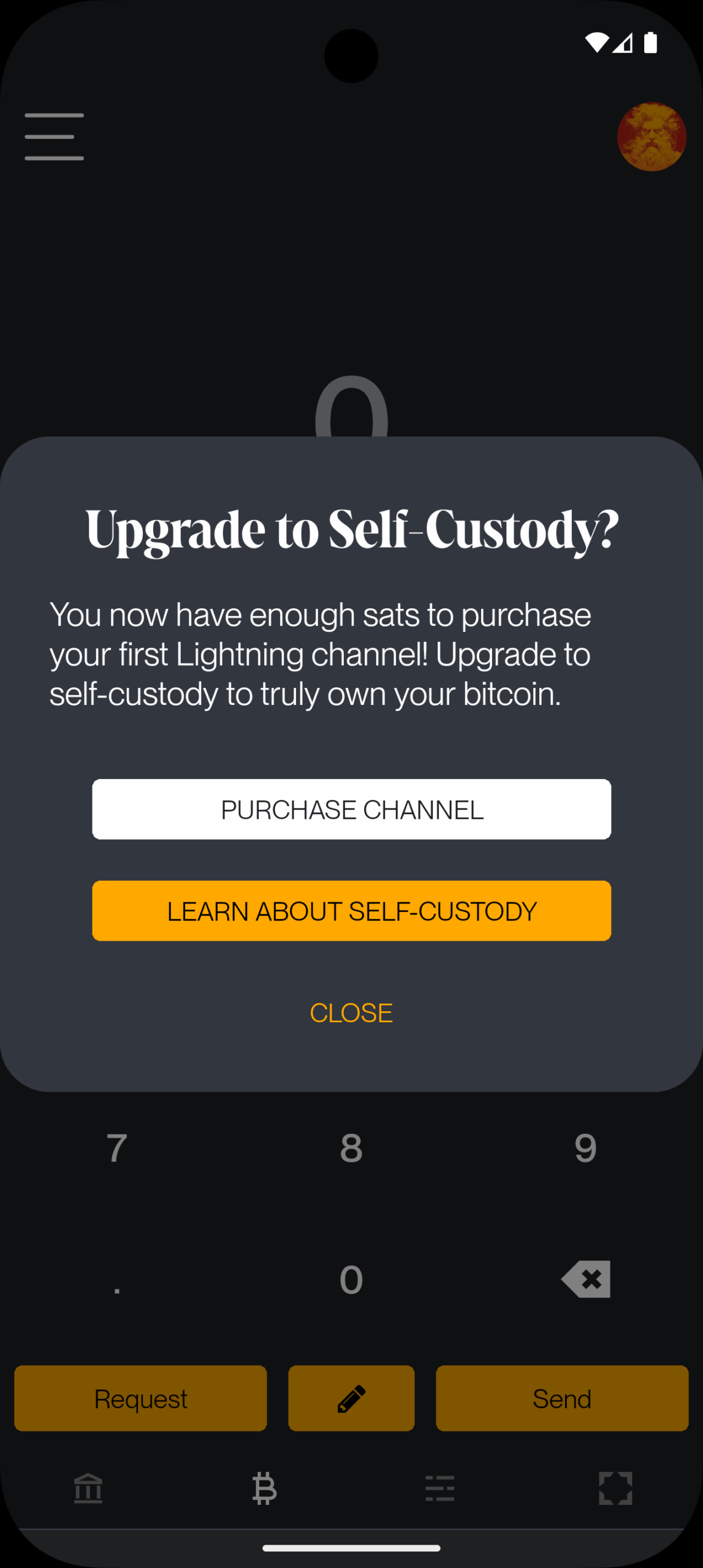

For both Phoenix and Zeus Wallets, if it is two of the least popular non-custodial options on the market, users will need to pay up to 10,000 SATs in advance to gain spending capacity. These fees are required to cover the on-chain fees spent opening channels for wallet liquidity service providers for users.

The upfront fee required represents a painful onboarding experience for new users who are difficult to explain and are used to apps that provide money to join instead. As a result, custody lightning wallets like Satoshi (WOS) wallets (WOS) will skyrocket. It took advantage of Bitcoin’s global intern tint settlement power to combine great user experience wallets that can create great user experience wallets, earning massive adoption early on. However, major developments have been underway for seven years since the Lightning Network was founded, with Zeus Wallet pushing the boundaries.

“With Ecash, anyone can set up their wallet and start joining the ecosystem. I think this will become more and more common,” Evan explained.

Today, at around $100,000 per Bitcoin, 1,000 Satosh is equivalent to $1 dollar, and transactions of these sizes are known as microtransactions. A common example is NOSTR social media tips known as Zaps. However, finding the right tool for this use case is not easy. Self-managed wallets, open channels and on-chain fees, such as Phoenix billing transaction fees at hundreds of Satosh, often cost the same and slower resolution. As a result, there is an entire expenditure category, as it is only offered by inexpensive alternatives such as custodial lightning wallets such as WOS and Blink, but often results in significant privacy sheet laid-offs that require phone numbers from users and sometimes more advanced KYC and IP tracking. Cashu wants to serve this market with reduced privacy costs, ease of use, speed and competitive fees.

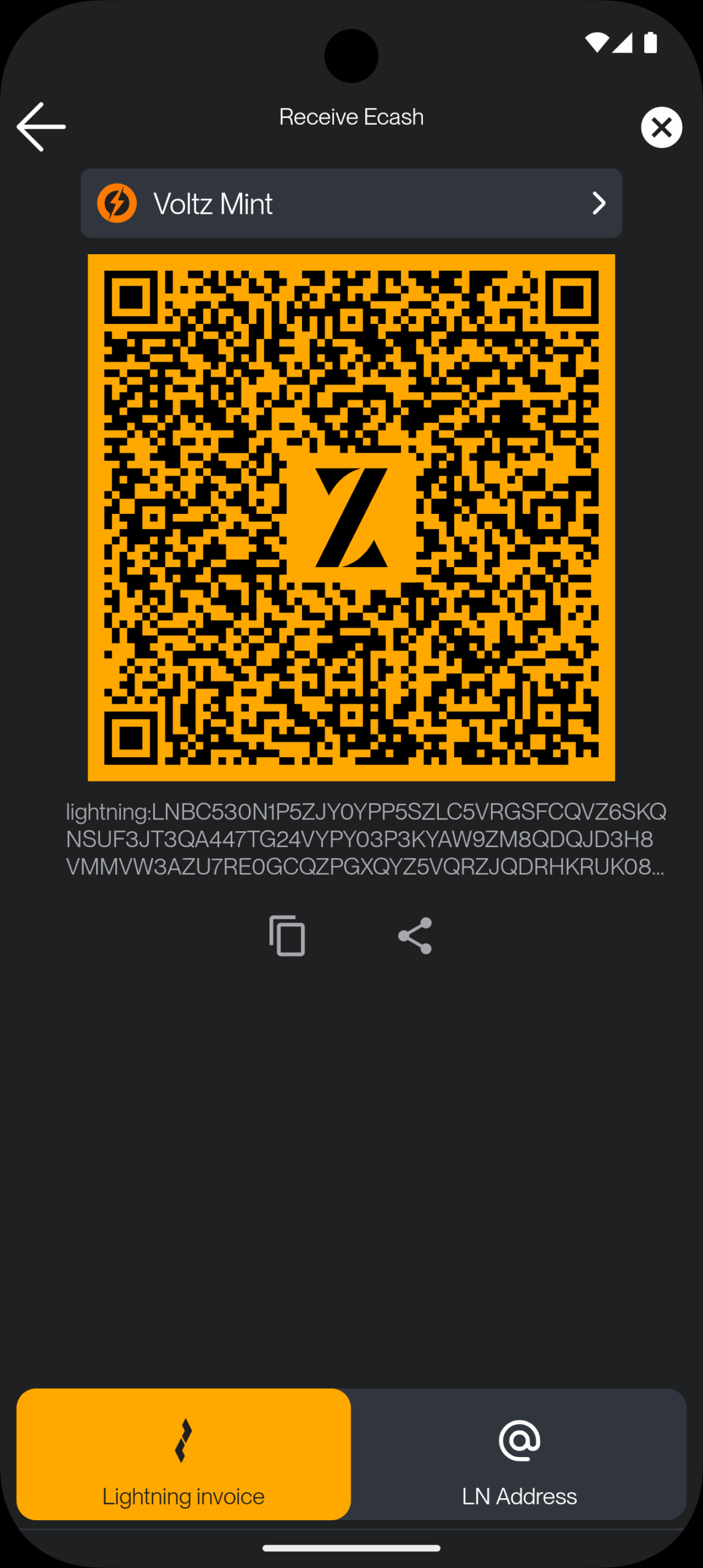

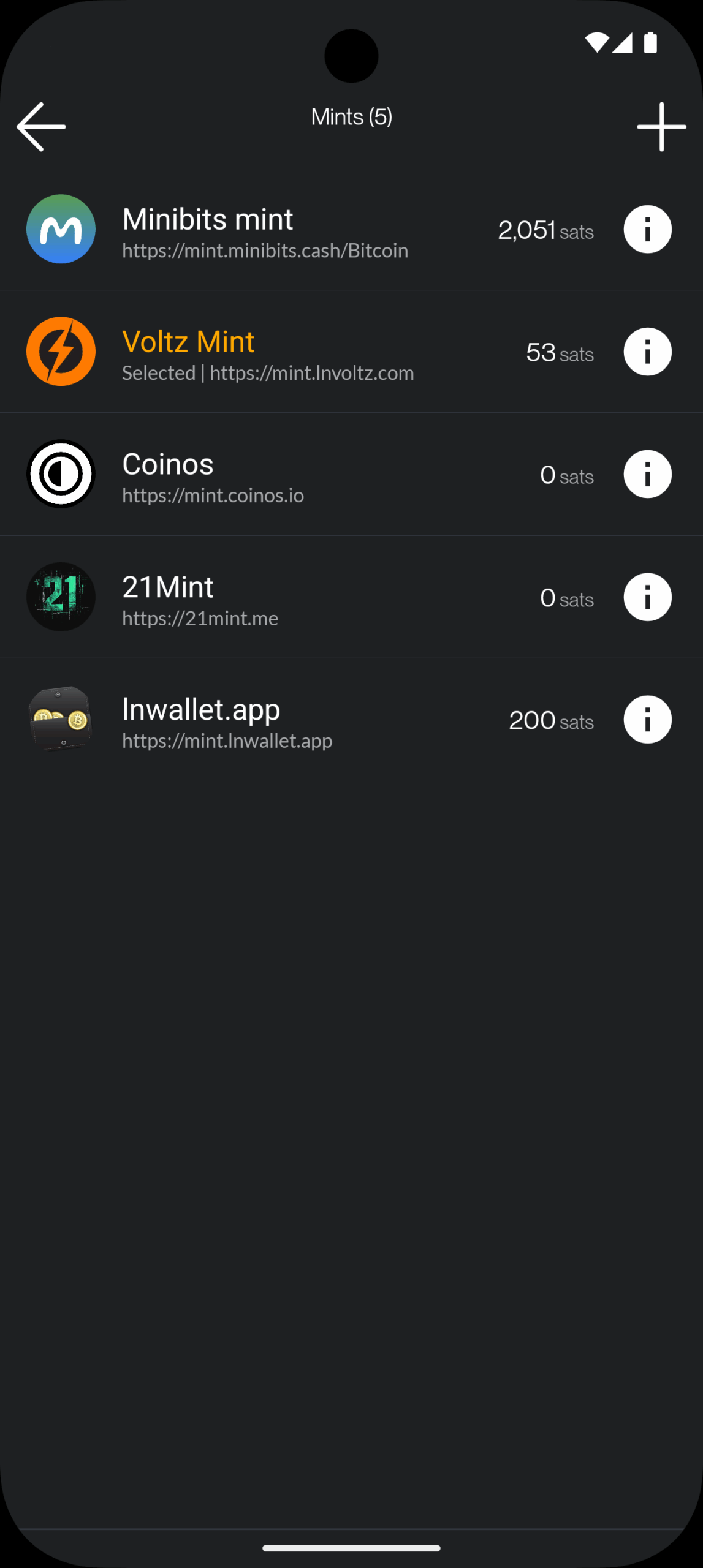

Evan delves deeper into Cashu integrations, saying, “For users, this means that you can select and switch between custodians in a single app. For developers, this means that you will postpone custodians’ responsibility to third parties and you won’t have to wire the new integration when the current custodians stop operating.”

Zaps are rewards provided by atshi, provided as “likes” or microchips for content in Nostr’s social media ecosystem. Zap is as small as one Satoshi, and is equivalent to the smallest amount of Bitcoin technically transferable, which today is about a tenth of a penny. “But I think you look at Nostr and see how many people are zapping and how big of that ecosystem is.

“CASHU maintains custody, but users accumulate small amounts without the need for 6,000 Satosh to open lightning. Zeus encourages users to upgrade to independence as the balance expands,” he concluded.

The trade-offs introduced by Cashu challenge a common understanding of custody in Bitcoin. Historically, you were either a centralized (custody) exchange or you were a non-uniform Bitcoin wallet. In the former, the coin is entrusted to a third party. In the latter, you will be personally responsible for those coins and their corresponding private keys. Cashu changes this paradigm by introducing Ecash notebooks or “nuts” that have been excluded from Bitcoin. This is a bearer instrument where the interoperability of full Bitcoin reserve and lightning needs to be withdrawn instantly.

Just like with Fiat Cash, you need to control and be responsible for these notes, but there is also a counterparty risk. In the case of Cashu, there are certain things that published mint can theoretically do to misuse users.

The big difference between Cashu or Custodial Bitcoin Exchange and Fiat Currency is that Cashu is open source, designed around user privacy, and scale is very well designed. In theory, to counter the centralized network effects of a particular mint, the cost of running mint is lower than either alternative, than the ability to facilitate mint competition.

Finally, the user experience of storing Cashu tokens is attached to known Bitcoin self-management, such as downloading 12-word seed through various mechanisms, but implementations vary from wallet to wallet, and the entire ecosystem is in its early stages.

To further mitigate the detention risk of Chowman-style Ecash in Bitcoin, the Cashu community has developed various methods for automatically managing custody risks.

“Users can split risks using multiple mints and switch between them in the user interface. Soon, Zeus will guide users to choose five or six reputable mints, automatically balancing their funds to minimize exposure,” explains Evan, referring to a specific approach called an automated bank run. The idea is that some Cashu mints may hold more of your funds, so Zeus will pull them apart and spin the value to minimize risk.

“I think there’s an idea to guide users to choose five or six reputable mints… and from there, users can automatically switch between those mints and decide which mints should currently be balanced according to the balance of all mints. Evan said: “Our discovery mint feature pulls reviews from bitcoinmints.com and shows guaranteed counts and user feedback like mint reliability and lifespan,” he explained, explaining the reputation layer stacked on top of various other risk management mechanisms.

There is no known way to use Kaauma-style ecash in a completely non-curative way. Therefore, as long as custody risks can be minimized, the benefits of scaling and privacy will be noticeable.

One opportunity to unlock Ecash is microtransactions. The most common example applies to small lightning transactions, but is often Nostr Zaps in a single value range. This use case raises important technical questions before Bitcoin. Do microtransactions actually make economic sense?

There has been a long-standing debate about the user experience friction specific to microtransactions. The term dates back to 1999, when Nick Shuzabo, one of Bitcoin’s intellectual fathers, wrote a paper on “micropayments and mental transaction costs.”

In his paper, Szabo poses much more serious challenges for user interfaces than anything else, so developers recommend focusing on minimizing these cognitive costs from a design perspective. Szabo’s paper existed as an important explanation for the failure of microtransactions to acquire adoption. But Bitcoiner has been thinking about this issue for a long time, and I believe some people may have solved it.

Zeus’ Cashu integration could mark a key moment in bringing Bitcoin into the mainstream via Zaps. Reflecting the spread of emojis and Facebook’s iconic “like” buttons, entrepreneurs like Evan and Calle, founders of Cashu, believe Zaps can make Bitcoin easier to use. Zaps present specific opportunities. This presents a new way for the public to experience by exchanging as a legacy-enveloped investment product or by acquiring and experiencing Bitcoin that is not from a brokerage.

Zaps is not an $100,000 asset, it is Internet chip technology. That means sending some Satoshi to friends to post funny memes on the Nostr app, or creating high quality content.

Evan believes that using the right interface is possible and that Nick Sabo’s microtransaction warning may have been addressed.

“If it’s Mindless, like a one click, like a heart button – pressing the ZAP button means you don’t have to fire your wallet and select your destination. Single click.”

Delivering Satoshi-style user experience wallets through a fully open source and trusted, minimal software stack is no easy task. In fact, it’s definitely a difficult road.

When WOS first launched, it caused waves in the world of Bitcoin. Do you have 12 word seeds downloads? Is there an account creation page? Do you just settle immediately and barely receive and send transaction fees for SAT?

This experience was so amazing and still one of the most popular Bitcoin wallets. However, this was only possible at the time due to the centralized, fully detained and closed source approach adopted by the creators of WOS. They defined standards and set up a bar for user experience, but now open source is catching up.

Zeus Wallet has walked this tiny line between working in public places and running profit-motivated startups.

“The wallet is completely open source, verifiable on GitHub, and has external contributors over the age of 50. Open source builds trust, attracts users to paid services and prevents black box risk,” Evan explained why open source is important when it comes to Bitcoin software.

The drawbacks of open source are self-evident to many developers, but others may copy your code to beat you. And the code must be good enough so that hackers can’t easily break it.

“We have a few employees currently hacking Zeus Code, but we have over 50 external code contributors working on the project,” Evan explained when asked about the top open source.

From a business model perspective, they are following the industry path to becoming a liquidity provider for the Lightning network.

“Revenue comes from LSPs. Here users lease renewable channels indefinitely for two weeks to a year. White Glove Services supports clients such as Pubkey with node management,” Evan explained.

However, Zeus’s biggest challenge came in the spring of 2024 with the arrest and prosecution of a Samourai wallet developer. This is a shot across the bow that threatened many Bitcoin entrepreneurs from the US and steered Zeus’ top competitors, Phoenix Wallet and WOS. Many companies have already hedged their bets by incorporating offshore. Zeus was not one of them, founded and built in the United States. They said they would get off the boat.

“It was a horrifying time when Satoshi and Phoenix’s wallets were pulled out and causing panic. I had my first child and was trying to fear the consequences, but folding out of fear felt bad. And the courage needed to stay in the US under such hostility was rewarded. With top competitors outside the US, Bitcoiner is looking for non-integrated software and a great user interface. There were few options.

“It was insane. LSP was just beginning, but at the time it probably grew 250-300% in the first six months. So we saw a ton of activity in LSP,” recalls Evan. How, this is just like a trial version and we passed. ”

This post How Zeus redefines Bitcoin with Cashu Ecash integration first appeared in Bitcoin magazine and was written by Juan Galt.